EZ Inflation beats

Eurozone inflation was more encouraging beating expectations by climbing 1% higher year on year in October. Whilst this is still a good distance from the ECB’s 2% target it is a definite improvement on September’s 0.7% increase. Core inflation also surprised to the upside, increasing for the third straight month.

The question is whether this increase in inflation can be sustained or even increased? Core inflation is on the up and wage growth is also rising so increased pressure on prices is possible. That said, businesses are lacking the confidence to put higher costs onto the consumer in any meaningful way. As a result, inflation could struggle to advance. Given the weakness in the euro investors are dubious of inflation picking up further.

The increase in inflation is good news for the ECB, which is growing increasingly concerned over the impact of its lose monetary policy. Still policy makers will want to see more evidence of increasing inflation before they take their foot off the easing pedal.

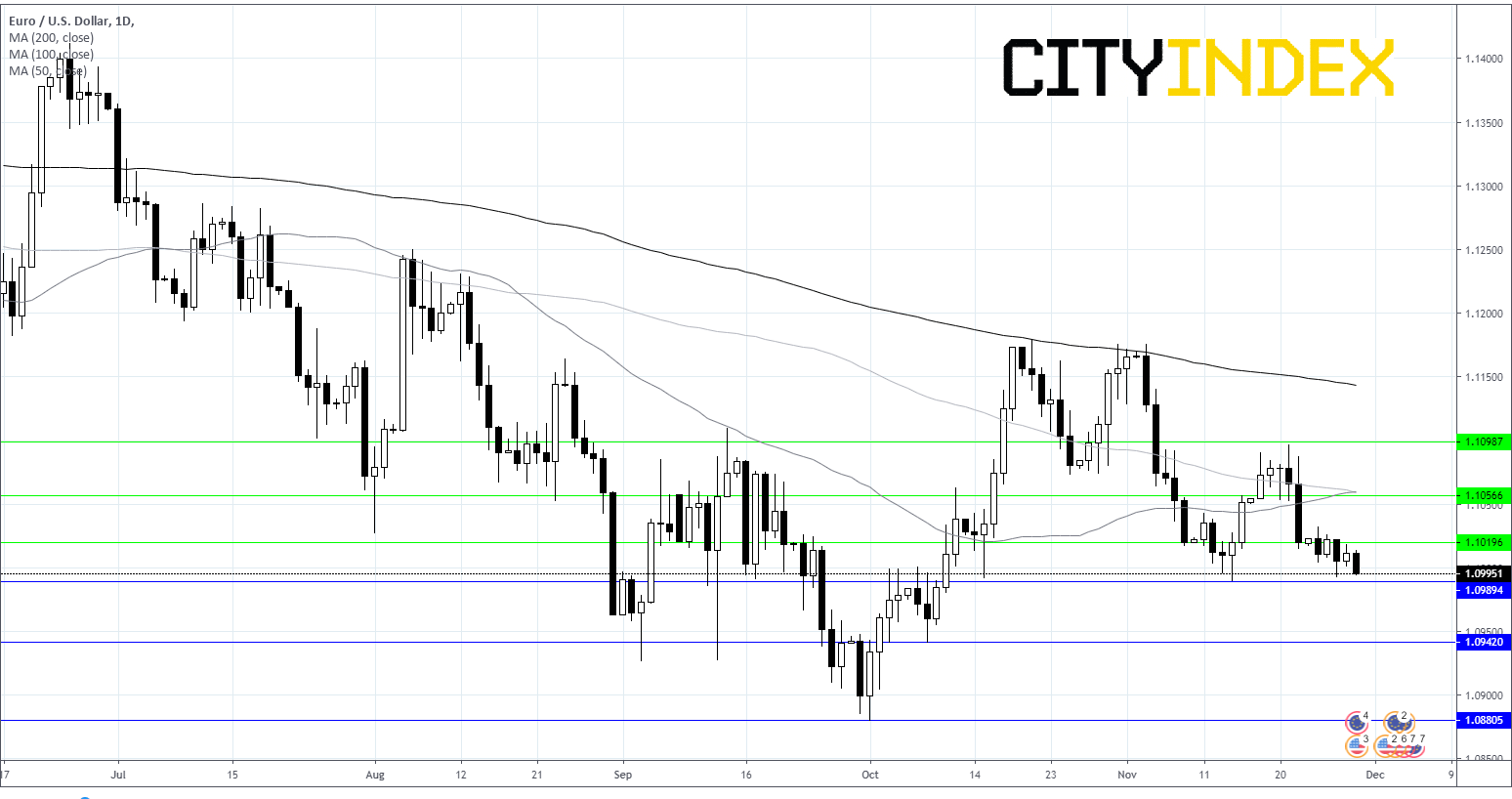

Levels to watch:

The EUR/USD trades below its 200, 100 and 50 sma – bearish signs. The pair broke through support at $1.10 and $1.0989 opening the door to $1.0940. Resistance can be seen at $1.1020, $1.1050 and $1.11.