EUR/USD testing YTD lows after woeful German data, bears gunning for 1.16 next?

It’s been a rough week or two for the world’s most widely-traded currency pair.

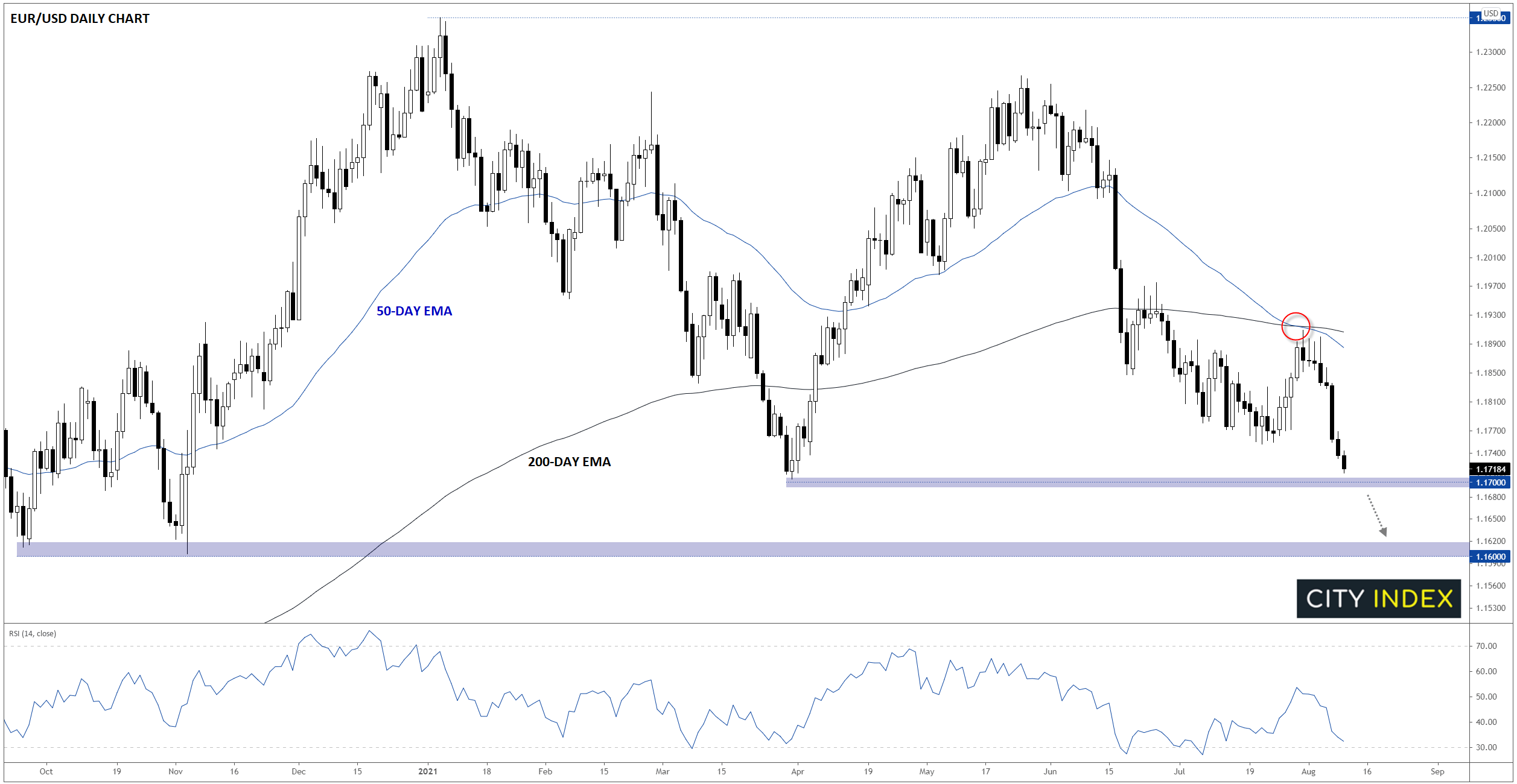

Including today’s (unfinished) price action, EUR/USD is working on its eighth consecutive bearish day, with prices shedding nearly 200 pips from peak to trough over that period. This big bearish move was preceded by a “death cross”, where the 50-day EMA crossed below the 200-day EMA. For the uninitiated, this ominous-sounding development has ominous implications: It suggests that the longer-term trend has shifted in favor of the bears for the first time since June 2020.

As of writing, EUR/USD is probing its year-to-date low near 1.1700, with a break below that support area potentially opening the door for a quick continuation down to the next level of support, the November 2020 low around 1.1600:

Source: StoneX, TradingView

So what is driving the selloff?

Generally speaking, traders are pricing in the potential for an earlier-than-previously-anticipated announcement that the Federal Reserve may start tapering its asset purchases after a run of strong data out of the US, highlighted by Friday’s strong NFP report. On that front, tomorrow’s Consumer Price Index (CPI) report from July will be closely monitored, with another hot reading raising the odds of an earlier taper announcement, perhaps as soon as September or even later this month at the Jackson Hole Symposium.

Meanwhile, on the other side of the Atlantic, Europe has seen more tepid economic reports. Just this morning, the German ZEW economic sentiment survey came in at 40.4, well below the 54.9 reading economists were expecting and last month’s 63.3 print. This is the worst reading since November, which was itself the worst reading since the depths of the COVID recession in April 2020.

With little in the way of additional top-tier data our of Europe for the rest of the week, EUR/USD traders will key on the US economic releases and general risk appetite. If US data continues to beat expectations, EUR/USD could set a fresh year-to-date low as soon as this week.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.