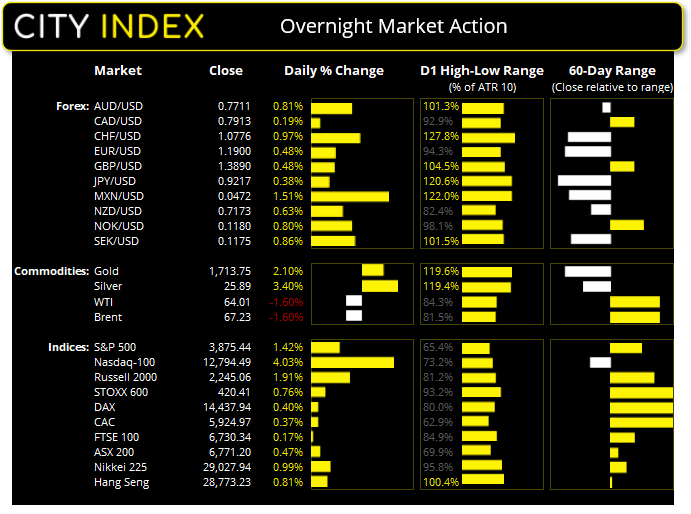

Asian Indices:

- Australia's ASX 200 index fell by -57.1 points (-0.84%) to close at 6,714.10

- Japan's Nikkei 225 index has risen by 5.8 points (0.0002%) and currently trades at 29,035.03

- Hong Kong's Hang Seng index has risen by 7.84 points (0.03%) and currently trades at 28,781.07

UK and Europe:

- UK's FTSE 100 futures are currently down -47 points (-0.7%), the cash market is currently estimated to open at 6,683.34

- Euro STOXX 50 futures are currently down -11 points (-0.29%), the cash market is currently estimated to open at 3,775.05

- Germany's DAX futures are currently down -49 points (-0.34%), the cash market is currently estimated to open at 14,388.94

- France's CAC futures are currently down 0 points (0%), the cash market is currently estimated to open at 5,924.97

Tuesday US Close:

- The Dow Jones Industrial rose 30.3 points (0.1%) to close at 31,832.74

- The S&P 500 index rose 54.09 points (1.42%) to close at 3,875.44

- The Nasdaq 100 index rose 495.41 points (4.03%) to close at 12,794.49

Index futures were slightly lower overnight, with the Nasdaq, Dow and S&P E-minis all ticking lower. Yet these moves appear corrective in nature following the strong close on Wall Street, where the Nasdaq rallied over 4% as lower bond yields provided a reprieve to bearish pressure and weighed on the dollar.

The DAX extended its lead to a new record high although volatility was lower which suggest the potential for a pullback. Our bias remains bullish above 14,200 with an open upside target.

Forex: USD selling subsides ahead of key data

It was tight ranges across FX markets overnight. The US dollar was slightly stronger although moves were likely minor adjustments or profit taking without any real catalyst. And besides, currencies are simply waiting for US data to kick in. So the good news is that there is plenty of potential ‘meat on the bone’ for volatility during the European and US session as nothing is overextended relative to its daily range.

- USD/CHF produced a bearish engulfing candle on the daily chart after finding strong resistance at the June 2020 low. The bias is for a run towards 0.9200 support.

- EUR/USD’s 200-day eMA held as support although prices have retraced back beneath 1.1900 overnight. The near-term bias is for a corrective phase towards 1.1952 – 1.2000 before returning to its bearish trend.

- USD/CAD should be in focus for news traders due to the BOC meeting, US CPI report and bond auction. Yet price action on the daily chart remains messy and range0bound between 1.2587 and 1.2763

- GBP/USD has retraced below its 20-day eMA overnight but the 3-day bullish reversal pattern (morning star reversal) suggests the swing low is in place

- The weaker USD helped USD/CNH fall back to the original breakout level around 6.515. Despite this minor setback our bias remains that a significant low has been achieved in February at 6.4000.

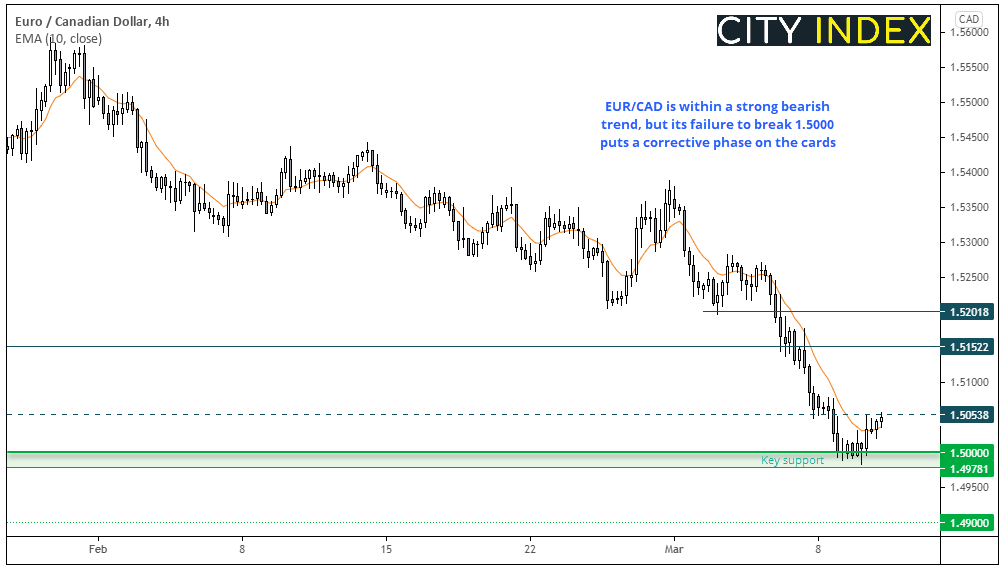

EUR/CAD: 1.5000 proves a tough nut to crack

With the euro showing signs of strength, oil prices retracing and BOC (Bank of Canada) meeting tonight then EUR/CAD could find itself within the crossfire of volatility.

We can see the daily chart remains within a strong downtrend, but it may need some mean reversion after such a strong sell-off. Besides, it has found support at the big round number of 1.5000.

- A break above 1.5040 (historical lows) assumes a deeper, counter-trend move towards 1.5100

- A break beneath the 1.4978 – 1.5000 paves the way for a run towards 1.4900

- The 1.5000 – 1.5040 zone is an area of day traders around today’s economic events (BOC, US CPI and bond auction)

RBA retain lower for longer narrative

RBA’s (Reserve Bank of Australia) Governor Dr Philip Lowe pushed back on market expectations for the RBA to hike rates before 2024. Instead, he reiterated the need to keep their 3yr interest rate at 0.1% and that inflation will take a long time to return to their 2-3% target band. Moreover, whilst they would like a lower AUD it is not currently overvalued in his view. Perhaps that view would be changed with a sustained above 80c.

AUD/USD fell 20 pips after the remarks and continues to trade slightly lower for the session. Although the moves appear related to the dollar retracing against yesterday’s US session. The ASX 200 traded -0.3% lower after sellers stepped in just above 6800.

China’s producer prices bounce back

The race for China’s manufacturer’s to fill export orders has further raised expectations for solid growth from the region. It’s a shame this has not yet spilled over to consumer prices, but inflation must start somewhere. China’s PPI rose 1.7% YoY in February versus 1.5% forecast and contracted -0.2% Mom versus -0.4% expected. Extraction and raw materials were the largest components at 6.8% and 2.9% respectively.

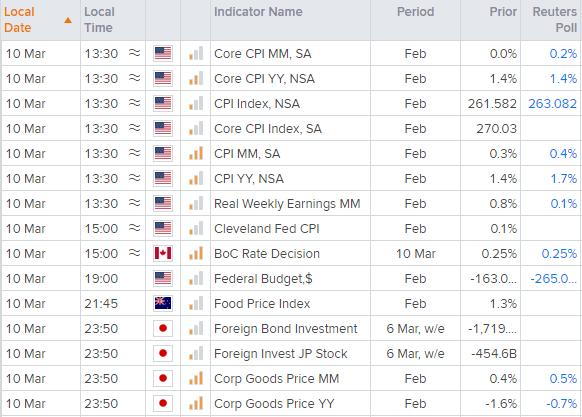

Up Next (Times in GMT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- US CPI is kicks off the US session at 13:30 and it could further weigh on the dollar if they land weaker than expected.

- The Bank of Canada (BOC) hold their interest rate decision at 15:00 GMT. The consensus is for policy to remain unchanged with rates at 0.25% and QE of at least $4 billion per week.

- As Joe Perry mentioned, US bond auctions will be closely watched this week and the 10-year is scheduled for today. Given the yesterday’s successful 3-year auction was enough to lift Wall Street and weigh on the dollar yesterday. today’s 10-year will be in full focus. (A weak bond auction would likely lift yields and weigh on indices).