EUR/USD Falls for Sixth Straight Day, 3-Year Low In Sight

“February is a suitable month for dying. Everything around is dead, the trees black and frozen so that the appearance of green shoots two months hence seems preposterous, the ground hard and cold, the snow dirty, the winter hateful, hanging on too long.”

The above quote, courtesy of author Anna Quindlen, is a bit dramatic but based on the first ten days, EUR/USD bulls will be glad when the February comes to a close, even if it is a day longer than usual this year. After finishing January just five pips below 1.1100, the world’s most widely-traded currency pair has fallen for six straight trading days, reaching a low near 1.0910 thus far.

From a fundamental perspective, economic data out of the Eurozone leveled off in recent weeks, making the drop in EUR/USD perplexing to some traders. Instead, the ongoing drop in the euro can be chalked up to the same factor driving all global markets at present: fears about the spread of coronavirus. Of course, both the US and Eurozone have international trade relationships with China, but the Eurozone economy is seen as more vulnerable to coronavirus-related disruptions in global trade given its 3.1% of GDP current account surplus, compared to a -2.4% of GDP current account deficit in the US.

In other words, the US’s comparatively low net dependence on global trade means that it may be relatively insulated from the ongoing growth shock from coronavirus. Needless to say, the greenback’s safe haven properties are also providing a boost to the world’s reserve currency.

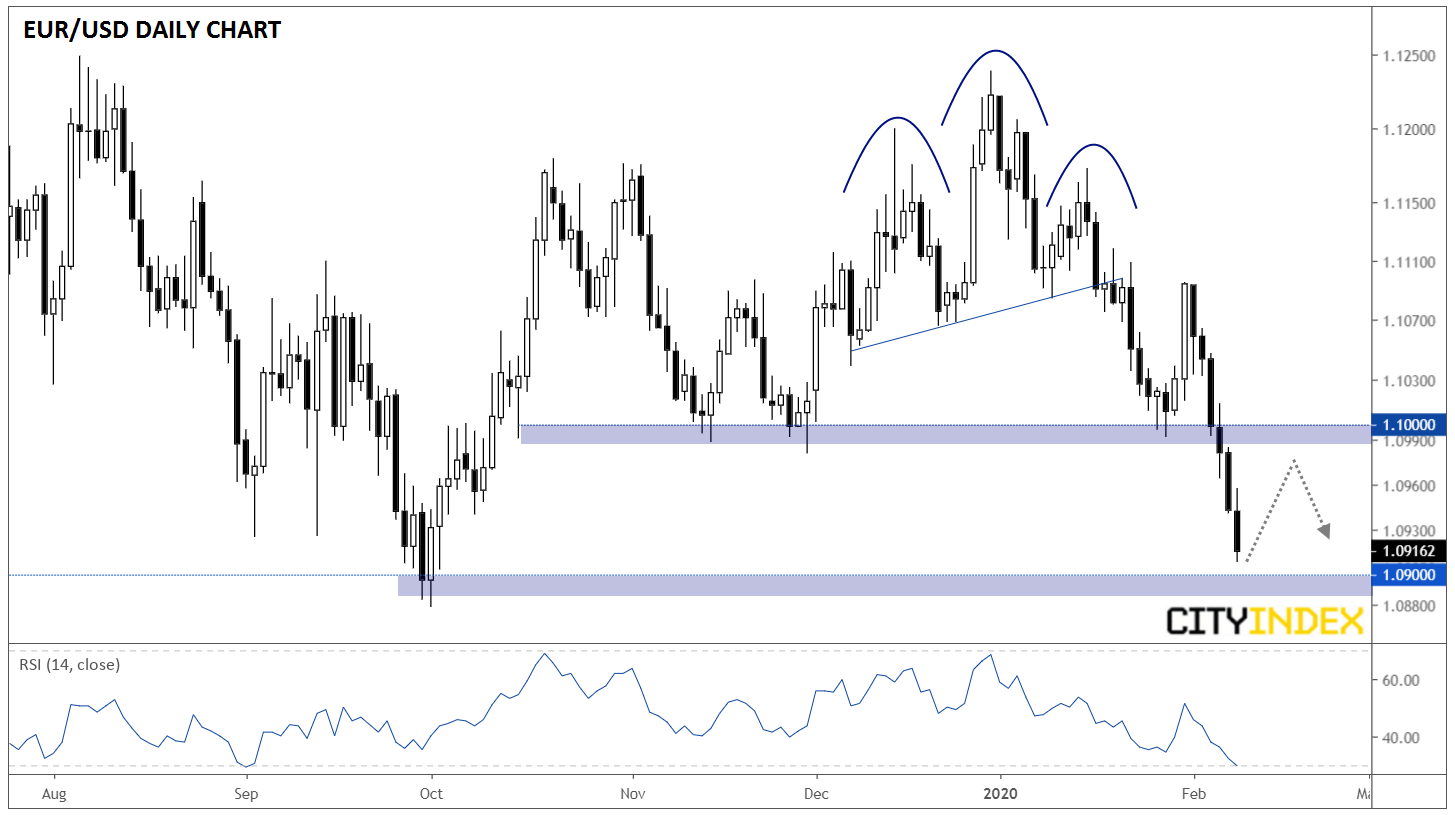

Technically speaking, EUR/USD has fallen for six consecutive days to reach the objective of the Head-and-Shoulders pattern we highlighted last week near 1.0930. Now, the key level to watch will be around 1.0900, the nearly 3-year low set last October:

Source: TradingView, GAIN Capital

With coronavirus fears peaking and EUR/USD deeply oversold, we wouldn’t be surprised to see the pair bounce back from 1.0900 support through the middle of this week. That said, previous-support-turned-resistance in the 1.1000 zone may cap any near-term bounces and set the stage for another leg lower heading into the end of the week.

While not the most likely scenario in our view, a break conclusively below 1.0900 support would signal strong bearish momentum and open the door for a potential continuation down toward 1.0800 or lower next. Perhaps that’s the move that would truly put EUR/USD bulls on the deathbed Quindlen so mournfully described!