Asian Indices:

- Australia's ASX 200 index fell by -46.5 points (-0.63%) and currently trades at 7,324.30

- Japan's Nikkei 225 index has risen by 102.99 points (0.43%) and currently trades at 25,262.96

- Hong Kong's Hang Seng index has risen by 103.36 points (0.41%) and currently trades at 25,257.68

- China's A50 Index has fallen by -293.81 points (-1.86%) and currently trades at 15,474.33

UK and Europe:

- UK's FTSE 100 futures are currently down -14.5 points (-0.2%), the cash market is currently estimated to open at 7,274.12

- Euro STOXX 50 futures are currently down -11.5 points (-0.27%), the cash market is currently estimated to open at 4,268.97

- Germany's DAX futures are currently down -38 points (-0.24%), the cash market is currently estimated to open at 15,768.29

US Futures:

- DJI futures are currently up 94.28 points (0.26%)

- S&P 500 futures are currently down -23.75 points (-0.15%)

- Nasdaq 100 futures are currently down -8.5 points (-0.18%)

Asian indices mixed overnight

Joe Biden’s recently unveiled $1.75 trillion spending package hit another road bump, with Dem Senator Joe Manchin refusing to commit his support for the bill.

Equity markets were mixed overnight as we head towards several central bank meetings. South Korea’s KOSPI 200 index was a top performer and on track for its best session in 4-weeks as tech stocks tracked Wall Street higher. The ASX 200 fell around -0.5% after the RBA began to tight policy and move a step closer towards raising rates sooner than (they) were letting on. China’s equity markets were the weakest of the session with China’s A50 index currently down -1.3% and the CSI300 down around -0.7%.

The STOXX 50 chart closed to a 13-year high, beyond out initial target around 4250/52. If it can stabilise above that key level then perhaps it will prompt another round of bullish activity.

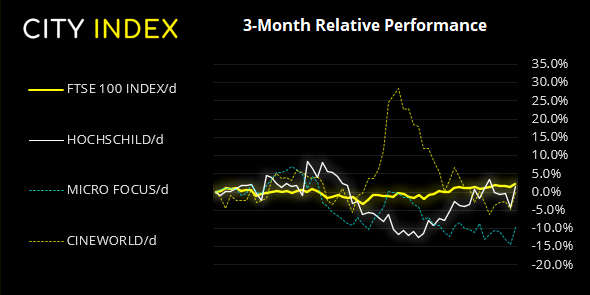

The FTSE broke to a new post-pandemic high following its bullish hammer on Monday. Our bias remains bullish above yesterday’s low. As for equities, Standard Charter (STAN) doubled its pre-tax profits compared with a year ago.

FTSE 350: Market Internals

FTSE 350: 4174.94 (0.71%) 01 November 2021

- 246 (70.09%) stocks advanced and 92 (26.21%) declined

- 25 stocks rose to a new 52-week high, 5 fell to new lows

- 60.97% of stocks closed above their 200-day average

- 80.06% of stocks closed above their 50-day average

- 24.22% of stocks closed above their 20-day average

Outperformers:

- + 5.96%-Hochschild Mining PLC(HOCM.L)

- + 5.36%-Micro Focus International PLC(MCRO.L)

- + 4.77%-Cineworld Group PLC(CINE.L)

Underperformers:

- -15.1%-Darktrace PLC(DARK.L)

- -4.45%-Petropavlovsk PLC(POG.L)

- -3.55%-AO World PLC(AO.L)

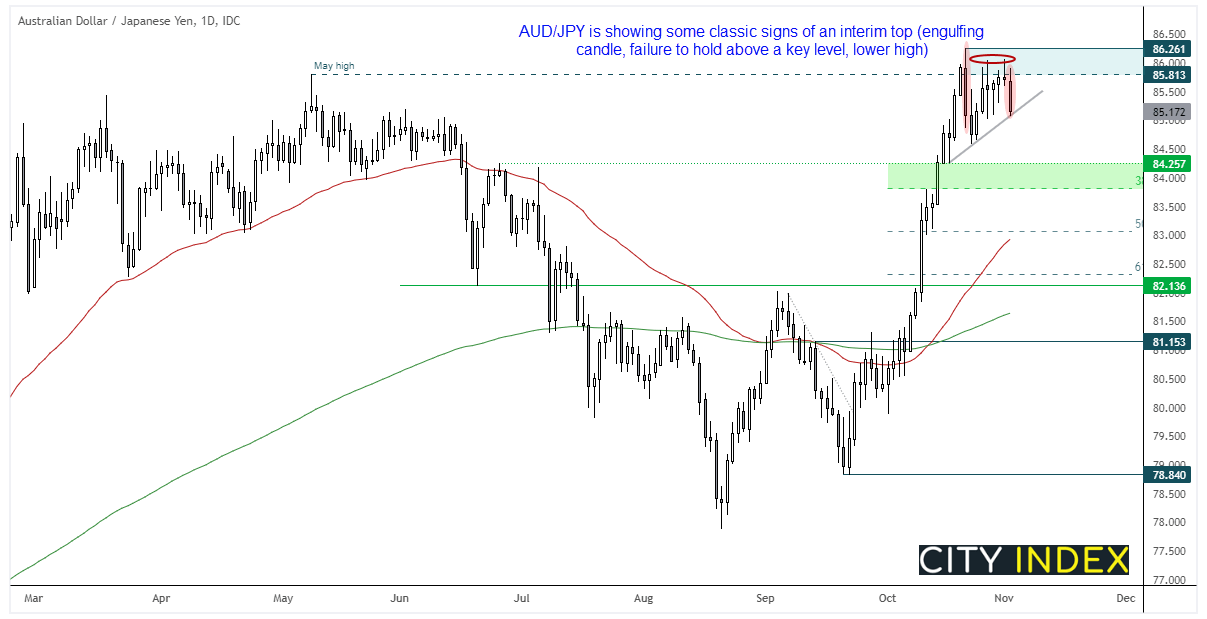

Forex: RBA begin to tighten (slowly)

It appears the RBA are finally coming in line with markets, after they scrapped their YCC (yield curve control) target of 0.1% and removed any reference to tightening in “2024”. This is a far cry from being hawkish mind, but with a central bank as dovish as the RBA, it will take a long time to turn the slow ship. During the following webinar with the Governor himself said it could be plausible rates could be raised by 2023. Given markets were already pricing in hikes for next year this seems typical of the RBA to drag their heels over a policy change.

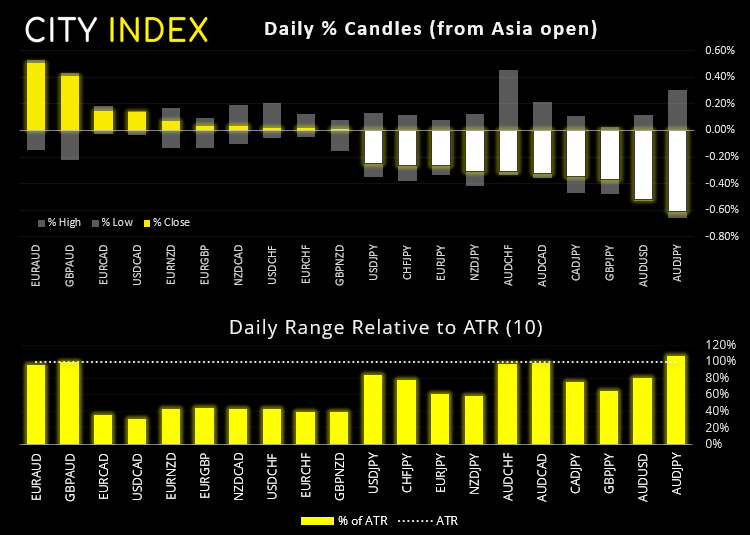

The Australian dollar is broadly lower as the RBA were not as hawkish the traders were positioned for. AUD/CHF is teasing key support around the support zone mentioned in today’s Asian Open report.

AUD/JPY fell around -0.6% and appears to be carving out an interim top. Given its extended run to the May high and its inability to break above it, we’re keeping a close eye on the cross as it is showing some classic signs of an inflection point. A bearish engulfing candle on October 21st slammed prices back below the May high before several Doji’s teased the key level before moving lower today. A daily close around current levels confirms a 3-bar bearish reversal. A break of trend support brings the 84.58 low into focus, with the 38.2% ratio sitting just beneath 84.0 as another viable countertrend target.

GBP/USD touched a 13-day low yesterday, although momentum is waning as we approach the FOMC meeting. Our bias remains bearish beneath the 1.3700/20 zone outlined in yesterday’s report.

Commodities:

Copper futures were slightly lower ahead of tomorrow’s FOMC meeting, with the strong selloff in Iron Ore markets also playing a part.

Silver looks like it wants to break higher after finding support above its 50-day eMA and printing a small inside day. In fact, the potential setup does not look too dissimilar to platinum did yesterday, just before it broke higher.

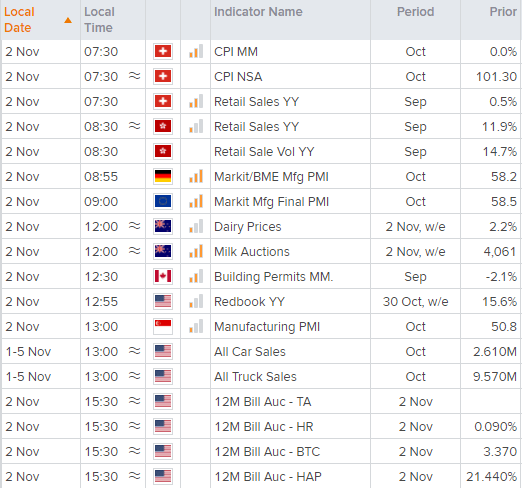

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade