Asian Indices:

- Australia's ASX 200 index rose by 4.5 points (0.06%) and currently trades at 7,515.50

- Japan's Nikkei 225 index has fallen by -504.08 points (-1.8%) and currently trades at 27,472.56

- Hong Kong's Hang Seng index has risen by 192.95 points (0.75%) and currently trades at 25,938.82

UK and Europe:

- UK's FTSE 100 futures are currently up 24 points (0.34%), the cash market is currently estimated to open at 7,205.11

- Euro STOXX 50 futures are currently up 9.5 points (0.23%), the cash market is currently estimated to open at 4,205.90

- Germany's DAX futures are currently up 31 points (0.19%), the cash market is currently estimated to open at 15,952.95

US Futures:

- DJI futures are currently down -282.12 points (-0.79%)

- S&P 500 futures are currently up 17.5 points (0.12%)

- Nasdaq 100 futures are currently up 3.5 points (0.08%)

Learn how to trade indices

Indices

Asian equity markets were in the green overnight as sentiment was more upbeat after a couple of days of selling. The Nikkei 225 rose 0.57% and broke a 4-day losing streak after touching its lowest point this month, the broader TOPIX was up 0.72% the HSCE (Hang Seng China Enterprise) index was a top performer, rising 1.13%. Futures markets are also pointing to a firmer open for European bourses.

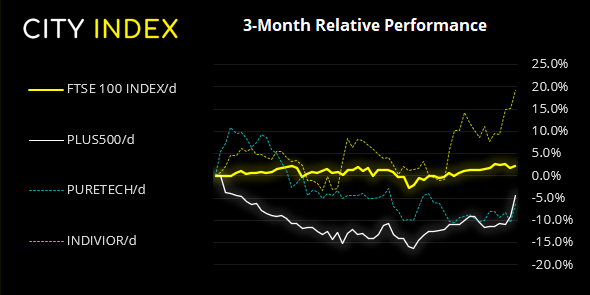

The FTSE 100 printed a bullish inside day and reaffirmed support at 7117. We need to see a break above the 7224.46 high before assuming bullish continuation on the daily chart, and it now sits around the midways point of 7117 – 7224. Therefore, range trading strategies are preferred until we see a decisive break of either level.

FTSE 350: Market Internals

FTSE 350: 4139.61 (0.38%) 17 August 2021

- 180 (51.28%) stocks advanced and 150 (42.74%) declined

- 34 stocks rose to a new 52-week high, 5 fell to new lows

- 75.78% of stocks closed above their 200-day average

- 67.24% of stocks closed above their 50-day average

- 25.36% of stocks closed above their 20-day average

Outperformers:

- + 5.11% - Plus500 Ltd (PLUSP.L)

- + 4.83% - PureTech Health PLC (PRTC.L)

- + 3.60% - Indivior PLC (INDV.L)

Underperformers:

- -5.50% - Hammerson PLC (HMSO.L)

- -5.21% - Avon Protection PLC (AVON.L)

- -4.50% - Syncona Ltd (SYNCS.L)

Forex: RBNZ buckle under the Delta pressure

RBNZ decided to hold interest rates today at 0.25% in response to the government’s decision to lockdown the country following a Delta outbreak. The single case which prompted the lockdown has now grown to seven, with reports it includes a nurse who was positive for several days without realising. This means the next few days are critical as NZ grapples and tries to curb the outbreak from advancing.

Delta aside, RBNZ still feel that raising rates will be the correct course (once they get the-all clear) and maintain an optimistic viewpoint on the economy, labour market with upside risks to inflation. That’s about as hawkish a central bank is these days, so it’s all eyes on NZ cases numbers over the coming week/s.

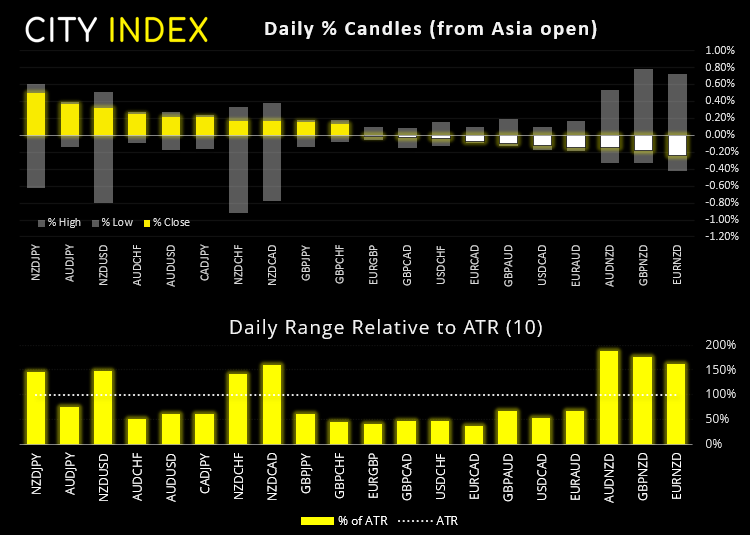

After NZD broadly sold off at the OCR decision, NZD pairs recovered are trading slightly higher for the session after a hawkish presser by Governor Orr. NZD/JPY is on track for an elongated bullish pinbar on H4, having found support around the July low, so a countertrend move remains the bias over the near-term.

- Australian wage growth data disappointed which only decreases the odds that RBA will taper at their next meeting in September.

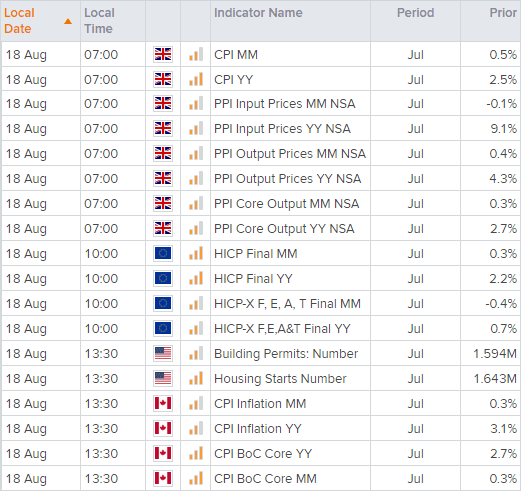

- UK inflation data is released at 07:00 BST. It outpaced expectations in June and, given the improvement in yesterday’s labour market figures, a strong CPI print should pile on further pressure for some members to vote to taper sooner.

- Canada also releases inflation data at 13:30 BST, where a strong print could send AUD/CAD towards our 0.9100 target.

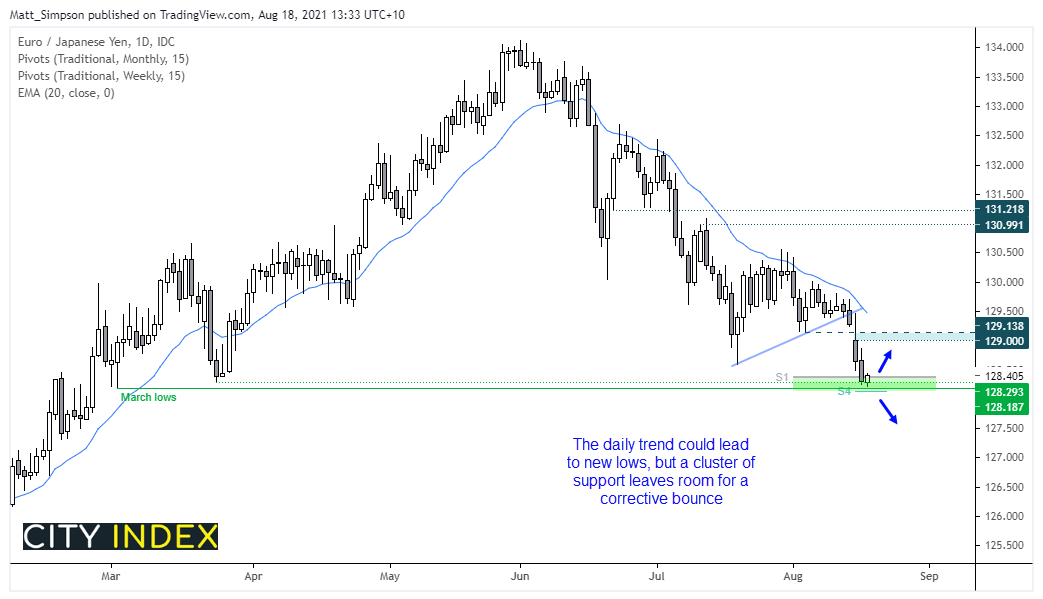

EUR/JPY remains in a clear downtrend on the daily chart, although its decline has paused at a cluster of support levels including the March lows, monthly S1 and weekly S4 pivots. Whilst a break below 128.18 assumes bearish continuation, it’s plausible we could witness a correction from current levels should sentiment improve today (so keep an eye on higher equity markets and bond yields to support a bounce here). Further out, new lows also seem feasible due to the bearish trend structure on the daily chart, so we’d be keen to explore bearish opportunities below 129.00 in line with its bearish trend (and yen-friendly environment).

Learn how to trade forex

Commodities:

Gold was up around 0.4% overnight the dollar strength took a breather and allowed the yellow metal to probe 1790 resistance. Until it breaks 1800 bulls are likely to tread cautiously.

If we had to pick a short, silver looks the better option of the two given its reluctance to rebound alongside gold prices since crashing lower last Monday. Should 24.0 cap as resistance, a break of Tuesday’s low could suggest further downside.

Platinum is meandering around 1,000 but we also see the potential for further downside should the dollar strengthen (very much like silver). Our bias remains bearish beneath last week’s high.

Copper has edged up from key support at 4.20 (trend support from the June low), but eyes will be on this pivotal level over the coming day/s.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.