Asian Indices:

- Australia's ASX 200 index fell by -25.7 points (-0.35%) and currently trades at 7,269.70

- Japan's Nikkei 225 index has risen by 85.99 points (0.3%) and currently trades at 29,027.96

- Hong Kong's Hang Seng index has fallen by -226.09 points (-0.78%) and currently trades at 28,692.01

UK and Europe:

- UK's FTSE 100 futures are currently up 0.5 points (0.01%), the cash market is currently estimated to open at 7,069.54

- Euro STOXX 50 futures are currently down -4 points (-0.1%), the cash market is currently estimated to open at 4,085.38

- Germany's DAX futures are currently down -34 points (-0.22%), the cash market is currently estimated to open at 15,658.90

US Futures:

- DJI futures are currently down -26 points (-0.07%), the cash market is currently estimated to open at 34,549.31

- S&P 500 futures are currently down -20 points (-0.15%), the cash market is currently estimated to open at 4,209.89

- Nasdaq 100 futures are currently down -5.25 points (-0.12%), the cash market is currently estimated to open at 13,765.53

Learn how to trade indices

Indices

Futures markets are pointing towards a slightly softer open today, and share markets in Australia, China and Japan are all in the red – but not by an alarming rate. The ASX 200 printed a fresh record high yet failed onto earlier gains as it fell back below 7300 and currently trades -0.19% lower, whilst the Hang Seng is the weakest major index and is currently trading -0.77% lower.

We could be in for some choppy trading action on the FTSE 100 today after Thursday’s bearish candle threw a spanner in the works. We noted in Thursday’s report that a break beneath 7069 could lead to bearish follow-through, which it indeed did. Friday produced a small indecision candle within Thursday’s bearish engulfing range and, until prices break out of Thursday’s range we could fine range trading strategies are preferred. Key support zones today include 7054 – 7057 (POC) and 7039 (value area low). 7069 – 7074 is a key resistance zone for bulls to conquer ahead of the 7100 handle.

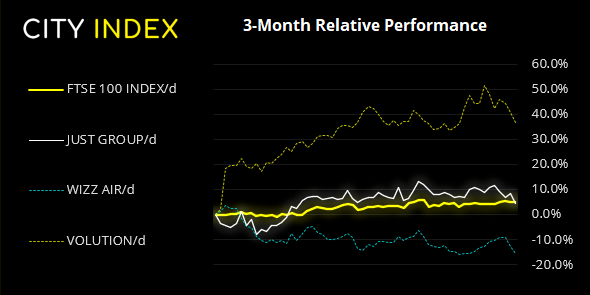

FTSE 350: Market Internals

FTSE 350: 7069.04 (0.07%) 04 June 2021

- 194 (55.27%) stocks advanced and 140 (39.89%) declined

- 22 stocks rose to a new 52-week high, 3 fell to new lows

- 88.03% of stocks closed above their 200-day average

- 24.5% of stocks closed above their 20-day average

Outperformers:

- + 4.85% - CMC Markets PLC (CMCX.L)

- + 3.75% - Premier Foods PLC (PFD.L)

- + 3.59% - Hochschild Mining PLC (HOCM.L)

Underperformers:

- -3.66% - Just Group PLC (JUSTJ.L)

- -3.27% - Wizz Air Holdings PLC (WIZZ.L)

- -2.89% - Volution Group PLC (FAN.L)

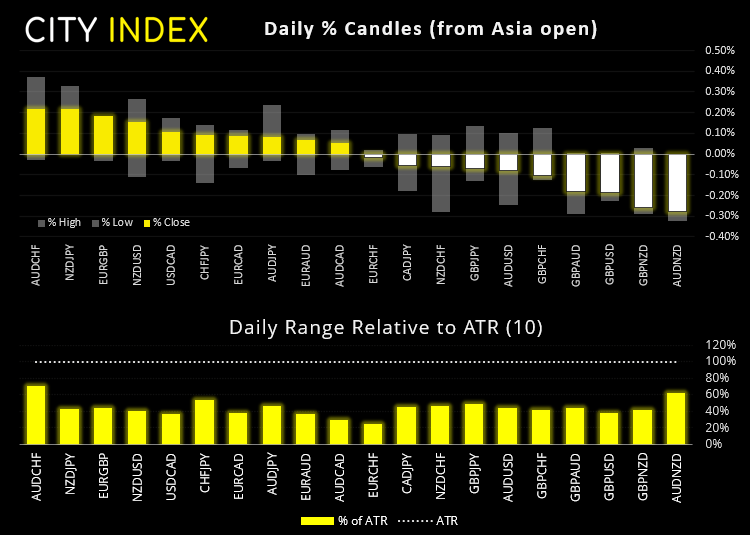

Forex:

China’s exports rose 27.9% YoY in May yet fell short of the 32.1% expected. Higher commodity prices and freight costs have weighed on exports, yet this has also boosted imports to rise by 51.1% - its fastest rate in ten years. USD/CNH is currently 0.15% higher, although our bias remains bearish whilst prices remain below 6.4120 resistance as outlined in today’s Asian Open report.

The US dollar index (DXY) is just 0.02% higher and remained in a tight range overnight, following Friday’s sell-off thanks to a weaker NFP print. Its 50-day eMA is capping as resistance and prices are now back below the 20-day.

GBP/CAD remains beneath its 1.7150/70 resistance zone although a spike higher on Friday tested the zone before selling off and leaving a bearish hammer for the day.

EUR/GBP has tested 0.8560 support overnight (May low) and currently trying to form a daily hammer. Given we’ve seen three spikes hold above 0.8560 it suggests a base is being formed which makes it less of interest for bearish setups. That said, it doesn’t look too appealing for longs either, so we’ll step aside for now.

154.84 remains a pivotal level for GBP/JPY. The prior resistance is now acting as support, although Friday’s bearish candle and attempt to break support today brings into question whether we’ll now see prices break lower.

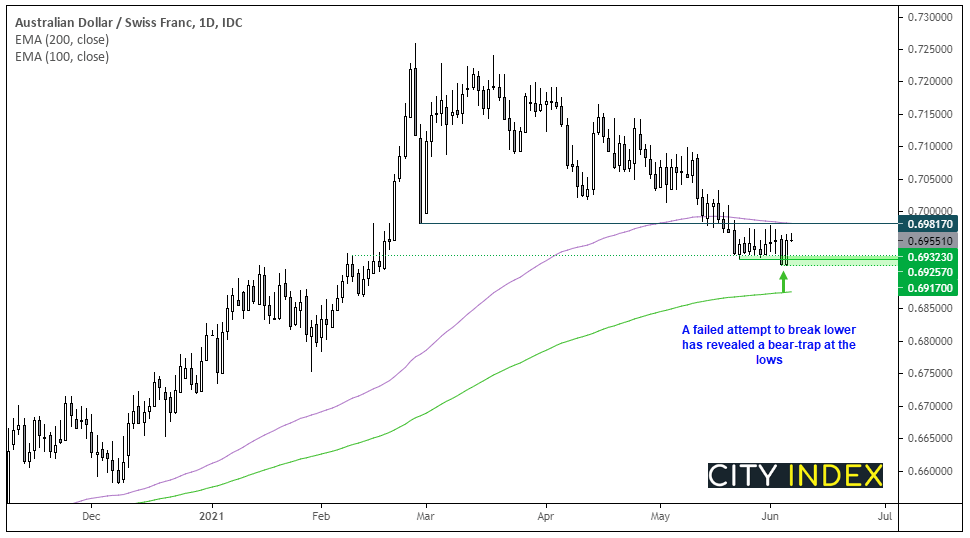

We’re keeping an eye on AUD/CHF for a possible bullish breakout after last week’s bear-trap. Despite closing beneath 0.6925 support on Thursday, prices reversed on Friday to take it aggressively back into range. Given the ‘V’ shape on the hourly chart it suggests demand is down at those lows, so a break above 0.6980 suggest a trend reversal is underway.

Learn how to trade forex

Commodities:

WTI rose to $70 overnight yet found resistance at this psychological round number. Given the significance of $70 we suspect a correction could be due and prices are already trying to carve out a bearish hammer beneath this key level.

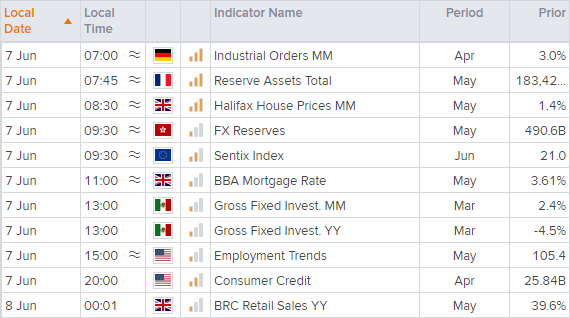

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.