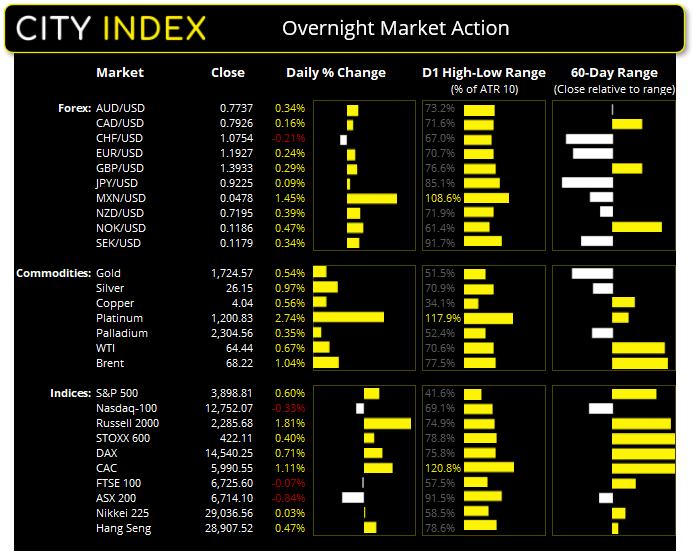

Asian Indices:

- Australia's ASX 200 index rose by 52.9 points (0.79%) to close at 6,766.80

- Japan's Nikkei 225 index has risen by 172.49 points (0.59%) and currently trades at 28,864.32

- Hong Kong's Hang Seng index has fallen by -173.14 points (-0.59%) and currently trades at 29,212.47

UK and Europe:

- UK's FTSE 100 futures are currently down -18 points (-0.27%), the cash market is currently estimated to open at 6,718.96

- Euro STOXX 50 futures are currently down -3 points (-0.08%), the cash market is currently estimated to open at 3,842.64

- Germany's DAX futures are currently down -29 points (-0.2%), the cash market is currently estimated to open at 14,540.39

Thursday US Close:

- The Dow Jones Industrial rose 188.57 points (0.58%) to close at 32,485.59

- The S&P 500 index rose 40.53 points (1.04%) to close at 3,939.34

- The Nasdaq 100 index rose 300.832 points (2.36%) to close at 13,052.90

Asian equities maintained the positive mood handed to them by Wall Street overnight. The KOSPI 200 is leader of the pack, up around 1.4% at time of writing, the TOPIX is up around 1.2% and the ASX 200 closed 0.8% higher at 6766.80.

US futures have also ticked higher with Dow Jones E-mini’s up 93 points (0.3%), S&P 500 E-minis up 7 points (0.18%) and the Nasdaq E-minis marginally up by 5.8 points (0.04%).

Nasdaq to play catch-up?

The Nasdaq 100 cash index closed above trendline resistance (projected from its all-time high) and we suspect it will now try and close the gap with the Dow Jones, S&P 500 and Russell 2000 which hit record highs yesterday. We’d like to see its bullish gap between 12,840 – 12,920 remain untested and for prices to retest the 13,300 high. But, ultimately, the near-term bias remains bullish above the 12,721 low.

Price action on the FTSE 100 daily chart remains choppy, so we’d refrain from becoming too bullish on this timeframe until prices break above 6,800. A break beneath Thursday’s low of 6,670.60 takes it further within its choppy range but could then bring the 6,560.79 low into focus for bears.

Vaccines

Biden is pushing all states to make adults eligible to receive the vaccine by May 1st, so they can enjoy gatherings over Independence Day on July 4th. 4,000 active duty troops will also be deployed to help with the vaccine rollout. To help drive the rollout the US has also told Europe to not expect the AstraZeneca vaccine soon. America first it is then!

Forex: A tumbleweed session (for now)

The lack of market driving news in Asia kept a lid on any meaningful volatility overnight. With that said, the US dollar is the strongest of a lame bunch whilst CHF and JPY are the weakest. With all major pairs we track, all daily ranges remained around 30-40% of their 10-day ATR’s which leaves plenty of ‘meat on the bone’ for potential moves when volume pick up over the European and US sessions.

EUR/USD: 1.2000 is the next major barrier for bulls to conquer. Judging from yesterday’s strong bullish close and the fact prices remain in the top quadrant of yesterday’s range suggest they may have a crack at it today. A break below 1.1951 brings 1.1900 into focus but, as we highlighted earlier this week, there was some strong bullish activity around that level so we don’t expect it to break easily.

EUR/GBP: A bullish outside candle (in the form of a spinning top Doji) warns of a hesitancy to test, let alone break beneath, the 0.8537 low. The longer it fails to do so, the greater the odds of a corrective bounce towards 0.8593. And a break above here could see further short covering which fuels a deeper counter-trend correction higher.

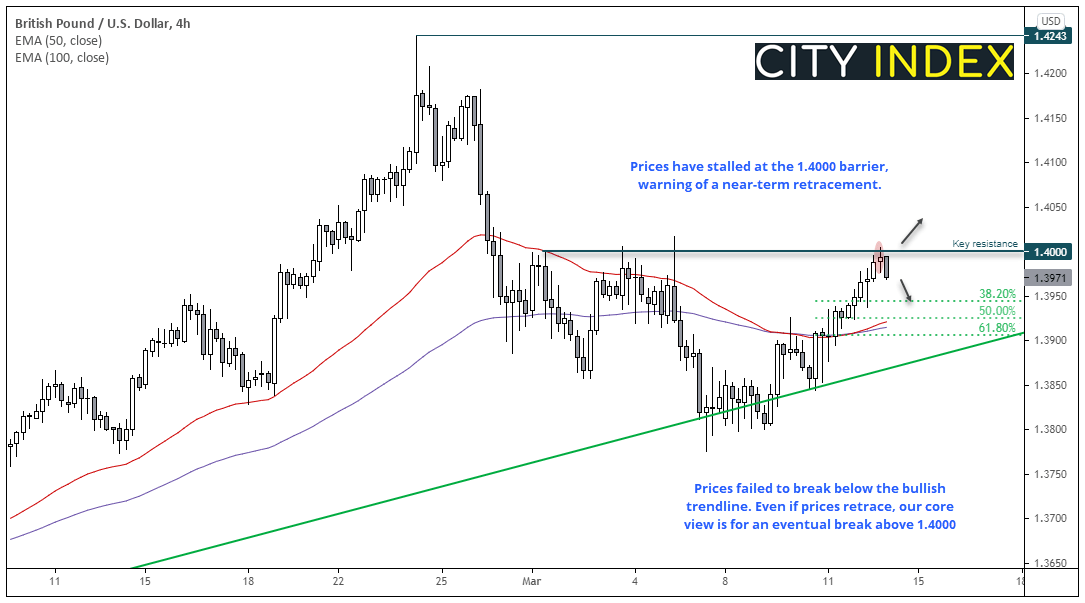

GBP/USD treads water ahead of UK data dump

Cable maintained its bullish structure on the daily chart this week, finding support at the 50-day eMA and producing a three-bar bullish candlestick pattern (morning star reversal). Each day this week has closed higher, although prices are now pausing for breath beneath the 1.4000 handle ahead of a slew of UK data before the open.

Given the US dollar is on the ropes the bias is for an eventual break higher. However, if data disappoints and prices inevitably retrace lower, we’d still be keep to explore bullish opportunities at lower prices.

The four-hour chart has produced a spinning top Doji at key resistance and the current H4 candle is trying to confirm a near-term reversal. If prices fall, we’d be looking for support to build around Fibonacci levels or the 50 and 100-bar eMA’s, above 1.3900.

- Counter-trend bears can seek to trade it towards 3.3950 (or the Fibonacci ratios) using a break above 1.4000 as an invalidation point

- Bulls could simply wait for a break above 1.4000, or…

- Seek a higher low to form around mentioned support levels further out

Commodities: Gold and Silver to dip lower?

A bearish hammer formed on gold’s daily chart after hitting our 1740 target yesterday. Given the daily downtrend and that prices are back beneath the 10-day eMA, we suspect the path of least resistance points lower. Over the near-term. Yet given the momentum shift around 1680 with a bullish engulfing candle, we suggest shorts do not outstay their welcome. Ultimately, we are now watching out for a corrective low before reconsidering log opportunities.

If gold falls silver likely will too, having found resistance at the 10, 20 and 50-day eMA’s. The next support level is around $25 but, if our gold thesis is correct, we do to expect silver to reach that far.

Copper prices have retraced slightly overnight but we remain bullish above 3.97 – 4.00 area. Given the morning star reversal pattern on the daily chart we suspect it is trying to break out of compression and retest its recent highs.

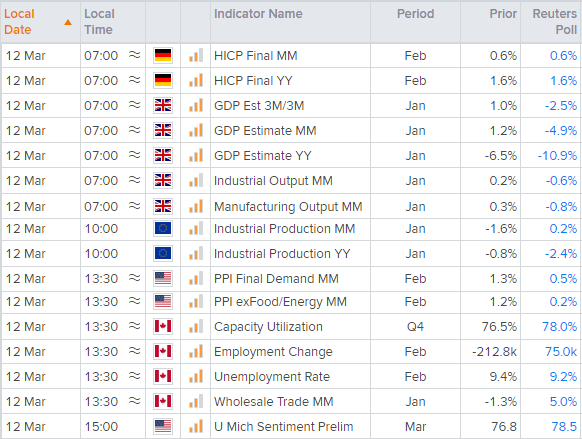

Up next (times in GMT)

- A host of UK data is released at 07:00 GMT, including GDP estimates, and output for industrial, manufacturing and construction work. Given Bank of England’s Governor Bailey is one of the few central banks warning that rising inflation could be sticky at the higher levels, the positive data could feed into this belief and further support GBP.

- Producer prices are in inflationary input, so any rise here could support the dollar (or at least slightly support its fall as it is on the back ropes). Preliminary data for Michigan consumer sentiment is also released which includes inflation expectations.

- Given Canadian employment is released at the same time as US PPI, then USD/CAD is a pair to keep an eye on.