German factory orders disappoint

Delving deeper into the numbers there was further cause for alarm, domestic demand has dropped, just as foreign demand has picked up.

The sharp fall in domestic demand will be a concern for policy makers, who had been counting on strong consumer demand to support the German economy whilst it weathers external headwinds such as the US – Sino trade dispute, the global economic slowdown and Brexit.

Lukewarm data to keep ECB from hiking

Adding to the euro’s woes, the EU commission cut EU 2019 growth forecast which also pressurised the common currency. The report also said that inflation would remain soft.

Data from the eurozone continues to be lukewarm at best and will do little to encourage the ECB to start raising interest rates anytime soon. The ECB remains in a dovish mood, with no plans to hike rates prior to March 2020. The minutes from the latest ECB meeting will be released on Wednesday.

Fed On Hold But For How Long?

The US economy, on the other hand looks to be in much better shape. US GDP unexpectedly jumped to 3.2% in Q1, April’s NFP showed a stellar 263k jobs wee created. Should numbers continue along these lines then the Fed could take their finger off the hiking pause button sooner rather than later.

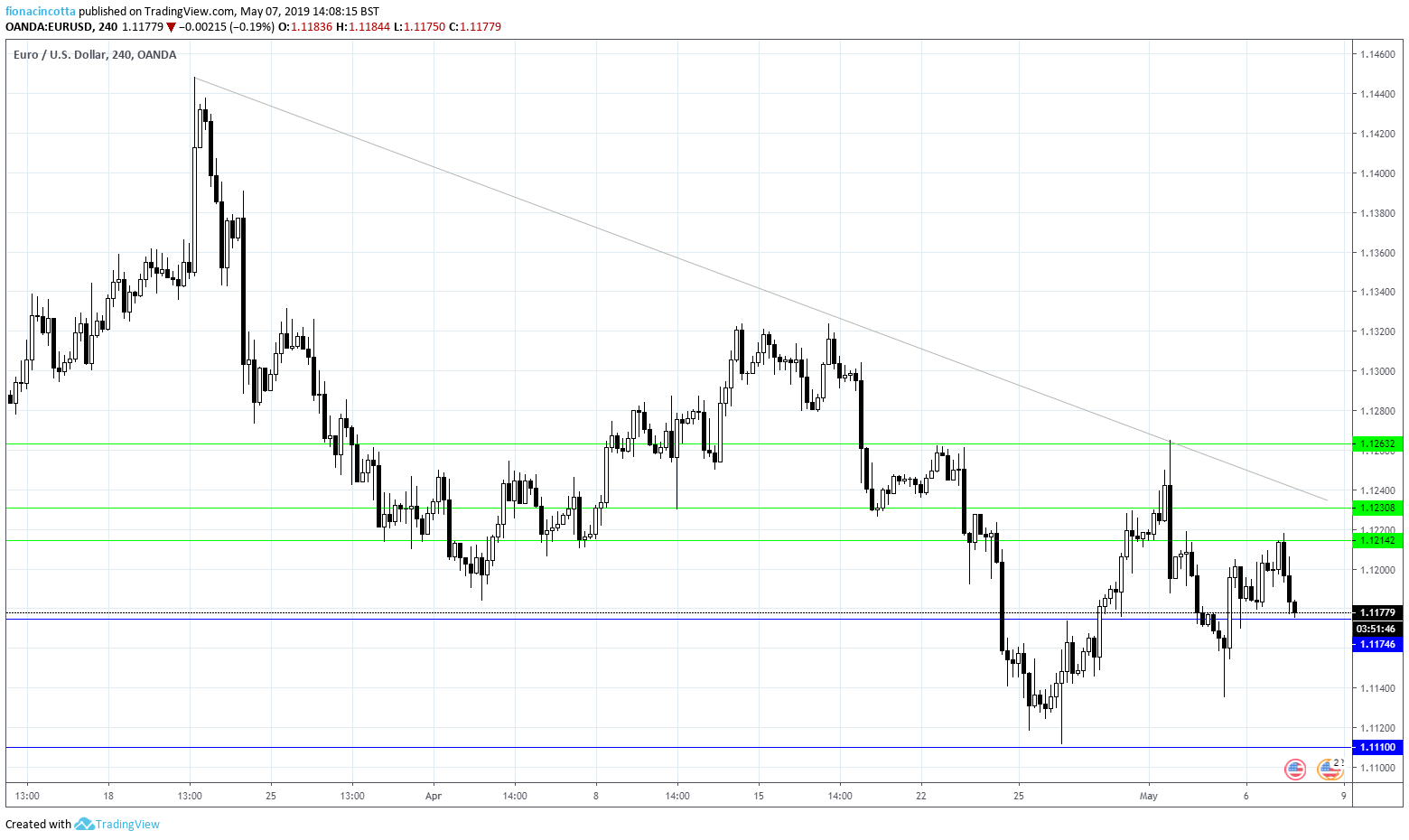

From a technical perspective, EUR/USD would need to break through resistance at $1.1175 before heading back to re-visit 2019 lows in the region of 1.1100. On the upside, a meaningful move above $1.1230 could open the doors to $1.1260.