EUR/USD provides opportunities taught in our recent webinar; Philly Fed PMI

EUR/USD provides opportunities taught in our recent webinar; Philly Fed PMI

The Philadelphia Fed Manufacturing Index for May continued the string of weaker than expected data from the US. The headline print was 31.5 vs 48 expected and 50.2 in March. Recall that the April Non-Farm Payrolls, Retail Sales, and ISM Manufacturing PMI, housing data (thus far) were all weaker than expected. And now it continues into May. However, the bad economic data means risk on for traders, as it pushes back expectations for tapering. That means higher EUR/USD.

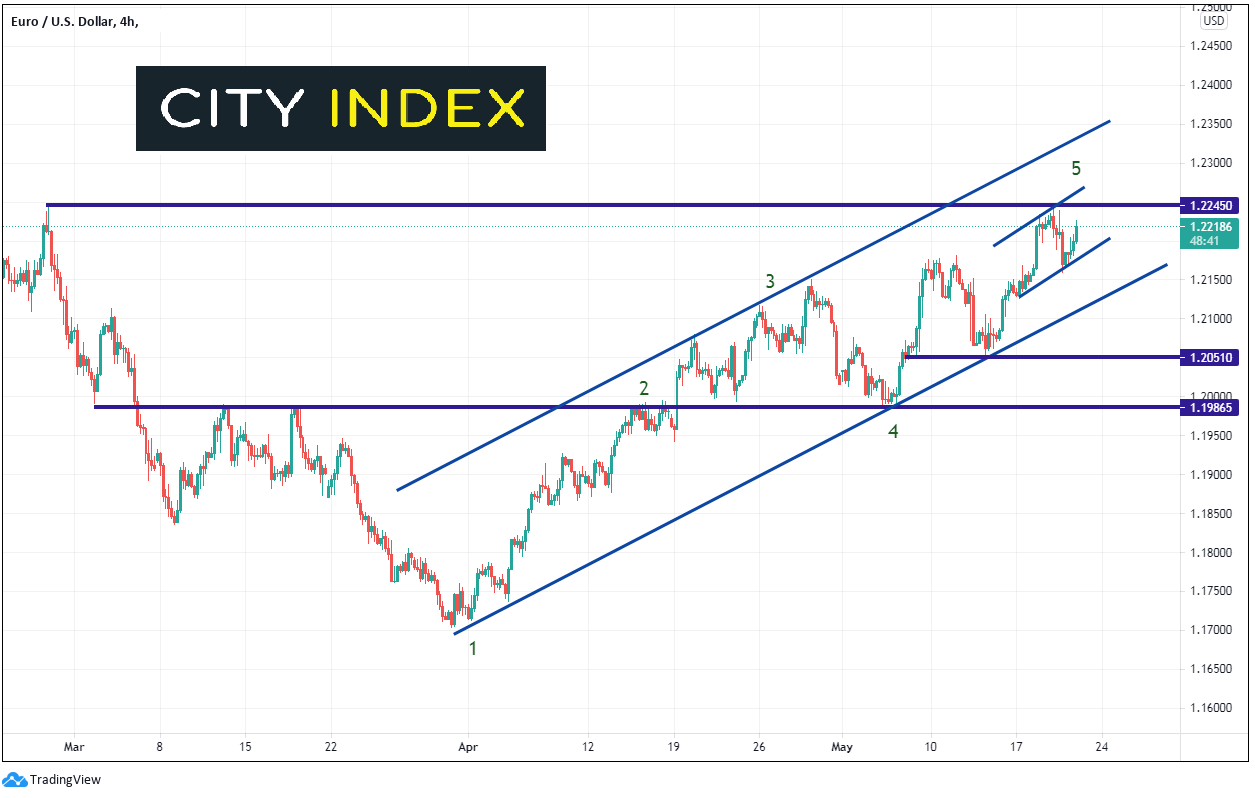

As we discussed in my last webinar, trendlines can be drawn to show support and resistance, trends, and channels. With the risk on move in stocks today, the EUR/USD is trading higher as well. However, on a 240-minute timeframe, even without the worse than expected data released today, EUR/USD was already in an up-trending channel from the lows on March 31st near 1.1704.

Source: Tradingview, City Index

- When the first few higher lows were formed back in early April, an upward sloping trendline was drawn, which was tested in early and mid-May.

- Notice that on April 14th and 15th, price stalled at horizontal resistance from previous lows and highs in May, near 1.1985.

- Price moved higher from there and in late April, formed 3 higher lows and the top trendline of a channel was drawn.

- EUR/USD pulled back in early May to test the previous resistance (now acting as support) at 1.1985, which converged with the bottom, upward sloping trendline of the channel.

- Since the beginning of May, price has oscillated within the upward sloping channel, and is currently trading mid-range. However, price is nearing horizontal resistance from previous highs on February 25th and May 19th , near 1.2245.

First resistance is at the 1.2245 horizontal line, followed by the upward sloping, top trendline of the short-term channel (within the larger channel), currently near 1.2270. The next resistance level is the top trendline of the longer-term channel near 1.2335.

First support is at the bottom trendline of the shorter term upward sloping channel near 1.2175. Below there is the bottom trendline of the longer term upward sloping channel near 1.2115, and then horizontal support on May 6th and May 13th lows near 1.2040.

Shorter-term traders can trade the swings in the channel to go long and short. Longer-term traders may wish to follow the longer-term trend and hold while price remains in the upward sloping channel.