The euro is edging higher versus the US dollar following better than forecast ZEW Sentiment data. German investor sentiment improved to the strongest level in two years. The brighter outlook comes amid hopes that trade tensions are slowly easing, and that the US will avoid a disorderly Brexit from the EU.

Encouraging sentiment data comes following unexpectedly strong German export data on Monday and increasing signs that the German economy could narrowly avoid a contraction in the final quarter of the year, after avoiding a recession in the third quarter. Germany is by no means out of the woods. However, there are signs that Europe’s largest economy could be in the brink of turning around.

Dollar eases on improved risk, FOMC Ahead

The dollar slipped lower as risk improved on rumours that the US will not hike trade tariffs on Chinese imports on 15th December. This can only mean that the two sides are close to a phase one deal, surely?

The dollar slipped lower as risk improved on rumours that the US will not hike trade tariffs on Chinese imports on 15th December. This can only mean that the two sides are close to a phase one deal, surely?

Investors will now look ahead to the FOMC rate announcement tomorrow. After cutting interest rates three times in 2019, policy makers are of the impression that they have done enough to stabilise the economy. Given the resilience in the labour market and the calm in the markets now compare to four months ago, then this assumption could well be spot on. With no change in monetary policy expected, traders will focus on the dot plot and Jeremy Powell’s press conference.

Levels to watch

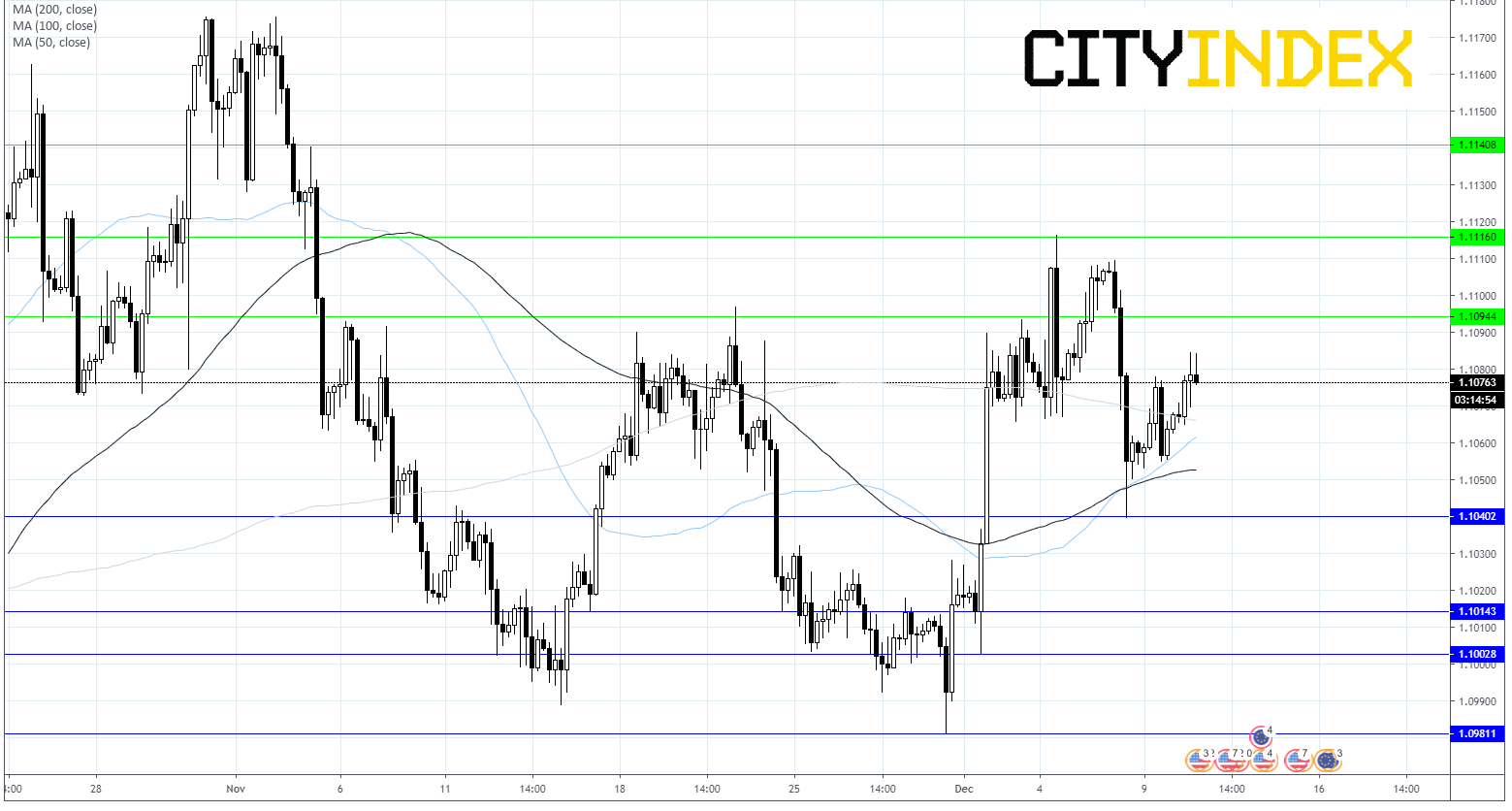

EUR/USD trade above its 50, 100 and 200 sma, a bullish chart. Resistance can be seen at $1.1094, $1.1115 prior to $1.1140.

Support can be seen at £1.1040, $1.1015 before $1.10. We would be looking for a break below $1.1040 to negate the current bullish trend.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM