In our last write up on the EURUSD in late April we were downbeat, concerned that the EU had failed to address the COVID-19 economic downturn, handcuffed by political bickering and debt constraints.

In an update on EURCHF and the EURUSD here on May 20th, we highlighted the positive surprise coming from a joint press conference where German Chancellor Angela Merkel and French President Emmanuel Macron proposed a €500bn Recovery Fund to support the regions worst hit by COVID-19 via grants rather than loans.

Last Wednesday, building on the Franco-German proposal, the European Commission proposed a new €750 billion recovery fund dubbed “Next Generation EU”. If ratified by all 27 EU member states it greatly increases the prospects of recovery across the European region. Equally important, it would consolidate the region's first step towards fiscal union.

Further reinforcing the positive sentiment, Germany the largest member of the EU enjoyed a run of better than expected economic data last week, including retail sales and the IFO survey, driven by a strong rebound in future expectations. Supporting the uplift in data, Germany has been able to relax social distancing measures faster than other European countries.

All of which has proved supportive of the Euro against the USD, helping the EURUSD to a 1.86% gain last week, and a daily close above 1.1100 for the first time since late March.

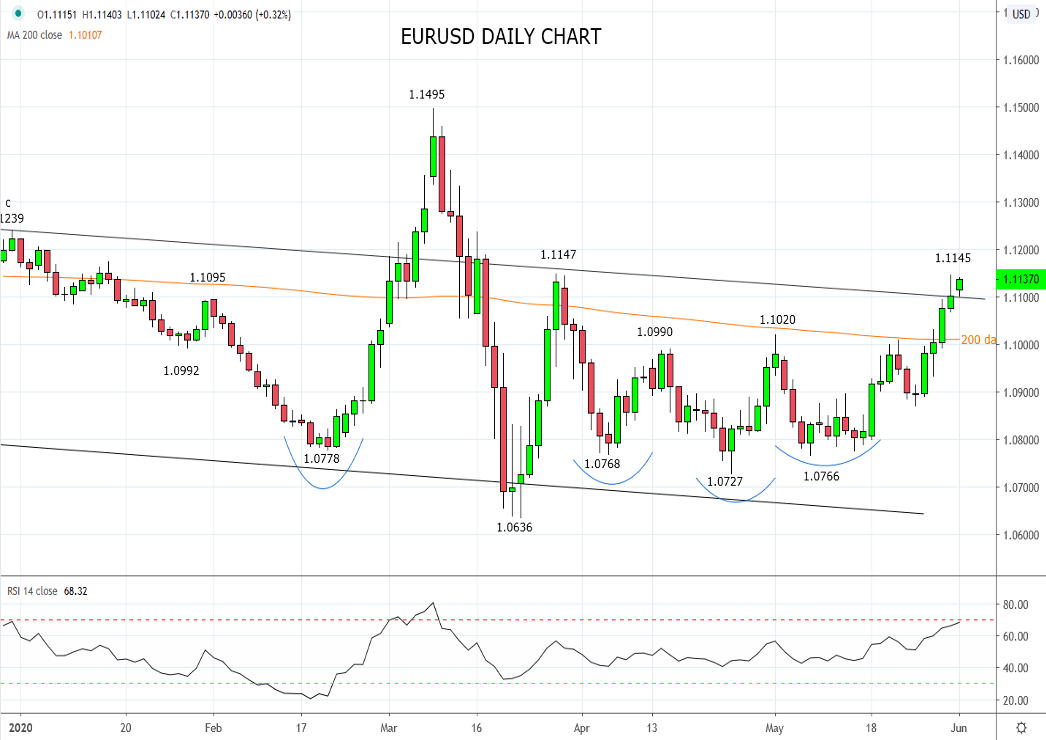

The EURUSD’s rally has been in line with our expectations following the bottoming pattern that formed at the 1.0765 area (outlined in recent video updates). However, from here things turn more critical as the EURUSD attempts to consolidate its break from out of the trend channel, which has largely contained the EURUSD for the better part of 18 months.

To this effect, I am watching for a break and daily close above 1.1150 to confirm the break out and that the next leg higher is underway towards year to date highs 1.1500 area. In this instance, consider opening a long EURUSD trade with a stop loss placed 25 pips below the 200 day moving average, currently at 1.1010.

Source Tradingview. The figures stated areas of the 1st of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation