The Euro is falling lower versus the US Dollar for the fifth straight session on Friday. The pair is currently trading 0.3% lower, putting EUR/USD on track for losses in the region of 2.7% across the week.

The Euro has been on the back foot across the week, which is not that surprising considering the devastation that coronavirus is having across the region. Whilst Italy, and possibly Spain have peaked in terms of daily deaths, the impact on the economies is only just starting to show through.

Jobless claims

Spain, which has over 102,000 coronavirus cases and a death toll of over 10,000 has been on lockdown since mid-March. The restrictions placed on the public have resulted in a huge demand shock to the economy causing many businesses to lay off staff or collapse. Spain reported its biggest rise in jobless claims ever. 800,000 people lost their jobs in Spain last month alone.

France also reported 4 million had applied for temporary unemployed benefits, this accounts for around 20% of Frances private sector workforce. The numbers are petrifying.

Service sector PMI

Service sector PMI revisions in Europe are expected to be dire. The final revision for the eurozone is expected to drop to 28.2, down from 28.4; confirmation that the eurozone economy has grinded to a halt. Meanwhile Italy’s PMI could serve as a warning of what’s to come, with service sector activity expected to plunge to just 22.5 in March, down from 52.1 in February. Evidence of a paralysed economy as lock down continues.

Spain, which has over 102,000 coronavirus cases and a death toll of over 10,000 has been on lockdown since mid-March. The restrictions placed on the public have resulted in a huge demand shock to the economy causing many businesses to lay off staff or collapse. Spain reported its biggest rise in jobless claims ever. 800,000 people lost their jobs in Spain last month alone.

France also reported 4 million had applied for temporary unemployed benefits, this accounts for around 20% of Frances private sector workforce. The numbers are petrifying.

Service sector PMI

Service sector PMI revisions in Europe are expected to be dire. The final revision for the eurozone is expected to drop to 28.2, down from 28.4; confirmation that the eurozone economy has grinded to a halt. Meanwhile Italy’s PMI could serve as a warning of what’s to come, with service sector activity expected to plunge to just 22.5 in March, down from 52.1 in February. Evidence of a paralysed economy as lock down continues.

No coronabonds

Political leaders failing to agree over economic relief for the coronavirus crisis is adding pressure to the Euro. Whilst Spain, France and Italy, along with other member states are seeking a coronabond – issuing joint European debt, Germany strongly opposes. The EC along with European finance ministers are trying to find a compromise. Without a solution the euro has room for further losses.

Political leaders failing to agree over economic relief for the coronavirus crisis is adding pressure to the Euro. Whilst Spain, France and Italy, along with other member states are seeking a coronabond – issuing joint European debt, Germany strongly opposes. The EC along with European finance ministers are trying to find a compromise. Without a solution the euro has room for further losses.

US NFP

The US jobs report is expected to be grim, although not that grim given that it only measures until 12th March and the first US lock down occurred on 20th March. Still with 10 million applying for unemployment benefits in just 2 weeks, even if March’s NFP is not so bad, April’s will be terrible.

The US jobs report is expected to be grim, although not that grim given that it only measures until 12th March and the first US lock down occurred on 20th March. Still with 10 million applying for unemployment benefits in just 2 weeks, even if March’s NFP is not so bad, April’s will be terrible.

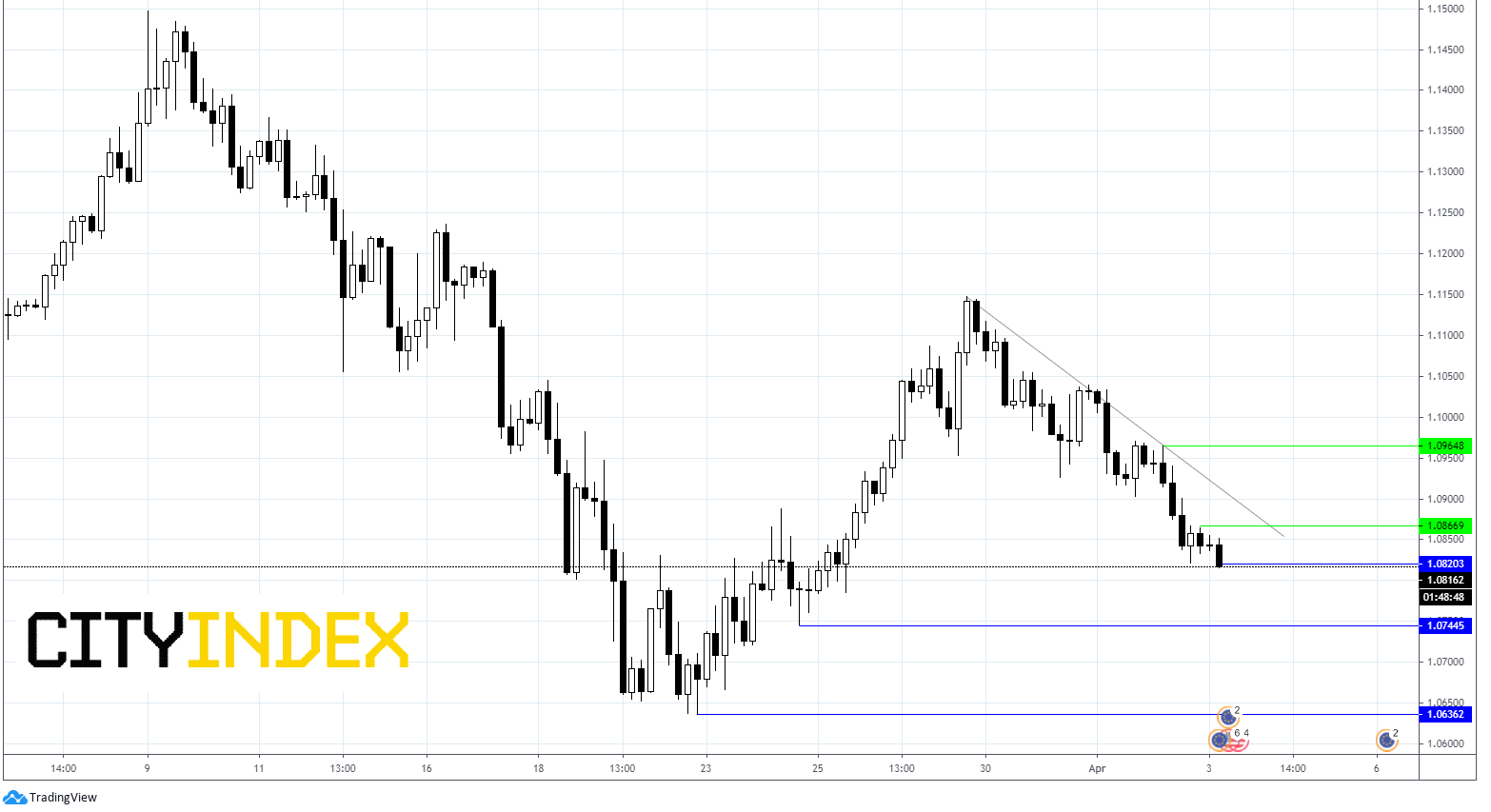

Levels to watch

EUR/USD is trading 0.3% lower and remains below the descending trendline. A break above $1.0910 could negate the current downward trend on 4 hour chart. Southwards is the path of least resistance.

Immediate support can be seen at 1.0823 (daily low) prior to $1.0745 (low 24th March) before $1.0640 (low 23rd March).

Resistance can be seen at $1.0864 (daily high) prior to $10910 (trendline) and $1.0965 (high 2nd April).

Latest market news

Today 08:33 AM