View our guide on the FX Dashboard:

Asian futures:

- Australia’s ASX 200 index fell by -27.3 points (-0.4%) to close at 6,762.3

- Japan’s Nikkei 225 index has fallen by -287.85 points (-0.95%) and currently trades at 29,380.34

- Hong Kong’s Heng Seng index has fallen by -447.04 points (-1.52%) and currently trades at 29,005.53

FTSE 100:

- UK’s FTSE 100 futures are currently down -23 points (-0.35%), the cash market is currently estimated to open at 6,565.53

European futures:

- Euro STOXX 50 futures are currently down -15 points (-0.41%), the cash market is currently estimated to open at 3,691.62

- Germany’s DAX futures are currently down -67 points (-0.48%), the cash market is currently estimated to open at 13,945.82

Monday’s US close:

- Dow Jones rose 603.14 points (1.95%) to close at 31535.51

- S&P 500 rose 90.67 points (2.38%) to close at 3901.82

- Nasdaq 100 fell -473.88 points (-3.56%) to close at 13282.953

It was a mixed picture for equities across Asia today, with shares in Japan and China trading mostly lower, the ASX 200 essentially flat yet major indices for South Korea, Singapore and Taiwan were higher.

Only consumer staples and the financial sectors closed higher for the ASX 200, with energy, materials and industrials each falling over 1%. Energy stocks were lower as oversupply concerns weighed on oil prices and sent WTI back to $60 ahead of Thursday’s OPEC meeting. Yet volatility was contained overall. Gold resources (GOR.AX) was the weakest stock in the index, falling -7.5% in line with gold prices which touched fresh lows and fell to 1,706.

The Nikkei 225 was under pressure following weak CAPEX (capital expenditure) data, which revealed that Japanese companies had cut spending on large equipment for a third consecutive quarter as manufacturer’s continued to cut costs.

Forex: Dollar slightly bid, EUR/USD quietly breaks support

The USD is slightly firmer with the US dollar index (DXY) rising +0.2% to a 3-week high. EUR/USD quietly broke beneath the 1.2023 low in Asian trade but, with the 100-day eMA and 1.2000 handle in close proximity, we are on guard for a false break and corrective bounce higher. USD/CHF closed above its 200-day eMA yesterday and prices have remained in a tight range near yesterday’s highs. The next major resistance is around 0.9200, which is around 45 pips away.

GBP/USD printed a 2-week intraday low but prices have since recovered back above 1.3888 support. Failure for bears to conquer this level could result in a minor, technically driven rebound. GBP/AUD nudged its was to a 2-day low following RBA’s meeting and traded back below its 100-day eMA. Last week’s rally appears to have topped out after finding resistance at its 200-day eMA on Friday.

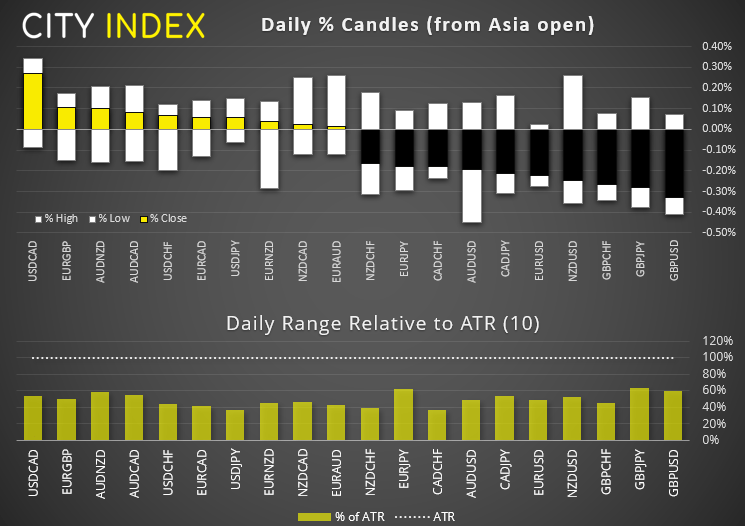

USD and CHF are currently the strongest major whilst GBP and CAD are the weakest. Although it has been a quiet session overall with all pairs remaining well within their 10-day ATR’s (average true ranges).

Asian PMI’s continue to rally

South Korean manufacturing PMI expanded at its fastest rate in 11 years in February, reaching 55.3 and up from 53.2 in January. With new orders and output hitting 11 year high it paints a very rosy picture for global demand and, ultimately, global growth in H2 2021. New export orders also rose for a fifth consecutive month, with respondents highlighting domestic demand and from South Asia.

RBA keep policy unchanged in dovish meeting

The Reserve Bank of Australia predictably held rates at 0.1%, where they expect to hold them until inflation rises comfortably within their 2-3% target range. The RBA think the economy still operates with considerable spare capacity and “significant gains” for employment are required to meet their goals. Moreover, wage growth will also need to be “materially higher”. And they don’t expect to see this until 2024. Dovish it is then!

It appears that Monday’s doubled-the-usual bond purchase may have been a single-off event, as opposed to a change in momentum as their statement made reference to bond purchases being “brought forward this week to assist with the smooth function of the market”. But they will continue to respond to “market conditions” (translates as ‘higher bond yields’) if and when need be.

The Australian dollar gave little response, although that could be expected since there was no element of surprise at today’s meeting. The ASX 200 spiked 70-points but now trades back near its opening price around 6,785.

USD/CAD in focus for Canada’s GDP

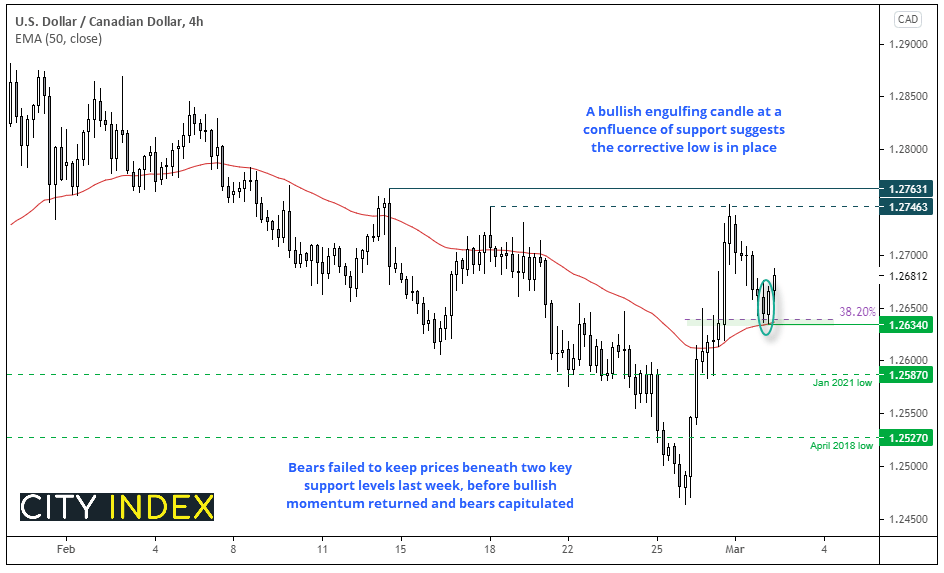

With GDP data for Canada released later in the US session and the recent rebound of the US dollar, we are seeking bullish opportunities on USD/CAD.

Recent price action on the weekly charts have made us question whether USD/CAD has already printed a significant low. February’s candle produced a Rikshaw Man Doji and last week’s candle produced a “buying tail” (lower wick) after bears failed to hold prices beneath the January 2021 and April 2018 low.

Switching to the hourly chart shows that a bullish engulfing candle formed at the 50-hour eMA and prices have now broken above its high to suggest a swing low is in place. The low has also respected a 38.2% Fibonacci retracement level. Given the strength of the rebound from the 1.2465 low, we suspect recent price action to be corrective and bulls will try and target the highs around 1.2746/63.

- If confident today’s low is already in place, bulls could enter around current levels.

- The bias remains bullish above the 1.2634 low

- Initial target is around the 1.2746/63 highs (take note that the 50-day eMA capped as resistance last Friday and this yesterday)

Up Next (Times in GMT)

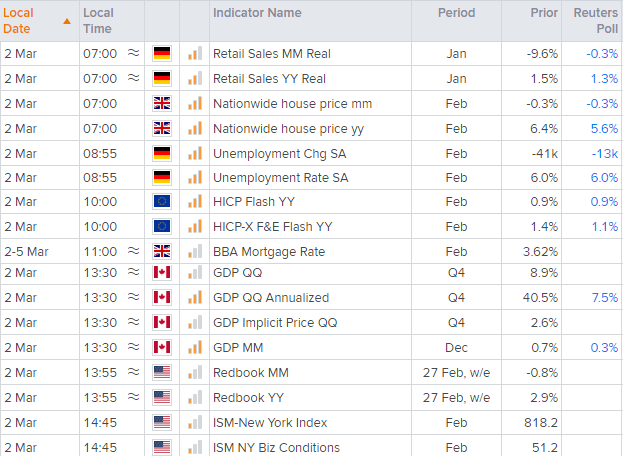

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

German retail sales are expected to fall -0.3% in January, although there may be potential for a downside surprise given lockdowns.

Canada’s GDP is expected to 7.5% in Q4, a far cry from Q3’s 40.5% rebound but admirable none the less. A downside surprise should help lift USD/CAD in line with our bullish bias, whereas a stronger print could cap upside potential.