Asian Indices:

- Australia's ASX 200 index fell by -38.3 points (-0.51%) and currently trades at 7,463.80

- Japan's Nikkei 225 index has fallen by -194.46 points (-0.7%) and currently trades at 27,391.45

- Hong Kong's Hang Seng index has fallen by -441.73 points (-1.71%) and currently trades at 25,425.28

UK and Europe:

- UK's FTSE 100 futures are currently down -42 points (-0.59%), the cash market is currently estimated to open at 7,127.32

- Euro STOXX 50 futures are currently down -25.5 points (-0.61%), the cash market is currently estimated to open at 4,163.92

- Germany's DAX futures are currently down -96 points (-0.6%), the cash market is currently estimated to open at 15,869.97

US Futures:

- DJI futures are currently down -382.59 points (-1.08%)

- S&P 500 futures are currently down -3.25 points (-0.02%)

- Nasdaq 100 futures are currently down -3 points (-0.07%)

Learn how to trade indices

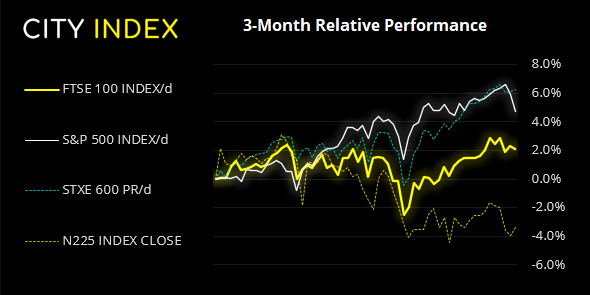

Asian Indices track Wall Street lower

Share markets were lower overnight as they took Wall Street’s lead after hawkish FOMC minutes were released. Whilst divisions remain among the ranks over the speed of the economic recovery, the majority of members now foresee tapering to begin this year.

The Hang Seng was the weakest performer, down -1.9% today and -3.9% for the week, the Nikkei was down -0.7% and the TOPIX fell -0.6%.

The FTSE 100 found resistance at 7200 yesterday before finding support at the July 19th trendline, yet still closing lower. Futures markets suggest the FTSE will open beneath the trendline today, and a break below 7100 assumes the bearish move may have some legs. Only a convincing break above 7224.46 puts us back into trending mode.

FTSE 350: Market Internals

FTSE 350: 4138.53 (-0.16%) 17 August 2021

- 214 (60.97%) stocks advanced and 120 (34.19%) declined

- 37 stocks rose to a new 52-week high, 4 fell to new lows

- 75.5% of stocks closed above their 200-day average

- 75.5% of stocks closed above their 50-day average

- 25.36% of stocks closed above their 20-day average

Outperformers:

- + 11.2% - Network International Holdings PLC (NETW.L)

- + 7.11% - Redrow PLC (RDW.L)

- + 5.94% - Ibstock PLC (IBST.L)

Underperformers:

- -7.02% - Balfour Beatty PLC (BALF.L)

- -5.94% - BHP Group PLC (BHPB.L)

- -4.85% - Burberry Group PLC (BRBY.L)

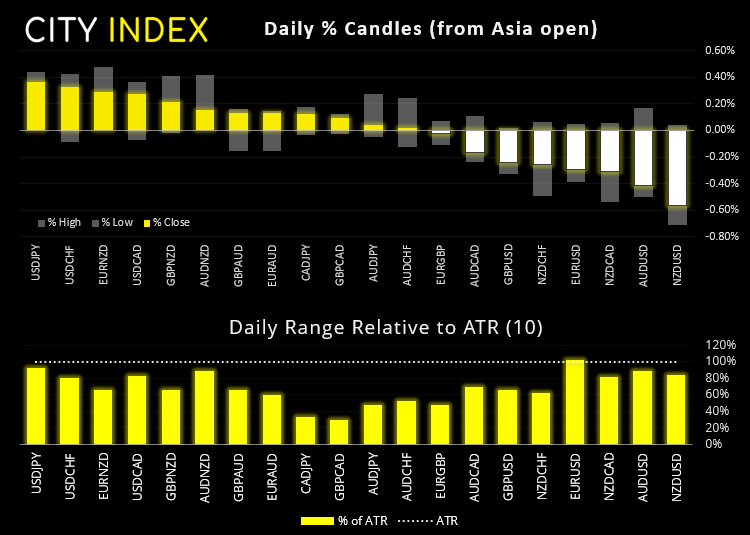

Forex: Dollar breaks higher overnight

NZD was the weakest major as 21 cases have now been linked back to an outbreak in NSW, Australia. However, they think they’ve found case zero, a traveller from Sydney who was in NZ hotel quarantine. If NZ can contain the breakout and open up, NZD could look like low hanging fruit in a few week/s due to RBNZ’s hawkish pause.

NZD/USD and AUD/USD fell to their lowest levels since November. Australia’s unemployment rate fell to 4.6%, but it was due to a lower participation as opposed to people finding jobs. 2.2k jobs were added, 6.44 of which were part-time so full-time jobs actually dipped by -4.2k.

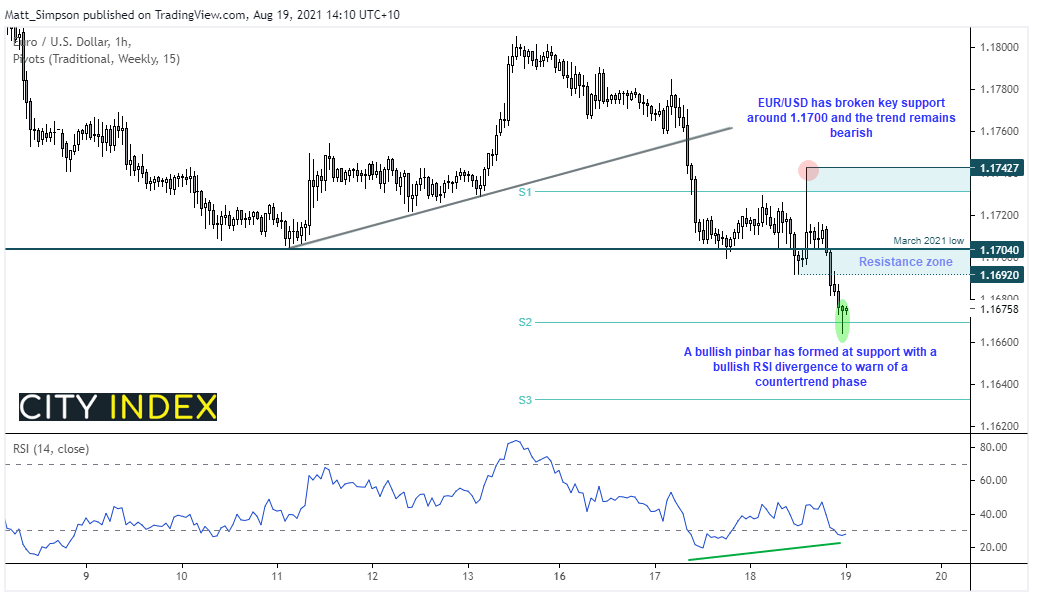

The US dollar was the strongest major overnight and traded higher against all its peers. Weak oil prices helped USD/NOK rise 0.5%, and USD/CAD rose to a 5-month high. The US dollar index (DXY) also breached the March 2021 high to a trade to its highest level since November as EUR/USD fell below key support to reach a 9-month low.

We can see on the 1-hour chart that momentum turned lower after printing a selling tail (large upper wick) during yesterday’s US session. The dollar strengthened at the end of the session and continued its move throughout Asian trade, although a bullish pinbar has formed at the weekly S2 pivot level. Given the significance of the March 2021 low its possible we may see a shakeout which could result in a retracement back towards that key level as party of a countertrend move. Beyond this however we’d be keen to explore bearish setups below 1.1692 - 1.1700 resistance zone, should they arise.

Learn how to trade forex

Commodities:

Copper futures probed the June low overnight after closing firmly beneath the March trendline. A move towards $4.00 seems feasible, whilst a break beneath the 3.943 low warns of a much larger downside move.

WTI is probing yesterday’s lows around 64.30 under US dollar strength. Assuming EUR/USD can bounce as we suggested then this leaves some wriggle room for oil prices to also bounce. But as for how far that yet remains to be seen.

Gold is trading in a potential bull flag on the dour-hour chart and, compared other metals, is holding up against US dollar strength. For gold to rally from here we’d need to see the US dollar index reverse bac below the March high. Until then we expect gold to remain in a corrective phase.

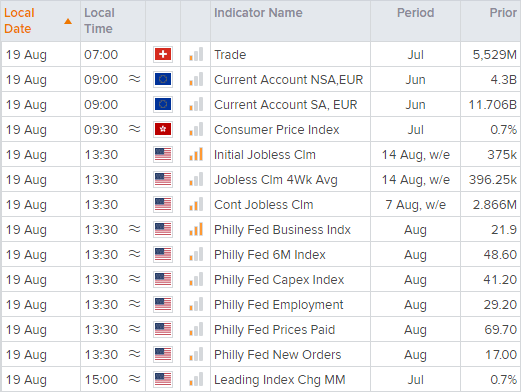

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.