This is the weakest quarter for at least two years for STOXX 600 company earnings

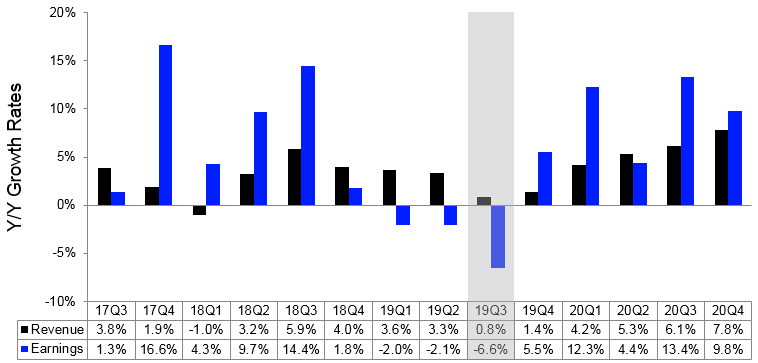

More than half of STOXX 600 had reported third-quarter earnings by Wednesday, looking at the reporting season that began around mid-September. Recent earnings have seen aggregate mathematics for the quarter improving. But even then, Q3 2019 is still set to be the weakest for at least two years, both in terms of earnings and for revenues, as shown below.

Consensus forecasts from institutional investors, compiled by Refinitiv, blended with actual performance in the quarter so far, point to an earnings decrease of 6.6% on average, compared to Q3 2018. Excluding the volatile energy sector, earnings are expected to decrease 3.7%. As for revenues, these are expected to increase 0.8% from Q3 2018. With energy out of the picture, average top-line growth would look better at 3.2%.

STOXX 600 year-on-year growth rates

Source: Refinitiv

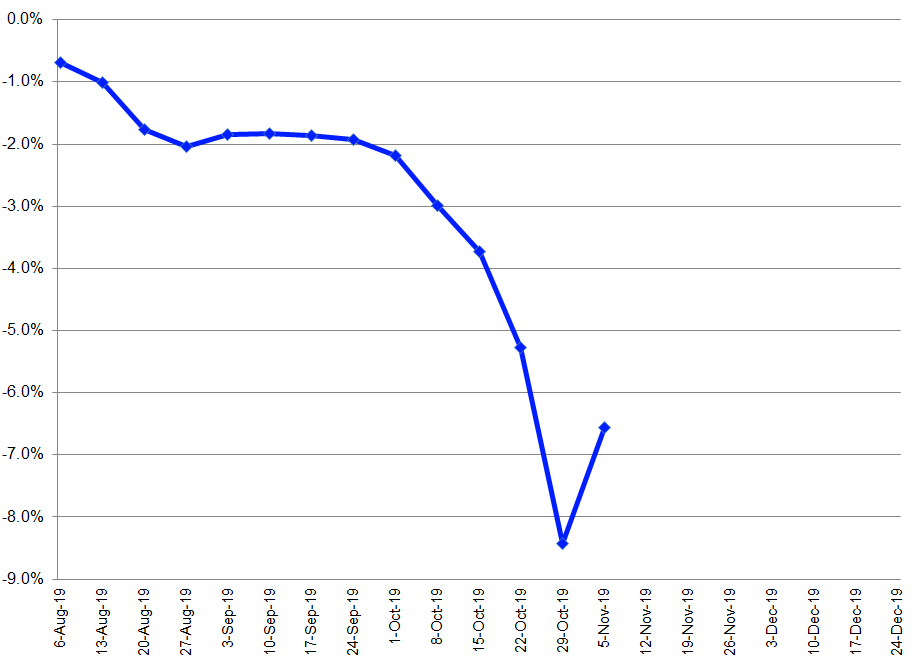

Despite the recent quarter being one many European firms would prefer to forget, the extent of low expectations that preceded the reporting season is underlined by the above-trend rate of companies that have beaten expectations. 57.3% reported results exceeding analyst estimates. In a typical quarter, 50% beat analyst EPS estimates, according to Refinitiv data. Furthermore, the trend of analysts’ earnings estimates combined with ‘actuals’ has been rising from an even lower base, if compared with expectations from late-October.

STOXX 600 Q3 2019 estimates/actuals trend

Source: Refinitiv

The impact on sentiment helps explain why the STOXX gauge continues to linger near its best levels in almost two years, even as global markets appear to face fresh turbulence on Wednesday from the latest twist in the trade saga. The baked-in case for easy European Central Bank policy to continue for the foreseeable future is another prop. Given the STOXX index’s near-20% rise in the year to date, markets are almost certainly pricing an eventual positive outcome on the trade front too. But these price gains are also ramping up valuations even as European earnings and growth expectations remain at a low ebb and Eurozone economic counters are declining. Fresh uncertainties or extended delays in the grind towards a resolution Washington’s and Beijing’s dispute alone, could raise the risk of a significant stock market correction.