Relief. That is the word that basically describes the sharp moves in the markets today. The euro and stock markets have absolutely surged higher on the back of news Emmanuel Macron secured almost 24% of Sunday’s first-round vote, suggesting he will probably beat Marine Le Pen in a run-off for the French presidency. The threat that a Eurosceptic leader will preside over France has therefore diminished sharply. However, the prospects of an unlikely victory for Le Pen remains and that may dampen the enthusiasm expressed by investors today. What’s more, there is always the possibility that the markets may have overreacted to the news. Thus, there is a risk that both the euro and European stock markets may ease back in the days to come, even if the German DAX index has climbed to a new record high level.

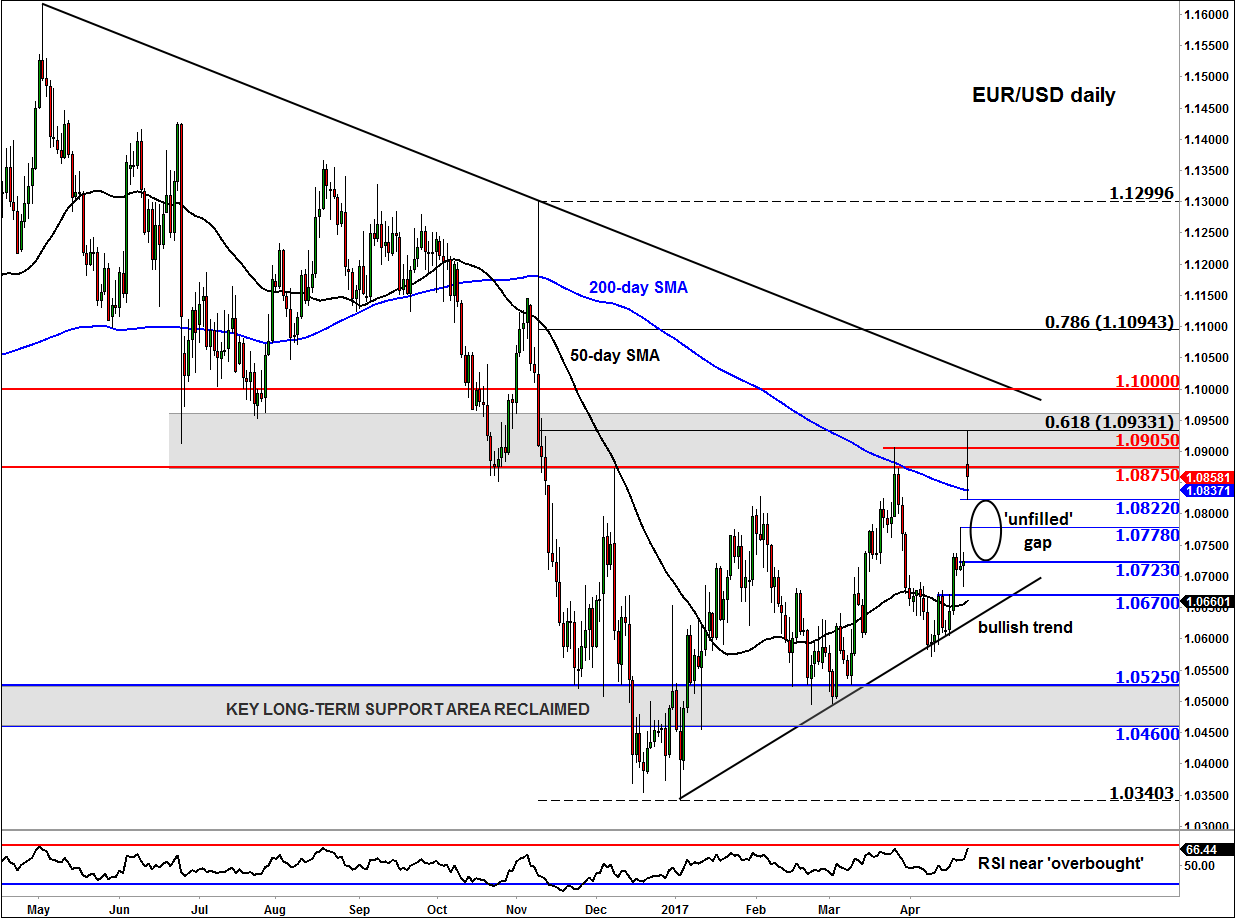

As far as the EUR/USD is concerned, well this pair has already filled a big chunk of the gap it created in reaction to the outcome of French elections. It turned lower after testing the 61.8% Fibonacci retracement level (around 1.0930/5) against the move down from November. It has since dropped back below the previous swing high at 1.0905 and below and old support and resistance level at 1.0875. it has potentially created a false breakout reversal pattern. If so, we could see a sharp move lower in the days to come. In the event the EUR/USD continues to ease later this afternoon, then it may drop to test an old resistance level at 1.0775/80 or go on to completely fill the gap to 1.0720/5 area.

Alternatively, if the EUR/USD recovers during the US hours later this afternoon and reclaims the prior swing high at 1.0905 then I wouldn’t be surprised to see the start of a potential move towards the bearish trend line and the next psychologically-important level of 1.10 in the coming days.