EUR/USD is heading northwards snapping a 7-session losing streak amid improved risk sentiment in the market, which is also hitting demand for the safe haven USD. The pair is trading at the upper end of its trading range having struck a three-day high.

Data is showing that the number of coronavirus cases are starting to level out in European hot spots such as Italy, Spain and France, whilst Germany has recorded more daily recoveries than new cases. New York is also showing signs of the covid-19 curve flattening. The improved coronvirus numbers have resulted in a strong injection of risk sentiment into the markets over the past 36 hours.

German industrial production beat

Stronger than forecast German industrial production figures have also helped underpin sentiment. Industrial output increased 0.3% month on month in February, in the first two consecutive month increase since early 2019. The data showed that German industry was finally recovering before the coronavirus hit. However, this is merely a relic of the past as lock down measures means a sharp fall in production is coming.

Stronger than forecast German industrial production figures have also helped underpin sentiment. Industrial output increased 0.3% month on month in February, in the first two consecutive month increase since early 2019. The data showed that German industry was finally recovering before the coronavirus hit. However, this is merely a relic of the past as lock down measures means a sharp fall in production is coming.

Coronabonds – not likely

Attention will now turn towards the Eurogroup meeting later today. The group ae expected to discuss joint action to help member countries tackle the economic fallout from the coronavirus outbreak. Discussions could touch on the controversial subject of “coronabonds” new debt for which all 19 members of the currency union would be jointly liable. Whilst the countries hardest hit by coronavirus, Spain and Italy are in favour, German and Netherlands strongly oppose to coronabonds to cushion the economic blow from coronavirus. The conservative north fears that coronabonds would mean the eventual sharing of all sovereign debt and taxpayers in the norther paying for the south's spending.

The broad expectation is that the group will agree to use the eurozone’s €410 billion bailout fund.

Attention will now turn towards the Eurogroup meeting later today. The group ae expected to discuss joint action to help member countries tackle the economic fallout from the coronavirus outbreak. Discussions could touch on the controversial subject of “coronabonds” new debt for which all 19 members of the currency union would be jointly liable. Whilst the countries hardest hit by coronavirus, Spain and Italy are in favour, German and Netherlands strongly oppose to coronabonds to cushion the economic blow from coronavirus. The conservative north fears that coronabonds would mean the eventual sharing of all sovereign debt and taxpayers in the norther paying for the south's spending.

The broad expectation is that the group will agree to use the eurozone’s €410 billion bailout fund.

Levels to watch

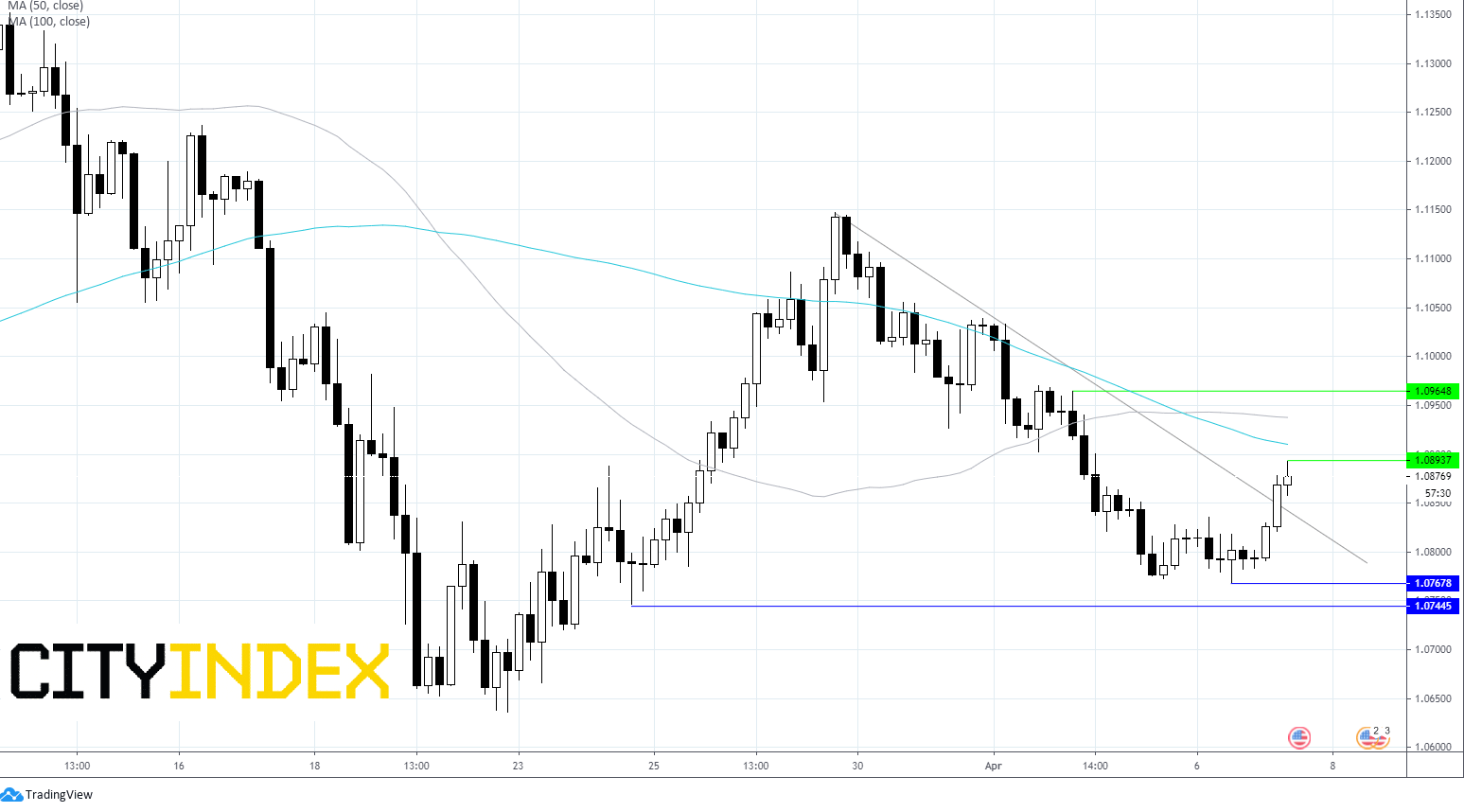

After a negative start to the week, EUR/USD is trading 1% higher. The pair has pushed above its descending trend line resistance and is set to test the 100 sma at $1.0910. A break through here could see an advance to $1.0940 (50sma) prior to $10965 high 2nd April.

On the downside support can be seen at $1.0835 (trend line resistance turned support) and $1.0676 (yesterday’s low).

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM