It has been a busy day on the economic data front, U.S. GDP dropped 32.9% on quarter in the second quarter advanced reading (-34.5% expected), from -5.0% in the first quarter third reading, marking a record low. Personal Consumption tumbled 34.6% on quarter in the second quarter advanced reading (-34.5% expected), from a revised -6.9% in the first quarter third reading, also marking an all-time low. Initial Jobless Claims rose to 1,434K for the week ending July 25th (1,445K expected), from a revised 1,422K in the prior week. Continuing Claims increased to 17,018K for the week ending July 18th (16,200K expected), from a revised 16,151K in the week before. Finally, the Bloomberg Consumer Comfort Index slipped to 44.3 for the week ending July 26th, from 44.7 in the previous week.

On Friday, Personal Income for June is expected to fall 0.6% on month, compared to -4.2% in May. Personal Spending for June is expected to rise 5.2% on month, compared to +8.2% in May. Market News International's Chicago Purchasing Managers' Index for July is expected to jump to 44.5 on month, from 36.6 in June. Finally, the University of Michigan's Consumer Sentiment Index for the July final reading is expected to fall to 72.9 on month, from 73.2 in the July preliminary reading.

In Europe, German 2Q GDP was released at -10.1% on year, vs -9.0% expected. July unemployment change was at -18,000 (vs +41,000 expected), and jobless rate was published at 6.4% vs 6.5% expected. The European Commission has reported the Eurozone's jobless rate for June at 7.8% (vs a rise to 7.7% expected) and Consumer Confidence for July at -15.0, as expected.

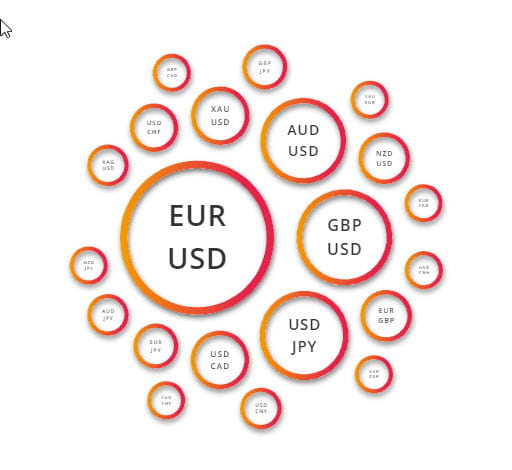

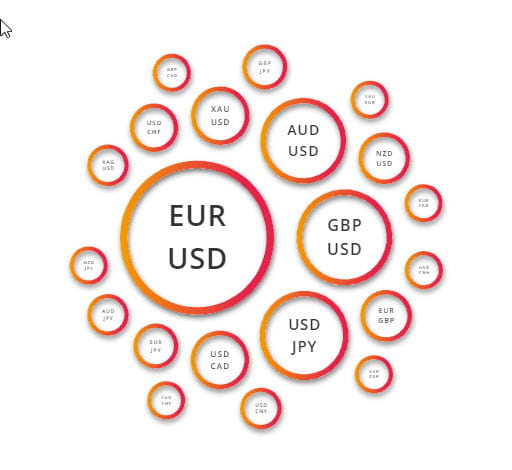

Looking at the "TC Market Buzz" research tool under the Market Analysis tab, the EURUSD pair is seeing increased news buzz.

Source: GAIN Capital, TC Market Buzz

The pair is coming into key resistance at the 1.182 level. Will prices rocket past resistance or take a pause? For now, the trend remains bullish as prices remain inside a trend channel. If price action breaks below 1.1575 support we may see a reversal of the strong uptrend in place since the end of May.

Source: GAIN Capital, TradingView

Happy trading

It has been a busy day on the economic data front, U.S. GDP dropped 32.9% on quarter in the second quarter advanced reading (-34.5% expected), from -5.0% in the first quarter third reading, marking a record low. Personal Consumption tumbled 34.6% on quarter in the second quarter advanced reading (-34.5% expected), from a revised -6.9% in the first quarter third reading, also marking an all-time low. Initial Jobless Claims rose to 1,434K for the week ending July 25th (1,445K expected), from a revised 1,422K in the prior week. Continuing Claims increased to 17,018K for the week ending July 18th (16,200K expected), from a revised 16,151K in the week before. Finally, the Bloomberg Consumer Comfort Index slipped to 44.3 for the week ending July 26th, from 44.7 in the previous week.

On Friday, Personal Income for June is expected to fall 0.6% on month, compared to -4.2% in May. Personal Spending for June is expected to rise 5.2% on month, compared to +8.2% in May. Market News International's Chicago Purchasing Managers' Index for July is expected to jump to 44.5 on month, from 36.6 in June. Finally, the University of Michigan's Consumer Sentiment Index for the July final reading is expected to fall to 72.9 on month, from 73.2 in the July preliminary reading.

In Europe, German 2Q GDP was released at -10.1% on year, vs -9.0% expected. July unemployment change was at -18,000 (vs +41,000 expected), and jobless rate was published at 6.4% vs 6.5% expected. The European Commission has reported the Eurozone's jobless rate for June at 7.8% (vs a rise to 7.7% expected) and Consumer Confidence for July at -15.0, as expected.

Looking at the "TC Market Buzz" research tool under the Market Analysis tab, the EURUSD pair is seeing increased news buzz.

Source: GAIN Capital, TC Market Buzz

The pair is coming into key resistance at the 1.182 level. Will prices rocket past resistance or take a pause? For now, the trend remains bullish as prices remain inside a trend channel. If price action breaks below 1.1575 support we may see a reversal of the strong uptrend in place since the end of May.

Source: GAIN Capital, TradingView

Happy trading

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM

Yesterday 01:13 PM