EUR/USD: ECB Day

The European Central Bank has kept its key rates unchanged and has decided to boost PEPP (Pandemic Emergency Purchase Programme) by 500 billion euros to at least March 2022. Yesterday, U.K. Prime Minister Boris Johnson and EU President Ursula von der Leyen agreed to continue Brexit talks until Sunday.

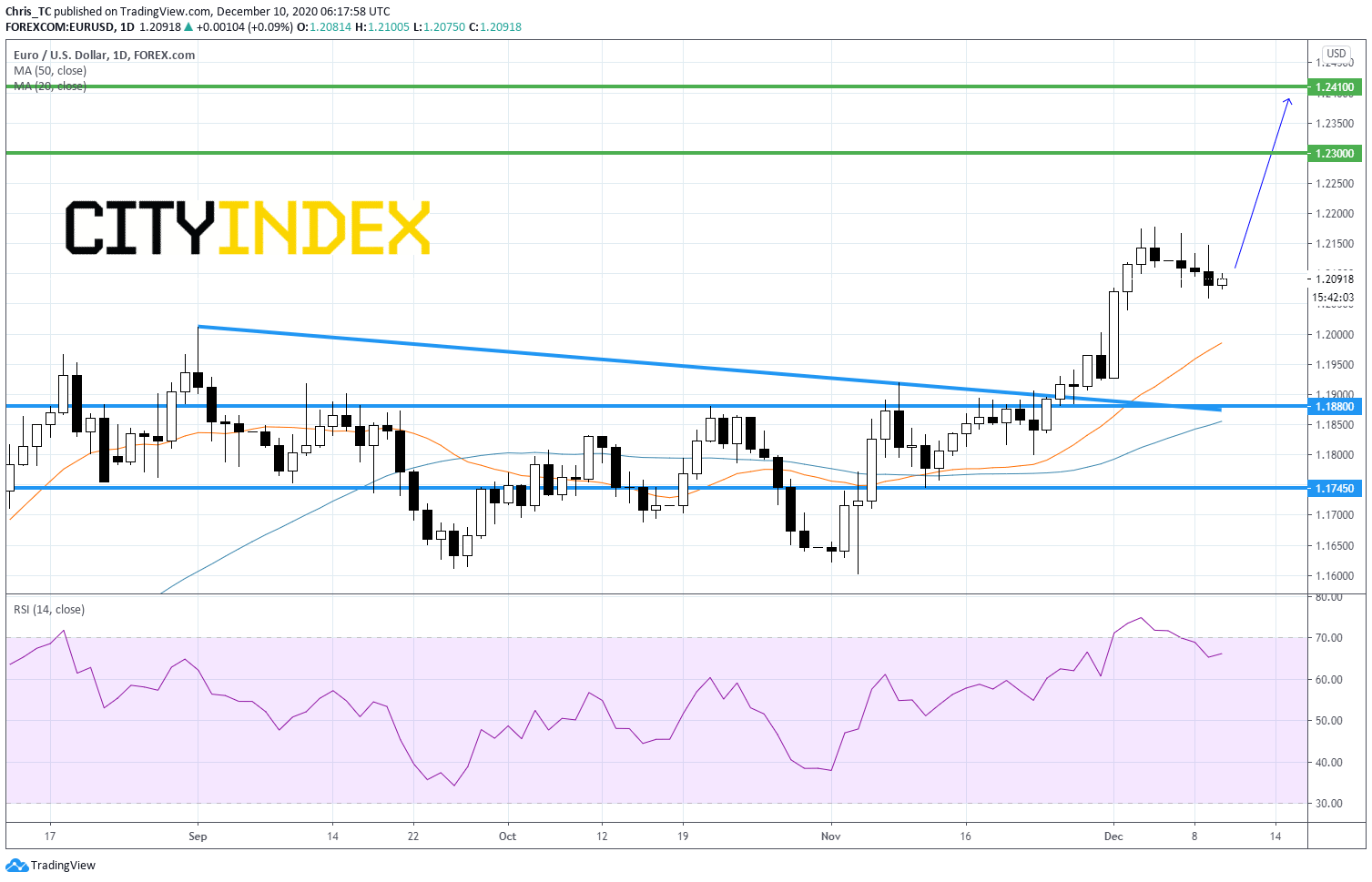

From a technical point of view, on a daily chart, EUR/USD has broken above a declining trend line and is supported by its rising 50-day moving average (in blue). Readers may therefore consider the potential for further advance above 1.1880. The nearest threshold would be set at horizontal resistance at 1.2300 and a second one is set at April 2018 top at 1.2410.

Source: TradingView, GAIN Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM