As we start the last month of the year, the EUR/USD continues to look remarkably strong. Investors have shrugged off political and economic risks in several Eurozone countries this year and instead concentrated on the brighter economic prospects. At the same time, market participants have chosen to largely ignore the dollar as the Fed turned increasingly hawkish. This is because they are probably expecting the disparity between US and Eurozone monetary policies to stop growing as the European Central Bank begins tightening its belt next year.

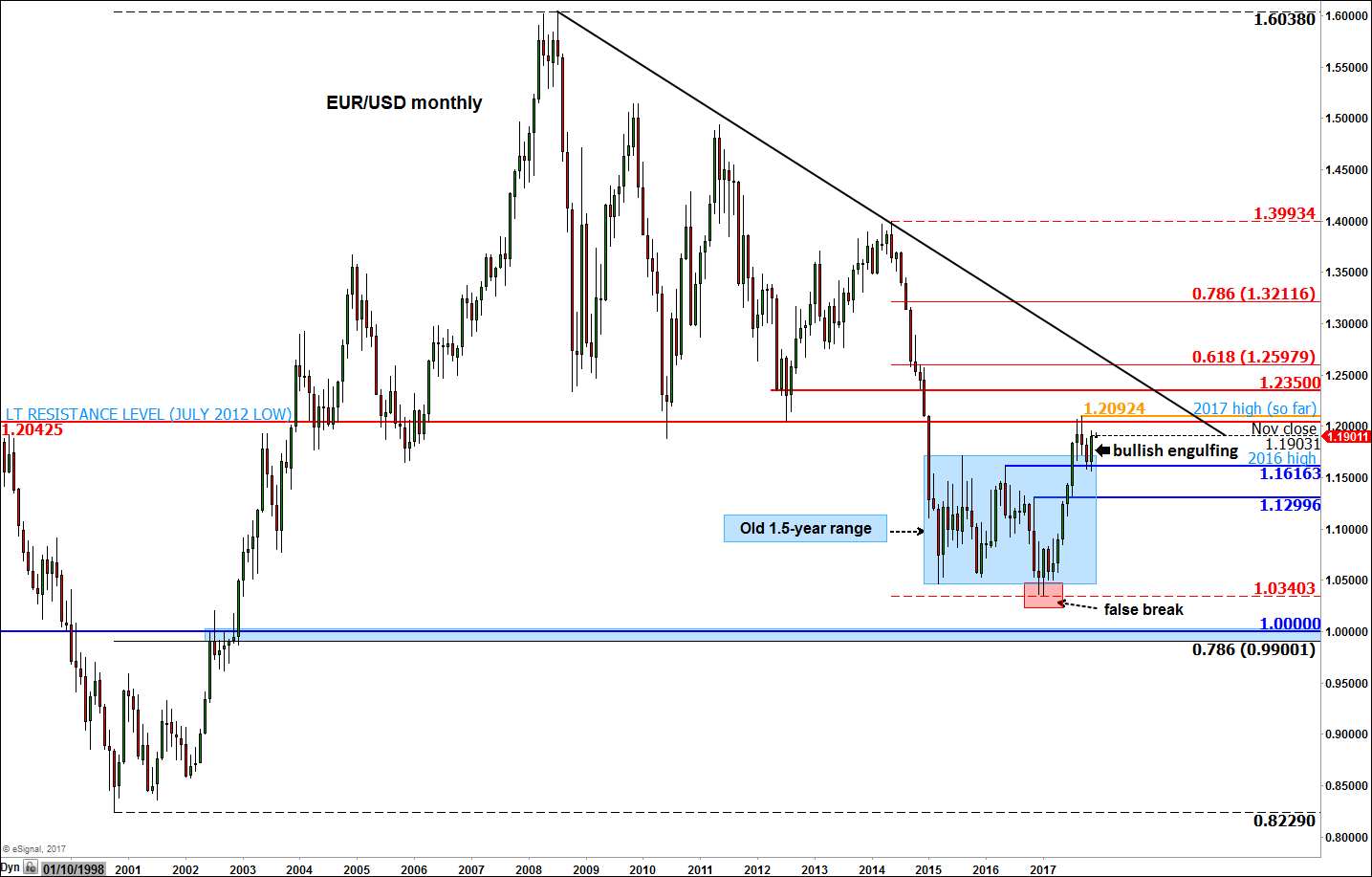

From a technical standpoint, the EUR/USD remains supported. In November, the EUR/USD reversed most of its losses that it had suffered in the previous couple of months. It managed to find strong support from the top of the old 1.5-year trading range and last year’s high around the 1.16/1.17 area. As a result of the rebound, the EUR/USD formed a bullish engulfing candle on its monthly chart, and also a higher low.

These bullish signs suggest we may see a run towards – and possibly beyond – this year’s earlier high that was hit in September at just shy of 1.21. Then, price turned lower as bullish speculators evidently took profit after the multi-month rally had caused the EUR/USD to reach severely overbought levels.

But given that the long-term resistance level at around 1.2040/50 area was respected, it may be that we have already seen the high. That being said, the relatively shallow pullback from the high and the subsequent bullish price action in the month of November makes me think that there is a possibility that the EUR/USD may hit a new high as we approach the year-end.

In the event the EUR/USD breaks through the 1.2040/90 resistance area then the next potential resistance to watch is around 1.2350. We will be quick to drop our bullish view in the even price breaks below November’s low.