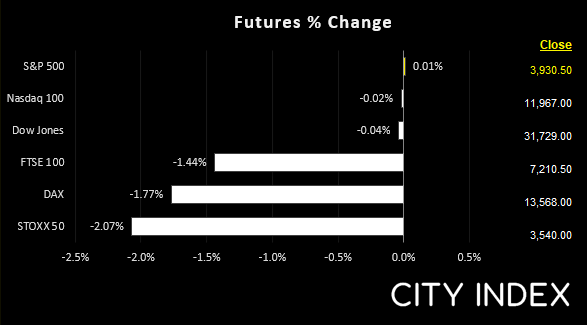

Asian Indices:

- Australia's ASX 200 index fell by -108.6 points (-1.54%) and currently trades at 6,956.10

- Japan's Nikkei 225 index has fallen by -357.17 points (-1.36%) and currently trades at 25,846.47

- Hong Kong's Hang Seng index has fallen by -208.8 points (-1.05%) and currently trades at 19,615.77

- China's A50 Index has fallen by -25.78 points (-0.19%) and currently trades at 13,204.99

UK and Europe:

- UK's FTSE 100 futures are currently down -105 points (-1.44%), the cash market is currently estimated to open at 7,242.66

- Euro STOXX 50 futures are currently down -74 points (-2.05%), the cash market is currently estimated to open at 3,573.87

- Germany's DAX futures are currently down -239 points (-1.73%), the cash market is currently estimated to open at 13,589.64

US Futures:

- DJI futures are currently down -13 points (-0.04%)

- S&P 500 futures are currently down -3.5 points (-0.03%)

- Nasdaq 100 futures are currently up 0.25 points (0.01%)

Sentiment remained fragile overnight with the S&P 500 e-mini futures trading near yesterday’s lows, Asian equity markets in the red and AUD/JPY touching a 7-week low. Yet volatility was lower for currency markets which traded in relatively small ranges. The ASX 200 opened at the high of the session, currently sits at the session low below 7,000 – a critical level for bulls to defend.

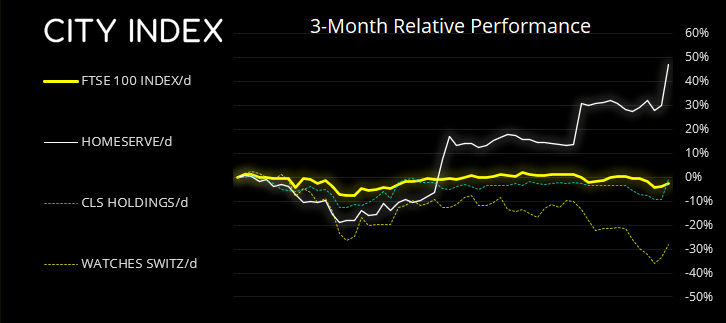

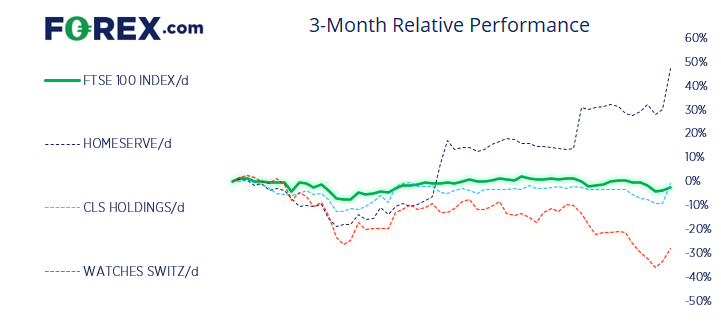

FTSE: Market Internals

FTSE 350: 4090.08 (1.44%) 11 May 2022

- 276 (78.86%) stocks advanced and 66 (18.86%) declined

- 1 stocks rose to a new 52-week high, 27 fell to new lows

- 23.43% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 7.14% of stocks closed above their 20-day average

Outperformers:

- + 13.45% - HomeServe PLC (HSV.L)

- + 9.15% - CLS Holdings PLC (CLSH.L)

- + 8.69% - Watches of Switzerland Group PLC (WOSG.L)

Underperformers:

- -9.08% - Marshalls PLC (MSLH.L)

- -4.20% - Darktrace PLC (DARK.L)

- -3.66% - LXI REIT PLC (LXIL.L)

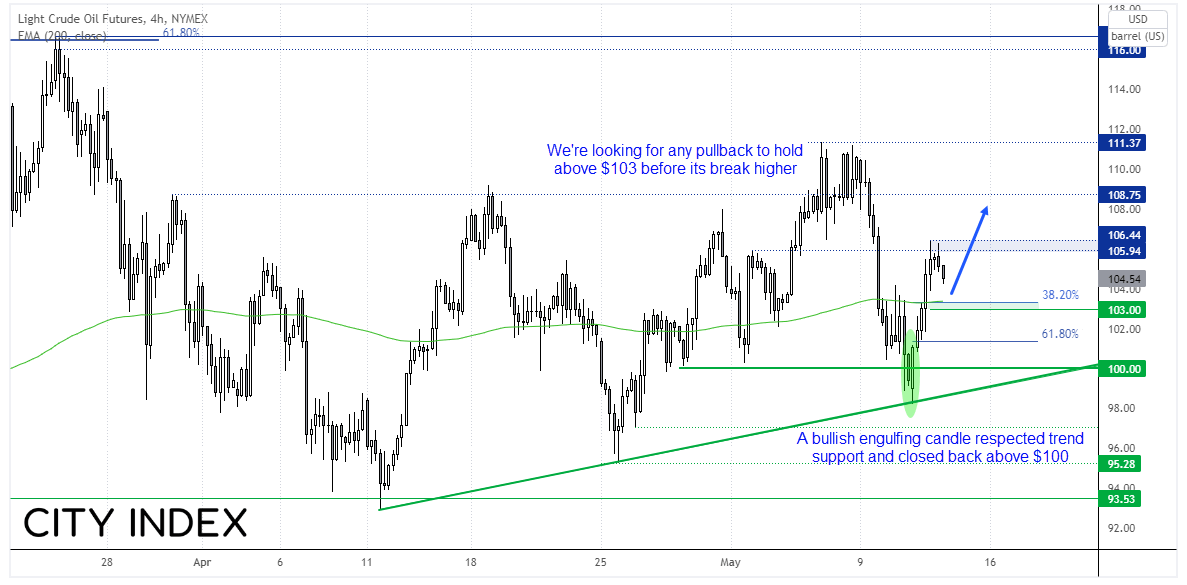

WTI looks strong since breaking above $100

Geopolitical tensions in between Russia and Europe helped energy prices rebound yesterday, and we think oil may be able to continue higher today. A bullish engulfing candle formed on the daily chart yesterday, and one also appeared on the four-hour chart which respected trend support and closed back above $100. We’ve since seen a clean break higher to the $106 area and prices are now retracing against that move. So we’re now seeking signs that the current retracement can complete at or above $103, which is near the 200-bar eMA and 38.2% Fibonacci retracement level.

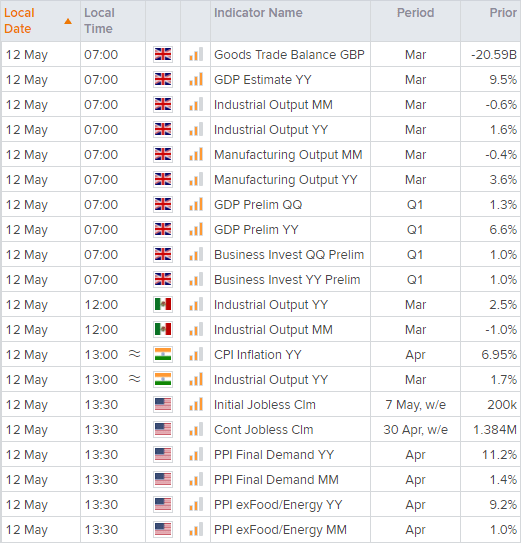

UK GDP and US PPI in focus

The US dollar index continues to trade around 104 waiting for its next catalyst. Not soft-as-hoped- inflation wasn’t enough to send it to new high, nor shake out nervous bulls. Perhaps a strong PPI report can change that later today.

But first we UK GDP. It is expected to rise to 9% y/y in Q1 from 6% in Q4, or down to 1% q/q form 1.3% previously. It’s a lagging indicator at the best of times, but the BOE’s recession warning could make this a non-event even if it does surprise to the upside, as inflation remains high along with expectations for more hikes from the BOE. GBP/USD fell to a fresh 2-year low overnight and trades just above 1.2200.

Earlier, the BOJ summary of opinions stated that they were not looking to change policy to control the weak exchange rate, and that a weak yen is good for the economy.

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade