Asian Indices:

- Australia's ASX 200 index fell by -49.7 points (-0.67%) and currently trades at 7,420.40

- Japan's Nikkei 225 index has risen by 20.28 points (0.07%) and currently trades at 29,797.08

- Hong Kong's Hang Seng index has risen by 278.97 points (1.1%) and currently trades at 25,669.88

- China's A50 Index has risen by 51.74 points (0.33%) and currently trades at 15,603.99

UK and Europe:

- UK's FTSE 100 futures are currently up 2 points (0.03%), the cash market is currently estimated to open at 7,353.86

- Euro STOXX 50 futures are currently up 4 points (0.09%), the cash market is currently estimated to open at 4,390.19

- Germany's DAX futures are currently down -4 points (-0.02%), the cash market is currently estimated to open at 16,144.64

US Futures:

- DJI futures are currently down -12.86 points (-0.04%)

- S&P 500 futures are currently down -4 points (-0.02%)

- Nasdaq 100 futures are currently down -2 points (-0.04%)

Xi and Biden’s first meeting is amicable (but lacked the beautiful chocolate cake)

The first meeting between Xi Jinping and Joe Biden was an amicable event, with Xi welcoming an ‘old friend’ and Biden promising ‘candor’. The 2-hour session overran by 30 minutes with both leaders appearing on large screens for one another. Officials have since downplayed expectations for any trade agreement, and avoided commenting on whether the US will send athletes over to the Olympic games. Whilst nothing concrete has yet to be achieved by the meeting, Asian equities seemingly lied to positive tone between the two leaders with the Hang Seng rising around 1.5% and the China A50 currently up around 0.8%.

RBA remain as dovish as ever

The RBA released their minutes of the meeting and Governor Philip Lowe presented a prepared speech titled “Recent Trends in Inflation”. Any hopes that the RBA would bow to market expectations and hint at an earlier hike than 2023/2024 were once again dashed. Whilst they conceded that inflation was stronger than expected, they reiterated that they want to see inflation rise sustainably within target and for wage growth needs to be above 3%. The Australian dollar reacted appropriately and did very little. Meh.

So what happened to the 1 million people on furlough, when it expired?

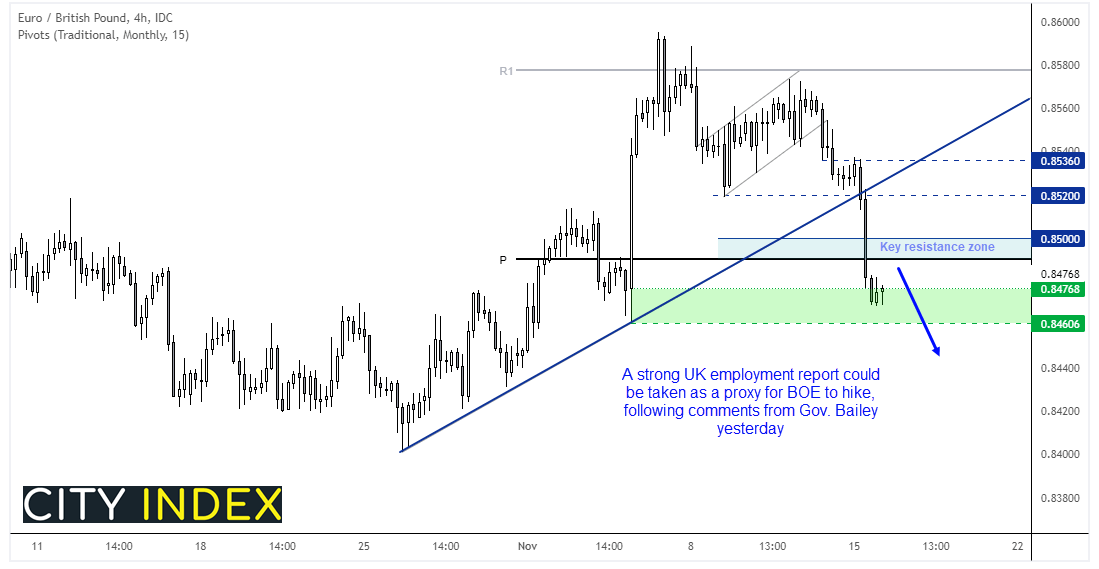

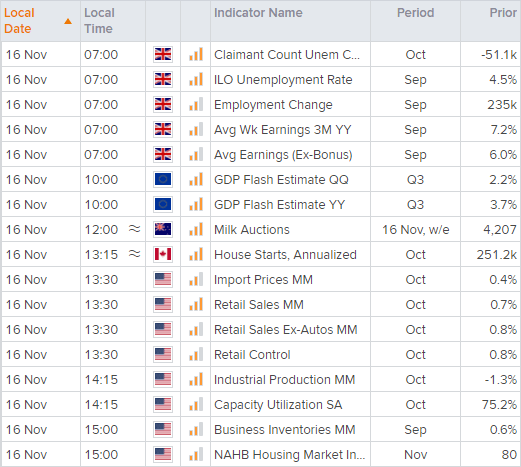

That is what the BOE want to know today, and was a key reason as to why they refrained from raising rates at their last meeting, according to BOE Governor Bailey. With around 1 million people still on furlough when it expired the bank will pay very close attention to today’s employment numbers. And if we find that the unemployment rate or claimant count hasn’t shot up markedly then it could be deemed as good as a rate hike for the pound today.

And that could pile further pressure on EUR/GBP which suffered its most bearish day since in 6-months yesterday. Given the large move yesterday we would prefer to seek bearish setups beneath or around the 0.8500 resistance zone. Conversely, should the UK deliver a poor employment set then we’d expect prices to hold above 0.8460 and challenge the 0.8500 handle. But, taking the bigger picture into account, we see upside as limited and the potential for it to break to new lows over the coming week/s.

Can US retail sales support the drop in consumer sentiment?

US retail sales could be a number to watch today, as a weak print would tie in with the weak consumer sentiment report which flagged concerns of high inflation and lower expected income. However, it’s also plausible we may see a dip ahead of the Black Monday’s sales, as consumers tighten their purse strings I hope of a good deal. So, from that backdrop we’d be more surprised to see a strong number today.

WTI tries to build a base above $80

$85 has proven to be a hard resistance level to crack, although bearish momentum form it decline form that key level is now trying to turn higher. A bullish hammer formed yesterday and closed back above $80, with much of yesterday’s volume on the futures market occurring within the lower wick, to suggest buyers at those lows.

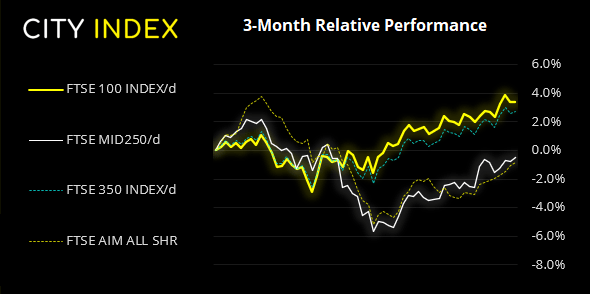

FTSE 350: Market Internals

FTSE 350: 4217.79 (0.05%) 15 November 2021

- 190 (54.13%) stocks advanced and 141 (40.17%) declined

- 21 stocks rose to a new 52-week high, 1 fell to new lows

- 62.68% of stocks closed above their 200-day average

- 20.51% of stocks closed above their 20-day average

Outperformers:

- + 7.05%-Avast PLC(AVST.L)

- + 6.55%-Cineworld Group PLC(CINE.L)

- + 6.37%-CMC Markets PLC(CMCX.L)

Underperformers:

- -9.31%-Kainos Group PLC(KNOS.L)

- -4.09%-Domino's Pizza Group PLC(DOM.L)

- -3.35%-Spirent Communications plc(SPT.L)

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade