Asian Indices:

- Australia's ASX 200 index rose by 7.1 points (0.1%) and currently trades at 7,334.00

- Japan's Nikkei 225 index has fallen by -209.98 points (-0.74%) and currently trades at 28,156.97

- Hong Kong's Hang Seng index has fallen by -559.5 points (-2%) and currently trades at 27,401.12

UK and Europe:

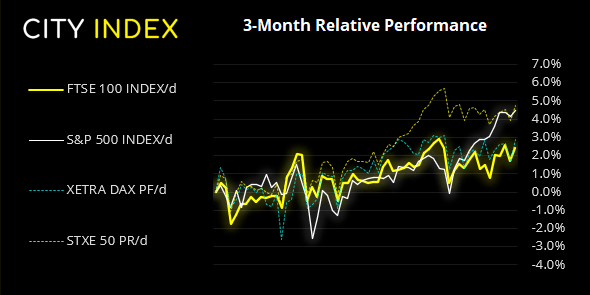

- UK's FTSE 100 futures are currently down -14.5 points (-0.2%), the cash market is currently estimated to open at 7,136.52

- Euro STOXX 50 futures are currently down -4.5 points (-0.11%), the cash market is currently estimated to open at 4,074.03

- Germany's DAX futures are currently down -19 points (-0.12%), the cash market is currently estimated to open at 15,673.71

US Futures:

- DJI futures are currently up 104.42 points (0.3%)

- S&P 500 futures are currently down -24.5 points (-0.17%)

- Nasdaq 100 futures are currently down -9.25 points (-0.21%)

Learn how to trade indices

Asian Indices trade lower

Economists expect the fed to announce a strategy to taper by August or September, according to a poll by Reuters, which is generally seen a net-positive for the dollar and weaker for equity markets.

Japanese share markets were broadly lower again today on reports that Japan is set to announce a state of emergency for Tokyo ahead that would likely be in place through the Olympics. This would de their fourth state of emergency since the pandemic began, and not helped by their relatively low vaccine rollout. Meanwhile South Korean stocks were also lower as a daily coronavirus cases rose at a record pace since yesterday. Futures markets have opened on the soft side with US and European futures all pointing to a slightly lower open in Europe.

The FTSE 100 formed a bullish inside candle and built a base of support at 7118 yesterday. Until we see a clear break of Tuesday’s range then intraday ranges are preferred.

FTSE 350: Market Internals

FTSE 350: 4102.51 (0.71%) 07 July 2021

- 237 (67.52%) stocks advanced and 103 (29.34%) declined

- 37 stocks rose to a new 52-week high, 2 fell to new lows

- 84.9% of stocks closed above their 200-day average

- 58.97% of stocks closed above their 50-day average

- 25.64% of stocks closed above their 20-day average

Outperformers:

- + 3.86% - PZ Cussons PLC (PZC.L)

- + 3.19% - BHP Group PLC (BHPB.L)

- + 3.18% - Ferrexpo PLC (FXPO.L)

Underperformers:

- -6.54% - 888 Holdings PLC (888.L)

- -5.50% - Tullow Oil PLC (TLW.L)

- -5.00% - Cineworld Group PLC (CINE.L)

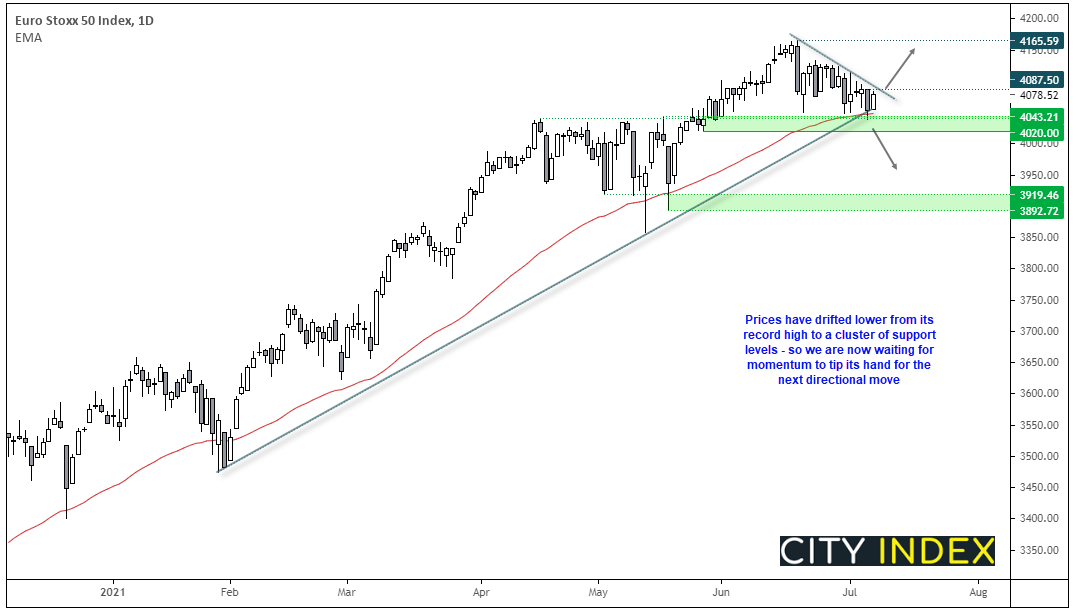

Euro STOXX 50 drifts to a technical juncture

The euro STOXX 50 index could be approaching a technical juncture. It remains in a strong uptrend on the daily chart, although prices have drifted lower from its record high in June. It has found support at its 50-day eMA (a level it has rarely closed beneath since the October low) and has tested the trendline projected from the January low. Should these levels break to the downside, there’s also potential support from around the previous record high (4032) and 4020 low.

So we are basically waiting for momentum to tip its hand. Should we range expansion either above the retracement line, or below 4020 we suspect it may provide a decent clue to its next directional move.

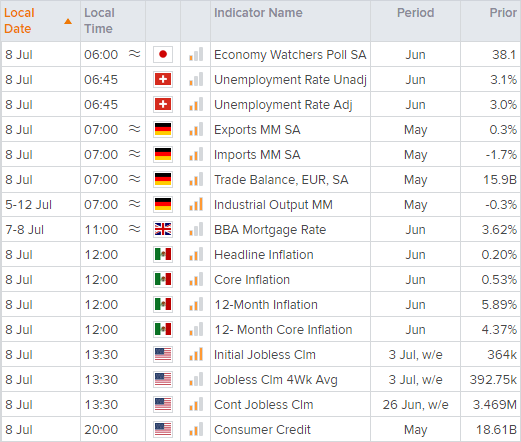

Forex: USD probes yesterday’s highs

Germany’s trade data is the main economic data point at 07:00 BST, and exports are expected to rise to 0.6%, up from 0.3% last month. ECB President Christine Lagarde is also scheduled to speak at 11:00 BST. In the US session the weekly jobless claims report will be in focus the US at 13:30 BST, followed by the weekly EIA report for energy traders.

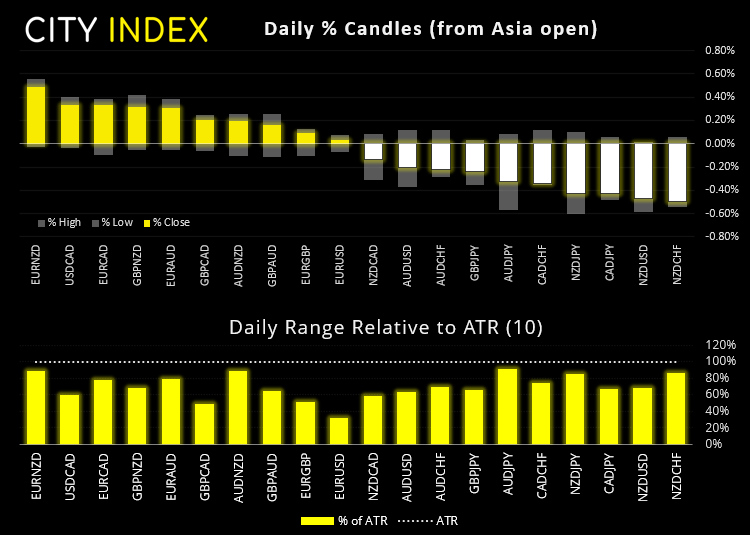

A slightly firmer US dollar weighed on commodity currencies overnight, sending NZD and CAD around -0.3% lower and AUD down -0.25%. The US dollar index (DXY) is trying to retest yesterday’s high which found resistance around the April 5th gap.

USD/CAD teased an 11-week high overnight, and 1.2600 is now within bullish reach this week if momentum can persist. EUR/USD remains anchored to yesterday’s 3-month low, weighed down by the dual force of weak domestic data and a potential tapering path from the Fed. USD/CNH is coiling up in a potential bullish triangle on the daily charts and USD/JPY is trying to hold above the June 30th low, although the US2-YP2 yield differential is not favouring a trough to form just yet.

Learn how to trade forex

Commodities:

Metals were lower overnight on the back of a stronger dollar. Platinum futures are currently trading -0.9% lower, and you can view our analysis in today’s video. Gold futures are down -0.4%, back below its 200-day eMA having found resistance at its 50-eMA. Silver futures are off by -0.6% and touched a 5-day low during Asian trade.

As we outline in today’s video, there’s potential for oil to bounce form current levels but in the face of a stronger dollar and OPEC in disagreement then new lows appear more likely.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.