Key support on DXY (USD index) around 97 has proven its worth, seeing prices bounce higher and fly in the face of the bearish engulfing candles seen on the weekly and monthly chart. Whilst it’s still possible we’ll see DXY hit a new low, bullish momentum is firm so there’s potential for further upside.

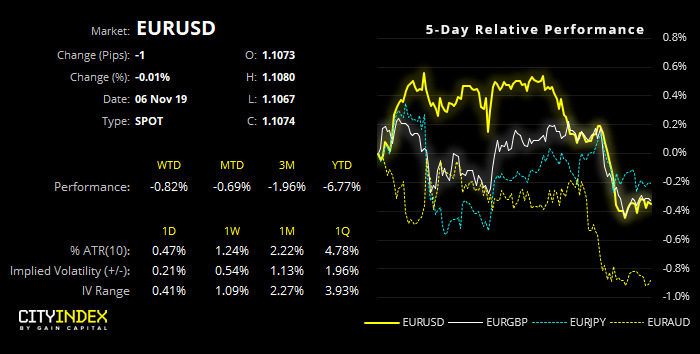

Out of the Euro pairs, EUR/USD and EUR/GBP appear the most favourable to bears. That said, EUR/CHF is one to watch if it can break below 1.0970 and, if risk global risk appetite is to sour, then EUR/JPY could also be considered with a break below 120.35.

Keep an eye on European data shortly which includes German factory orders and EZ retail sales. Whilst it may cause some noise, we doubt this 2nd tier data can lift the Euro convincingly from the lows.