Asian Indices:

- Australia's ASX 200 index rose by 80.9 points (1.12%) and currently trades at 7,326.00

- Japan's Nikkei 225 index has risen by 562.3 points (2.01%) and currently trades at 28,489.45

- Hong Kong's Hang Seng index has risen by 340.63 points (1.46%) and currently trades at 23,690.01

- China's A50 Index has risen by 107.2 points (0.68%) and currently trades at 15,771.79

UK and Europe:

- UK's FTSE 100 futures are currently up 2.5 points (0.03%), the cash market is currently estimated to open at 7,234.78

- Euro STOXX 50 futures are currently up 17.5 points (0.42%), the cash market is currently estimated to open at 4,154.61

- Germany's DAX futures are currently up 59 points (0.38%), the cash market is currently estimated to open at 15,439.79

US Futures:

- DJI futures are currently up 138 points (0.39%)

- S&P 500 futures are currently up 48.75 points (0.31%)

- Nasdaq 100 futures are currently up 17 points (0.37%)

Asian equity markets were higher overnight on the dual combination of Wall Street’s lead and the promise of further easing in China. The PBOC will cut the RRR (reserve ration requirements) to stimulate the economy, although some are questioning whether the real driver here is to cushion the blow from Evergrande’s fall from grace. Japan’s Nikkei 25 is a top performer, rising around 2%, the Hang Seng is up around 1.6% and China’s A50 rose 0.6. US futures around 0.4% higher and the FTSE is expected to tick higher at the open.

RBA hold policy, optimistic on labour data

The Australian dollar was the strongest major currency overnight on optimistic comments from RBA’s statement. They held policy as widely expected, but their statement said they expect the Australian economy to return to its pre-Delta path in the first half of 2022, and that leading indicators point to a healthy labour market rebound. Still, they’ll not be changing policy until they’re convinced that inflation is ‘sustainably’ within its 2-3% target range, which requires the labour market to push wages ‘materially’ higher. Let’s hope those leading labour market indicators turn out to be correct then.

AUD/USD rose to a 2-day high and trades around 0.7067, although 0.7100 is the next hurdle for bulls to conquer.

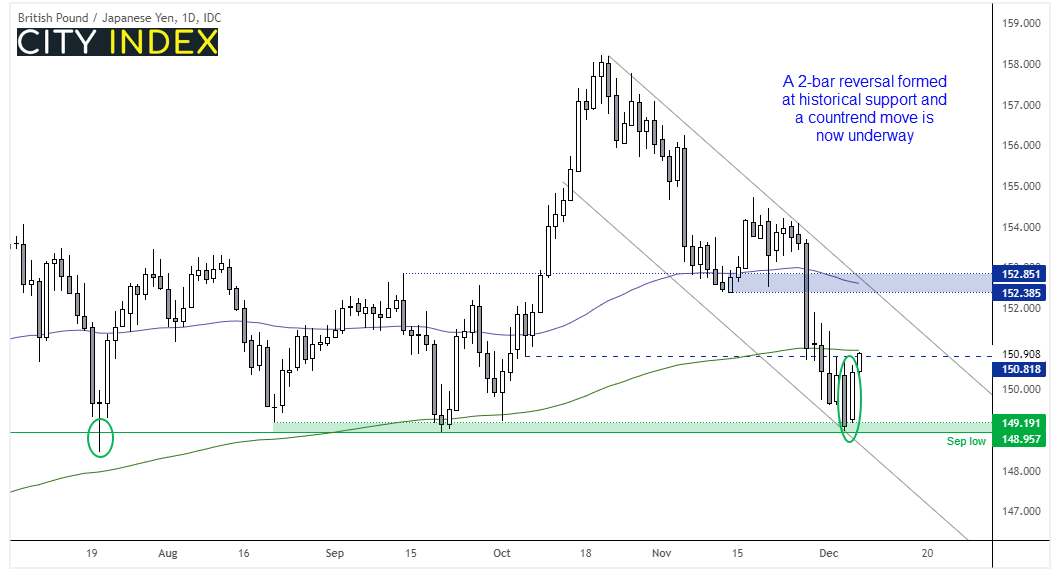

Countertrend move underway on GBP/JPY

GBP/JPY is perking up as a countertrend move gets underway. It trades within a bearish channel on the daily chart, although yesterday the pair produced a along bullish inside day after finding support at the September low (also note that bullish pinbar around 149 in July). Overnight trade has seen the pair break above 150.82 resistance and is set to test the 200-day eMA – a break above which assumes bullish continuation.

WTI back above its 200-day eMA

It closed above this key milestone yesterday after falling beneath it four and six days ago. Prices overnight have drifted higher back above $70, so clearly a key level for bulls to defend this session is the 200-day eMA at 69.20. For brent this level equates to 72.15 and appears to the be stronger rebound of the two.

FTSE 100 closed above 7200

Friday’s bearish hammer was not confirmed with a break of its low yesterday, as prices simply rallied from the open and closed above the 7200 and the August and June highs. This is actually the move we had been waiting for after it held above the 200-day eMA last week, but in true FTSE fashion it made hard work of it and wrong-footed us along the way. Intraday support levels for potential dips for bulls to take advantage include 7200 and 7172.

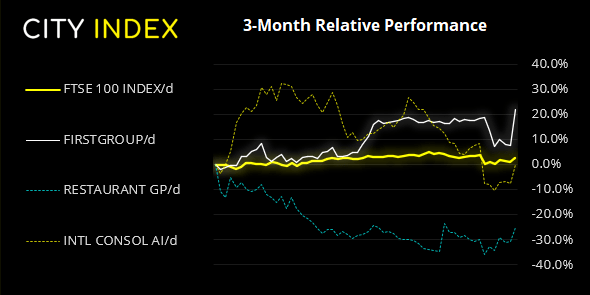

FTSE 350: 4137.9 (1.54%) 06 December 2021

- 283 (80.63%) stocks advanced and 61 (17.38%) declined

- 7 stocks rose to a new 52-week high, 9 fell to new lows

- 51.28% of stocks closed above their 200-day average

- 56.13% of stocks closed above their 50-day average

- 13.39% of stocks closed above their 20-day average

Outperformers:

- + 13.3%-FirstGroup PLC (FGP.L)

- + 8.35%-Restaurant Group PLC (RTN.L)

- + 8.08%-International Consolidated Airlines Group SA (ICAG.L)

Underperformers:

- -14.4%-Synthomer PLC (SYNTS.L)

- -3.62%-Playtech PLC (PTEC.L)

- -3.22%-Volution Group PLC(FAN.L)

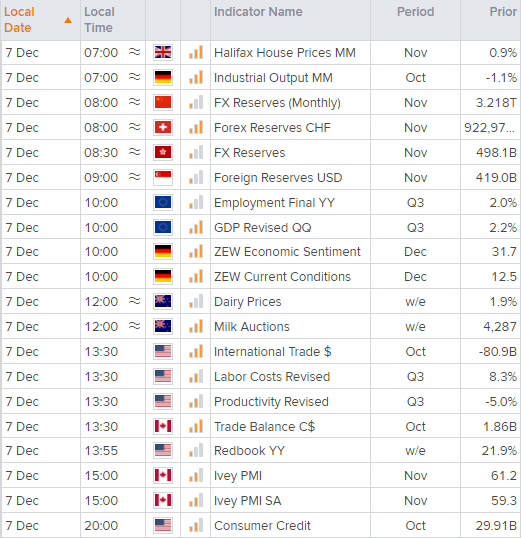

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade