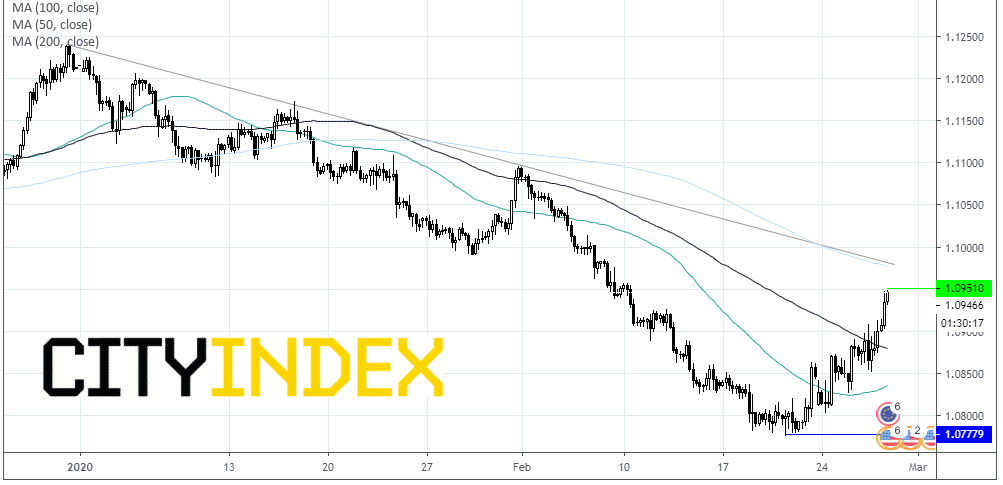

EUR/USD is approaching $1.0950, a 2-week high in its 5th straight bullish session. Whilst coronavirus fears are dragging on the greenback, hopes of stimulus in Germany are boosting the euro.

German Stimulus Hopes

Reports that Germany’s finance minister, Olaf Scholz, wants to ease strict fiscal policy rules is helping to boost the euro. Mr Scholz is considering a suspension to the country’s current curb on taking on more debt, in order to help cash strapped towns and cities struggling to service their dent pile and, in a bid, to boost the stagnant Germany economy. His words will be well received by ECB President Christine Lagarde, along with other economists and business leaders who have been vocal in their wish for Angela Merkel to loosen the purse strings. With interest rates at record lows now is the time to boost fiscal spending, this would also take some of the pressure off the ECB, which could be running short of tools in the case of a deeper economic downturn.

Reports that Germany’s finance minister, Olaf Scholz, wants to ease strict fiscal policy rules is helping to boost the euro. Mr Scholz is considering a suspension to the country’s current curb on taking on more debt, in order to help cash strapped towns and cities struggling to service their dent pile and, in a bid, to boost the stagnant Germany economy. His words will be well received by ECB President Christine Lagarde, along with other economists and business leaders who have been vocal in their wish for Angela Merkel to loosen the purse strings. With interest rates at record lows now is the time to boost fiscal spending, this would also take some of the pressure off the ECB, which could be running short of tools in the case of a deeper economic downturn.

EZ business confidence improves, pre-virus

Eurozone business confidence data was better than expected, underpinning the euro. Like PMI’s, German IFO index, the European Commission ‘s economic indicator also improved in February, gaining for a 4th straight month. The manufacturing sector showed a healthy increase in confidence for a 2nd straight month thanks to improving order books. However, before we get too carried away on the prospect of a recovery in the manufacturing sector, the survey was conducted in the first 2 / 3 weeks of the month before the coronavirus outbreak in Italy and before numbers in China really started to take off.

Eurozone business confidence data was better than expected, underpinning the euro. Like PMI’s, German IFO index, the European Commission ‘s economic indicator also improved in February, gaining for a 4th straight month. The manufacturing sector showed a healthy increase in confidence for a 2nd straight month thanks to improving order books. However, before we get too carried away on the prospect of a recovery in the manufacturing sector, the survey was conducted in the first 2 / 3 weeks of the month before the coronavirus outbreak in Italy and before numbers in China really started to take off.

Dollar Sinks As Rate Cut Bets Rise

Meanwhile the dollar is trading on the back foot across the board as investors are rattled by the first coronavirus case in the US of an unknown origin. This has raised fears of a pandemic and questions over whether the US is prepared for such an event. Trump did little to quash concerns.

According to the CME Fedwatch, traders are now pricing in a 41% probability of a rate cut in March. This is up from 23% earlier in the week.

Meanwhile the dollar is trading on the back foot across the board as investors are rattled by the first coronavirus case in the US of an unknown origin. This has raised fears of a pandemic and questions over whether the US is prepared for such an event. Trump did little to quash concerns.

According to the CME Fedwatch, traders are now pricing in a 41% probability of a rate cut in March. This is up from 23% earlier in the week.

GDP & Durable Goods Up Next

GDP is expected to confirm 2.1% growth annually in Q4. Durable goods are expected to show -1.5% decline in January.

GDP is expected to confirm 2.1% growth annually in Q4. Durable goods are expected to show -1.5% decline in January.

Levels to watch

Despite trading 0.7% higher today and gaining over 1% so far this week, the EUR/USDA downtrend on the 4 hour chart remains intact. The price would need to push beyond resistance at $1.0970 (trend line & 200 sma) to negate the current bearish trend.

Failure to break above $1.0970 resistance could send the pair back towards support at $1.0780 (low 20th Feb).