Asian Indices:

- Australia's ASX 200 index rose by 22.4 points (0.3%) and currently trades at 7,483.30

- Japan's Nikkei 225 index has risen by 468.04 points (1.75%) and currently trades at 27,484.75

- Hong Kong's Hang Seng index has risen by 449.99 points (1.81%) and currently trades at 25,299.71

UK and Europe:

- UK's FTSE 100 futures are currently up 36 points (0.51%), the cash market is currently estimated to open at 7,123.90

- Euro STOXX 50 futures are currently up 25 points (0.6%), the cash market is currently estimated to open at 4,172.50

- Germany's DAX futures are currently up 102 points (0.65%), the cash market is currently estimated to open at 15,910.04

US Futures:

- DJI futures are currently up 225.98 points (0.01%)

- S&P 500 futures are currently up 58.25 points (0.39%)

- Nasdaq 100 futures are currently up 15 points (0.34%)

Learn how to trade indices

Asian indices rise

Equity markets are off to a positive start to the week, with all major futures markets trading higher overnight. Hong Kong markets outperformed with the Hang Seng Enterprise index rising 2.2%, whilst the Hang Seng is up 0.9%. Even bears gave Japan’s share markets a break with the TOPIX rising 1.9%, and the Nikkei 225 rising 1.7% despite weaker PMI data due to lockdown restrictions. The ASX 200 is 0.3% higher although the 20-day eMA is capping gains and stalling a test of 7500.

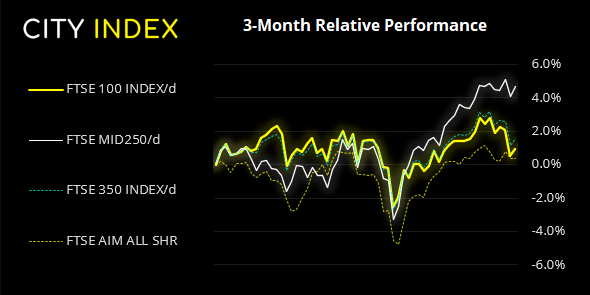

The FTSE 100 made a mild effort to reclaim some of Thursday’s -1.5% selloff yet remains below 7100 resistance. Should prices break above there, then resistance also sits around 7117, 7150 and 7169. Due to its lack of bullish effort we suspect the index is vulnerable to another leg lower.

FTSE 350: Market Internals

FTSE 350: 4097.36 (0.41%) 20 August 2021

- 250 (71.23%) stocks advanced and 85 (24.22%) declined

- 39 stocks rose to a new 52-week high, 10 fell to new lows

- 71.23% of stocks closed above their 200-day average

- 63.53% of stocks closed above their 50-day average

- 20.8% of stocks closed above their 20-day average

Outperformers:

- + 14.1% - Marks and Spencer Group PLC (MKS.L)

- + 4.23% - Wm Morrison Supermarkets P L C (MRW.L)

- + 3.90% - Watches of Switzerland Group PLC (WOSG.L)

Underperformers:

- -4.59% - Trainline PLC (TRNT.L)

- -3.33% - John Wood Group PLC (WG.L)

- -2.92% - Wizz Air Holdings PLC (WIZZ.L)

Forex: Asian PMI’s soften, European reports up next

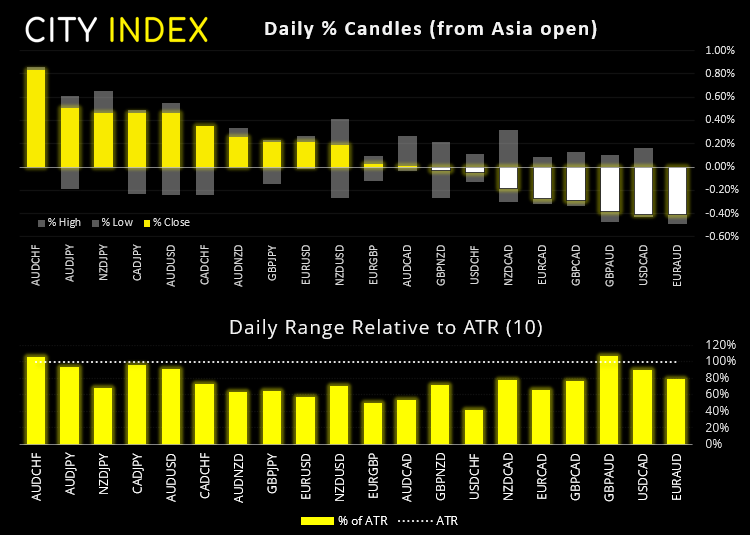

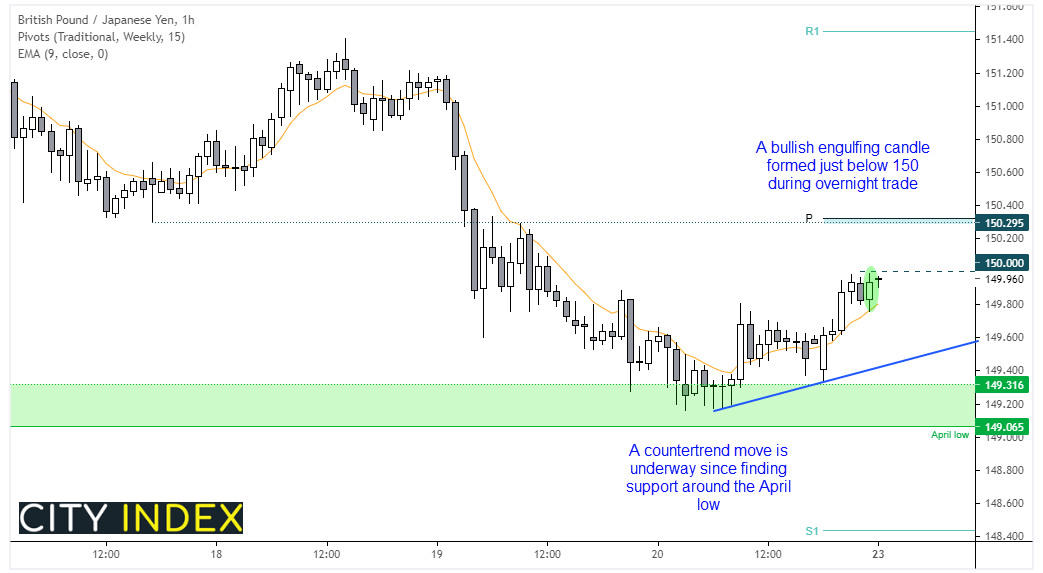

Overnight moves are essentially a reversal against last week’s direction, making it likely traders are booking profits ahead of this week’s Jackson Hole symposium. Commodity FX lead the way higher with CAD, AUD and NZD rising between 0.3% and 0.4% whilst the US dollar and Japanese yen are the weakest. That is not to say we have had a risk-on session though, taking the lack of volatility into account. But, if the UK can print a better than expected PMI set then GBP/JPY may be of interest to bulls.

GBP/JPY printed a Rikshaw Man Doji candle on Friday above its 200-day eMA and near the April and July lows, which showed downside momentum was waning. Prices have broken marginally above Friday’s high during Asian trade, and we suspect it is due a countertrend move. The hourly chart has formed a higher high and higher low, and has now printed a bullish engulfing candle which respected the 10-day eMA, so we’re looking for a break of recent highs (above 150) to assume bullish continuation and potentially probe the 150.29 low and weekly pivot point.

Australia’s composite PMI (manufacturing and services combined) contracted at its fastest rate since March 2020, coming in a 43.5 down from 45.2. The service sector was the main drag which fell to 43.3 from 44.2, and manufacturing PMI expanded at a slower pace of 51.7, down from 56.9. A reading above 50 denotes expansion. Japan’s manufacturing and service PMI’s also disappointed by falling below expectations, as extended lockdowns continue to weigh on growth prospects.

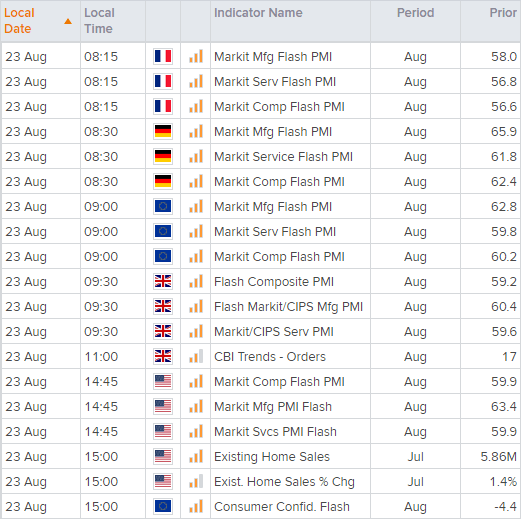

Flash PMI for Europe, UK and US will be released today, and overall expectations are for a slightly softer rate of expansion. France kicks off at 08:15 BST, followed by Germany at 08:30 (which can usually be a good indication of the Eurozone PMI, released at 09:00). UK PMI is scheduled for 09:30 and manufacturing PMI is forecast to fall to 59.5 from 60.4, and service to fall to 59 from 59.6. Then at 14:45 eyes will be on the US data set, with manufacturing PMI expected to fall to 62.4 from 63.4, and services to 59.1 from 59.9. With EUR/USD sitting near the 1.1700 resistance area traders will want to see a clear divergence between the European and US data sets to create a decent move above or below that level.

Learn how to trade forex

Bears give commodities a break

Copper futures rose 1.3% to a 2-day high and close to proving 4.20. However, it is too soon to tell whether the low has been seen around 4.00 or whether bears will return around the broken trendline. It’s one to watch however it plays out.

WTI is up 1.6% overnight as it tries to break a 7-day losing streak, all thanks to a weaker US dollar.

This also means that gold prices are perking up and we’re interested to see if it can break it of its bull flag formation on the four-hour chart and gun for the 1800 – 1805 area where the 200-day eMA resides.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.