Asian Indices:

- Australia's ASX 200 index fell by -36.7 points (-0.5%) and currently trades at 7,270.60

- Japan's Nikkei 225 index has fallen by -294.51 points (-1.02%) and currently trades at 28,751.34

- Hong Kong's Hang Seng index has fallen by -240.41 points (-0.82%) and currently trades at 29,027.89

UK and Europe:

- UK's FTSE 100 futures are currently down -8.5 points (-0.12%), the cash market is currently estimated to open at 7,064.47

- Euro STOXX 50 futures are currently up 1 points (0.02%), the cash market is currently estimated to open at 4,090.91

- Germany's DAX futures are currently down -9 points (-0.06%), the cash market is currently estimated to open at 15,545.18

US Futures:

- DJI futures are currently down -150.57 points (-0.44%)

- S&P 500 futures are currently down -31.75 points (-0.22%)

- Nasdaq 100 futures are currently down -7 points (-0.16%)

Indices

Share markets turned lower overnight as concerns over the spread of the Delta variant across Asia weighed on sentiment. China and Japan’s markets led the way lower, with the CSI currently down -0.89% and the TOPIX falling -0.85%. The ASX 200 also fell -0.66% as another State (QLD) announced a lockdown to curb the rise in Delta cases. Futures markets are pointing to a weak open with US and European markets ticking lower.

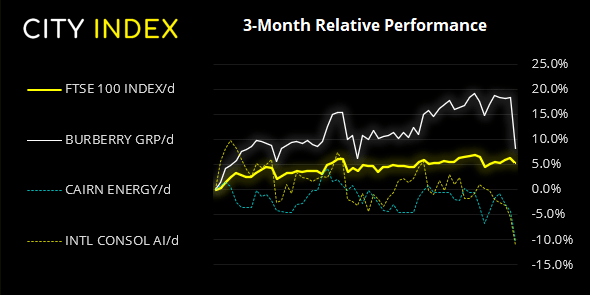

The FTSE 100 opened at its high and closed at its low yesterday, suggesting a swing high (and therefore a lower high) is in place. Whilst 7000 appears achievable for a day or two of bearish dominance, take note of key levels mentioned in today’s video.

FTSE 350: Market Internals

FTSE 350: 4051.78 (-0.88%) 28 June 2021

- 252 (71.79%) stocks advanced and 86 (24.50%) declined

- 15 stocks rose to a new 52-week high, 3 fell to new lows

- 84.33% of stocks closed above their 200-day average

- 53.85% of stocks closed above their 50-day average

- 13.68% of stocks closed above their 20-day average

Outperformers:

- + 4.23% - Crest Nicholson Holdings PLC (CRST.L)

- + 3.65% - Hiscox Ltd (HSX.L)

- + 3.40% - HgCapital Trust PLC (HGT.L)

Underperformers:

- -8.67% - Burberry Group PLC (BRBY.L)

- -6.02% - Cairn Energy PLC (CNE.L)

- -5.91% - International Consolidated Airlines Group SA (ICAG.L)

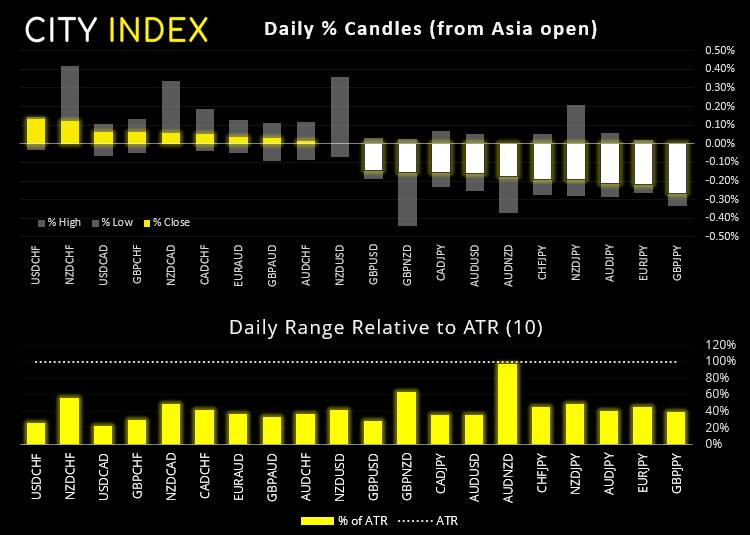

Forex: The yen rises on safe-haven flows

The Australian dollar was lower amid a general risk-off session overnight due to the spread of the Delta variant, alongside news that the state of Queensland has implemented a three-day lockdown, joining New South Wales and Wester Australia’s example. AUD/USD is around -0.2% lower.

EUR/AUD printed a bullish outside candle yesterday, suggesting a swing low has formed. That it occurred back above the 1.5690 high and is also a ‘higher low’ adds extra weight to this argument. However, given the 200-day eMA sits just beneath this month’s high means we are only bullish o this pair over the near-term.

The Japanese yen was the strongest currency overnight, rising against all of its major peers. AUD/JPY fell to a five-day low and is currently around -0.28% lower, EUR/JPY is down -0.2% and NZD/JPY is down by -0.3%.

The US dollar was slightly former overnight against all but the yen. GBP/USD touched a six-day low after breaking beneath yesterday’s bearish pinbar although volatility is lacking somewhat. EUR/USD looks like it wants to turn lower on the daily chart, given the series of upper wicks last week (selling tails) which all closed beneath the 200-day eMA. Yet, whist there’s a hesitancy to push higher there is also clearly a hesitancy to push lower as well.

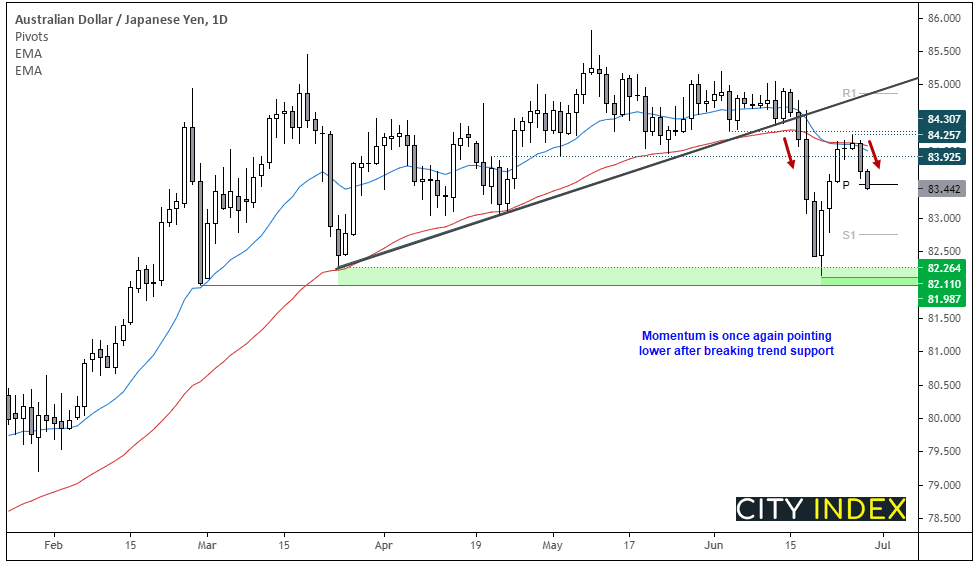

If sentiment is to remain sour then AUD/JPY is once again of interest for bears, as momentum is pointing lower once more. The cross fell nearly -3% in three days when trend support broke on the 21st June, although it clawed back most losses with a counter-trend move. Yet notice the small candles near the 20 and 50-day eMA which occurred before Monday’s sell-off. And price action overnight is pushing lower to suggest a swing high is in place at Friday’s high (84.44). At the time of writing, prices are trying to break beneath the weekly pivot point which would bring the 83.00 level and weekly S1 into focus for bars.

Learn how to trade forex

Commodities:

With the exception of platinum and palladium, metals are stuck in sideways ranges. Gold and silver lack basic direction and copper has probed yesterday’s 3-day low. Platinum appears to have printed a swig high below its 200-day eMA (see today’s video) yet palladium looks quite firm at its 7-day high. Unless a bearish reversal pattern occurs then a break above the 2720 low assumes bullish continuation.

Oil prices fell for a second consecutive day as concerns arise that demand will take a knock with the rise in Covid cases across parts of Asia, seeing WTI futures fall -0.52% to a four-day low

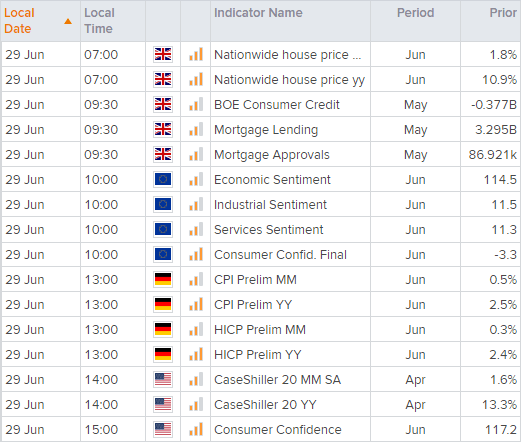

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.