The eurozone has been through a lot recently; Brexit, impact from US – China trade war, political clashes (think Italy & Brussels) and a downturn in German manufacturing. However, today’s data indicates that the bloc could avoid being dragged into a recession, which had looked plausible not so long ago.

Data highlights:

EZ GDP +1.2% yoy vs. 1.1% exp.

Italy GDP +1% yoy vs. -0.1% exp.

Unemployment 7.7% vs. 7.8% exp.

German CPI +2% vs. 1.5%

Italy avoids recession

Italy’s GDP expanded by 0.2% in the first three months of the year, following on from a 0.1% contraction from the third and fourth quarter. News that Italy has emerged from recession in the first quarter has been well received by traders and the populist government in Rome, as they struggle to implement tax cuts and changes to spending.

Whilst this is clearly a well needed win for the Italian coalition government, the long-term picture is still shaky at best; Italy remains the sick dog of the eurozone. Still investors were willing to look beyond this today.

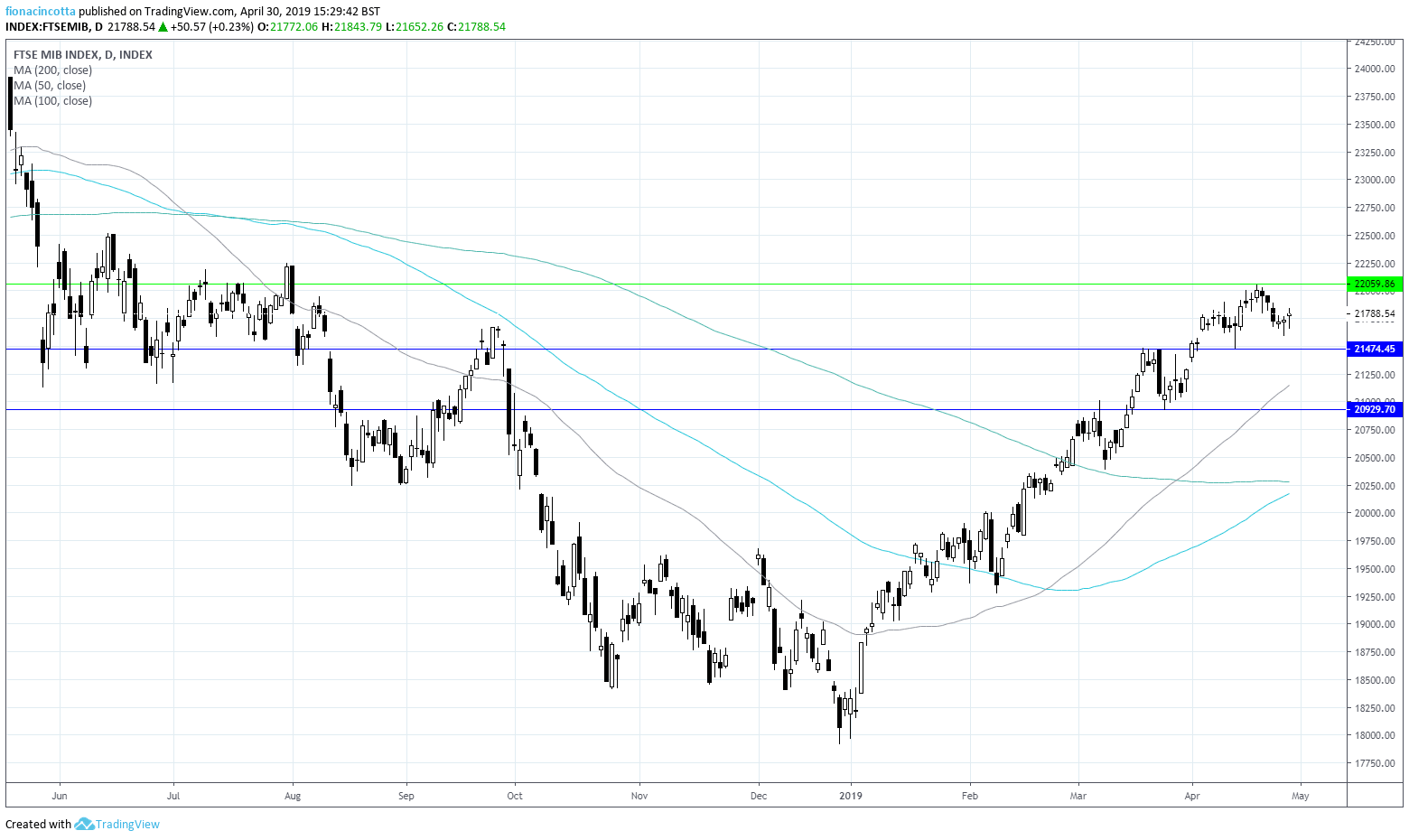

The FTSE MIB jumped higher following the release. The Italian index is leading the charge in Europe up over 0.2% in the early afternoon.

The FTSE MIB is trading above its 50, 100 & 200 SMA as it continues a bullish run up from the start of the year. The FTSE Mib needs to push above its recent 7 month high of 22055, in order to continue towards 22500. On the downside support can be seen at April’s low of 21475 before 20930.