Asian Indices:

- Australia's ASX 200 index rose by 38.2 points (0.55%) to close at 6,924.10

- Japan's Nikkei 225 index has risen by 61.1 points (0.21%) and currently trades at 29,757.73

- Hong Kong's Hang Seng index has fallen by -163.15 points (-0.56%) and currently trades at 28,775.59

UK and Europe:

- UK's FTSE 100 futures are currently up 16.5 points (0.24%), the cash market is currently estimated to open at 6,840.05

- Euro STOXX 50 futures are currently down -6 points (-0.15%), the cash market is currently estimated to open at 3,964.42

- Germany's DAX futures are currently down -19 points (-0.12%), the cash market is currently estimated to open at 15,193.68

Tuesday US Close:

- The Dow Jones Industrial fell -96.95 points (-0.29%) to close at 33,430.24

- The S&P 500 index fell -3.97 points (-0.1%) to close at 4,073.94

- The Nasdaq 100 index fell -19.71 points (-0.14%) to close at 13,578.46

European and US indices pause for breath, FTSE approaches YTD high

US indices printed small bearish candles yesterday, despite positive economic data and increased optimism over the US vaccine rollout. It’s possible bulls got a little ahead of themselves on Monday and the rally is in need of a pause with the S&P 500 and Dow Jones hitting new highs. But whilst prices remain beneath said highs, traders should be on guard for a retracement, even if only a minor one.

The DAX and CAC gapped notably higher, yet finished the session lower. If we were to find that prices were to create a new gap lower (whether today or some time this week) it would leave what is known as an ‘Island Reversal’ pattern which can be associated with market tops. Alternatively, we may find prices drift lower and fill yesterday’s gap – but these are two scenarios to consider whilst prices remain beneath record high.

The FTSE 100 jumped to a three-month high on hopes that the UK will prepare to reopen, with oil and mining stocks leading the way. SSE (+4.4%), Antofagasta (+3.8%) and BP (3.4%) were the strongest performers whilst BT Group (-2.4%) and Next (-2.4%) were the weakest. Gaining +1.28% by the close, the FTSE 100 has inched its way to its year to date high of 6904.29. A break above here would bring 7,000 into focus which we expect could be a tough nut to crack.

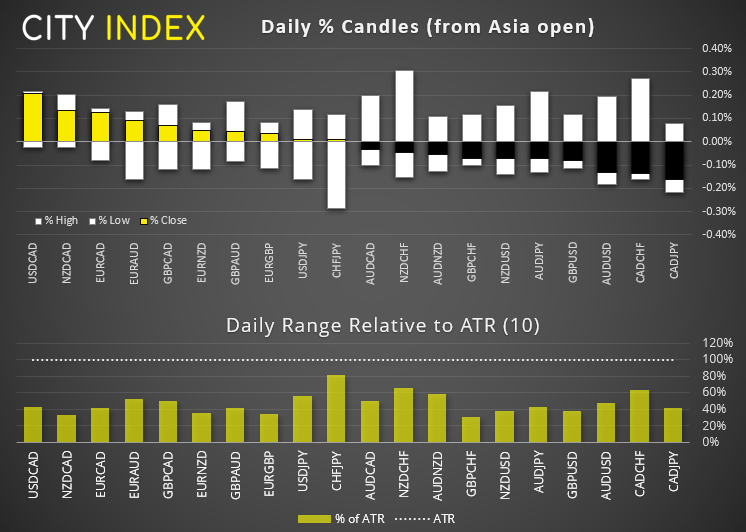

Forex: USD and GBP on the back foot

The US dollar index (DXY) invalidated its bullish trendline and closed beneath 92.50 support yesterday to cement our bearish vias on USD. Overnight trade saw prices remain anchored to yesterday’s low, and it would be no major surprise to see at least a minor bounce from current levels. Structurally the bias is bearish beneath the March high (93.44) but we would be keen to exposure potential shorts around resistance levels or the broken trendline.

The British pound was mostly flat across the board but it endured a bout of heavy selling, particularly against the euro, Japanese yen and Swiss franc. After much trawling there is no definitive reason, but possibilities include a stronger FTSE, stops being triggered on EUR/GBP or concerns that the AstraZeneca vaccine does cause issues and the vaccine rollout (and therefore economic recovery) could effected. If the latter, it leaves GBP vulnerable to headline risk around the vaccine, particularly over the coming sessions.

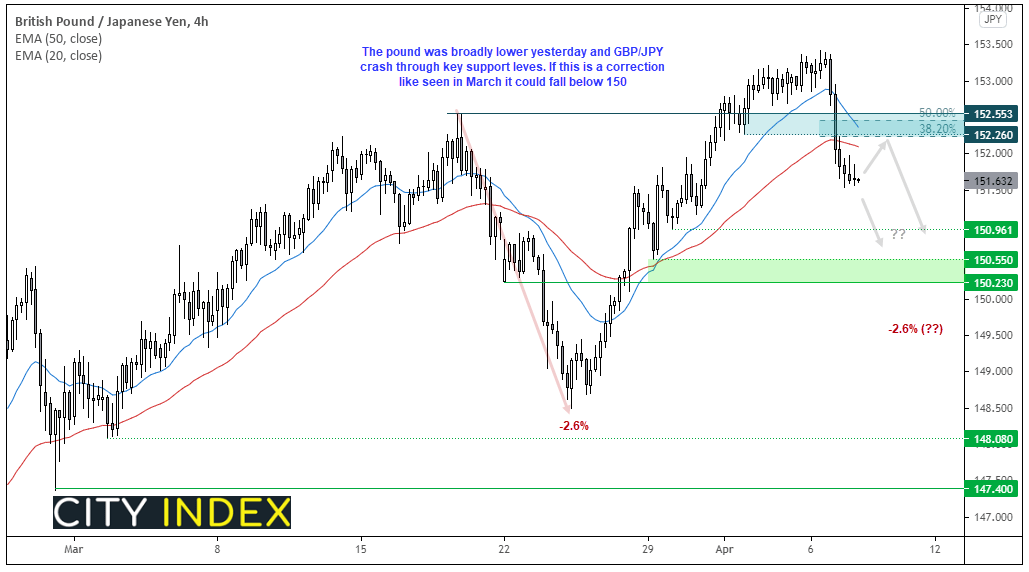

GBP may have entered a corrective phase

The pound was broadly lower and printed large bearish candles against all majors yesterday. GBP/CHF sliced through 1.3000 with apparent ease and, whilst price action is similar to GBP/JPY, price action on the latter appears to be less obscured on the hourly chart.

We can see on GBP/JPY’s four-hour chart that a momentum shift occurred at its highs before crashing through support. Given the magnitude of the decline our near-term bias is bearish below the 152.29.53 resistance zone, but we could also see direct losses should price action break yesterday’s low early on in today’s session.

- The bias remains bearish below the 152.26/55 resistance zone

- If prices retraces higher from current levels, bears could look for signs of weakness below the resistance zone

- If prices continue lower then support resides around 150.96, 150.55 and 150.23

Commodities: Metals trying to move higher in unison

Gold prices are holding just below 1740 in a narrow range, after moving to a two-week high yesterday. The hourly chart is holding above its 50-bar eMA and next targets for bulls are likely the 1750 handle and 1755 high as long as prices can remain above 1727 support. A break below 1720 brings the 1705 back into focus.

Copper prices are trading slightly lower for a second consecutive session. Yet our bias remains bullish whilst prices hold above the bullish gap around $4.00. A break above Monday’s high ($4.16) would be constructive to the bull case.

Platinum touched a six-week high yesterday and posted an marginal gain of 0.6% overnight. With momentum having realigned with its bullish trend on the daily chart our near-term bias remains bullish above the 1195 low (and 1200 round number). 1300 is the next target, although that level triggered a -16% declined the last time prices tried to break above it in February.

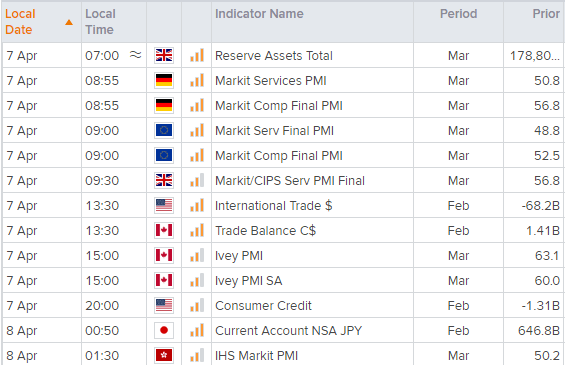

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.