Asian Indices:

- Australia's ASX 200 index fell by -80.3 points (-1.13%) and currently trades at 7,016.70

- Japan's Nikkei 225 index has fallen by -549.83 points (-1.92%) and currently trades at 28,058.77

- Hong Kong's Hang Seng index has fallen by -103.21 points (-0.37%) and currently trades at 27,910.60

UK and Europe:

- UK's FTSE 100 futures are currently down -30.5 points (-0.44%), the cash market is currently estimated to open at 6,917.49

- Euro STOXX 50 futures are currently down -24 points (-0.61%), the cash market is currently estimated to open at 3,922.06

- Germany's DAX futures are currently down -81 points (-0.54%), the cash market is currently estimated to open at 15,038.75

Tuesday US Close:

- DJI futures are currently down -252 points (-0.74%), the cash market is currently estimated to open at 34,017.16

- S&P 500 futures are currently down -133 points (-1%), the cash market is currently estimated to open at 4,019.10

- Nasdaq 100 futures are currently down -30.5 points (-0.74%), the cash market is currently estimated to open at 13,320.77

Asian equities and futures markets point lower

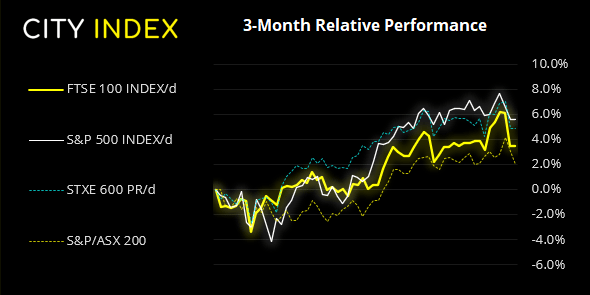

Futures markets across US, Europe and Asia are mostly in the red, despite a strong fight back from Wall Street heading into yesterday’s close. After falling around -2% at the open, US equities pared or erased most of the losses yet cash markets closed at key resistance levels. Traders seem to be pricing in a bad (ie strong) print from the US inflation report later today, which is weighing on sentiment heading into the open.

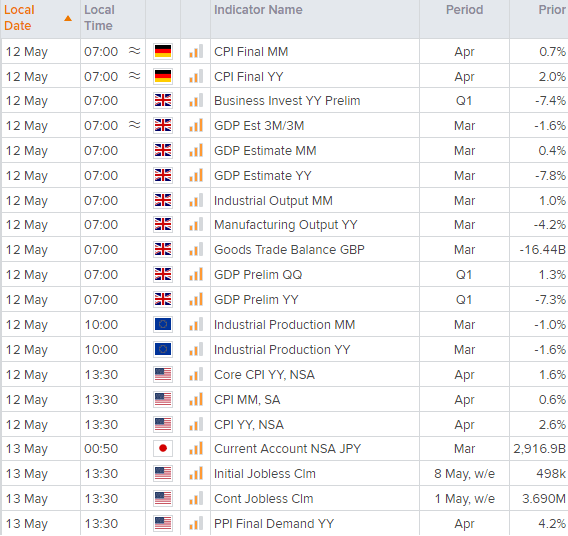

US CPI is expected to rise to rise to 3.2% (or 3.6% depending on which poll is used) which would take inflation to its highest level in around 10 years. However, this is the last month where the basing effect will take place, so perhaps it is the May read released next month could be more revealing as to whether rising CPI is simply transitory as the Fed expect, or the start of something more ‘sticky’ at higher levels (which the Fed are not prepared for).

The FTSE 100 finally took note of inflation fears, falling -2.5% in its worst single day in seven months yesterday and closing below 7,000 after a whopping four days above it. Perhaps it may find support around 6900 after the open but the bias remains bearish below 7,000 today.

FTSE 350: Market Internals

FTSE 350: 6947.99 (-2.47%) 11 May 2021

- 11 (3.14%) stocks advanced and 338 (96.57%) declined

- 7 stocks rose to a new 52-week high, 12 fell to new lows

- 81.14% of stocks closed above their 200-day average

- 13.43% of stocks closed above their 20-day average

Outperformers:

- + 2.16% - Greencore Group PLC (GNC.L)

- + 1.84% - Premier Foods PLC (PFD.L)

- + 1.31% - Vivo Energy PLC (VVO.L)

Underperformers:

- -7.40% - International Consolidated Airlines Group SA (ICAG.L)

- -7.10% - Playtech PLC (PTEC.L)

- -6.72% - Renishaw PLC (RSW.L)

Learn how to trade indices

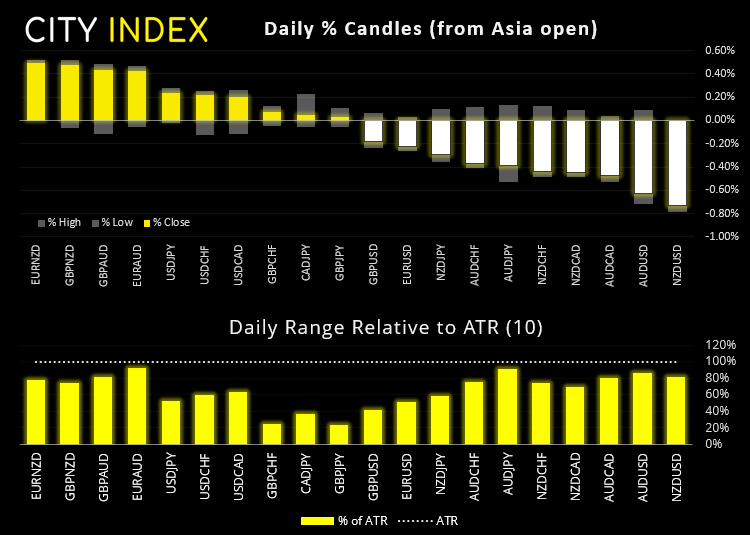

Forex: GBP consolidates ahead of data dump

The British pound is consolidating against its peers after a bullish start to the week. Up at 07:00 BST we have the UK’s data dump which includes GDP and business investment for Q1, alongside manufacturing and industrial output. This means there’s plenty of potential for volatility (and a directional move) should the data be stacked one way or the other for the pound. Given sentiment has improved this week then it could make for a clean break higher if data outperforms, although should it miss target (on net) then it could cause some profit taking and a dip lower for GBP pairs. That said, It may have to be a dire set of data for it to really roll over though.

- EUR/GBP retraced towards (yet didn’t quite reach) the 0.8620/30 resistance zone highlighted yesterday, providing bears an opportunity to fade into the move if they anticipated a break of Monday’s low. Yet prices are yet to break key support, and the longer it takes to do so, the risk of a pop higher increases.

- GBP/CHF confirmed support at the 1.2736 breakout level, so our bias remains bullish above it.

- GBP/USD is testing yesterday’s lows as the dollar retraces ahead of today’s inflation report. We see the potential for it to correct further and may make the better short should UK data disappoint.

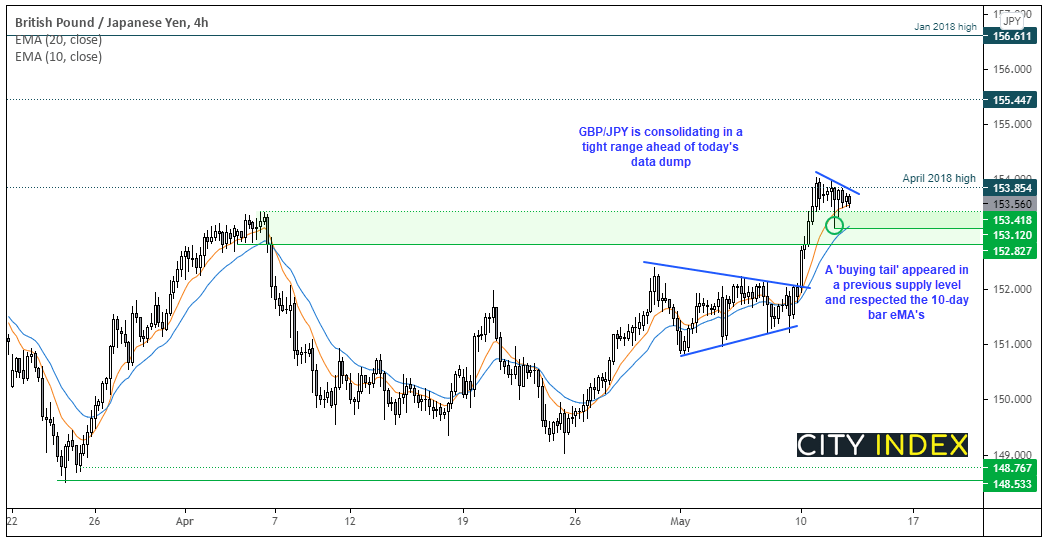

GBP/JPY is trading just below its three-year high. Were it not for the spike at 153.12 (yesterday’s low) we would label is a bull-flag, but at least the lower wick shows demand at 153.12. As we have a host of UK data then we may find volatility creates noise around such levels, but ultimately our bias is for a break above this week’s high and for prices to hold above 152.87 (a break beneath of which invalidates the near-term bullish bias).

Learn how to trade forex

Commodities slightly lower ahead of US inflation report:

Gold and silver are trading -0.5% and -1.2% lower respectively as the US dollar creeps higher ahead of today’s inflation report. As silver has tested the upper trendline of its bullish channel on the four-hour chart and printed a lower high, we see the potential for a dip towards the 27.00/10 support zone. Further out we would look for the lower channel trendline or 26.63 to provide support and to create a potential trough.

Oil prices are also a touch lower yet both WTI and brent remain in a daily uptrend, with potential support sitting around $64.00 and $67.00 respectively.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.