Asian Indices:

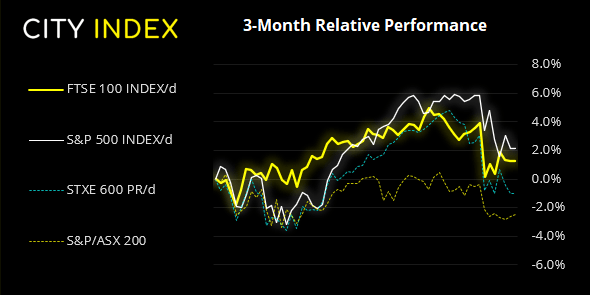

- Australia's ASX 200 index rose by 12.9 points (0.18%) and currently trades at 7,254.10

- Japan's Nikkei 225 index has fallen by -128.19 points (-0.46%) and currently trades at 27,901.38

- Hong Kong's Hang Seng index has fallen by -300.3 points (-1.26%) and currently trades at 23,466.39

- China's A50 Index has risen by 148.44 points (0.95%) and currently trades at 15,755.53

UK and Europe:

- UK's FTSE 100 futures are currently up 60 points (0.84%), the cash market is currently estimated to open at 7,182.32

- Euro STOXX 50 futures are currently up 51 points (1.25%), the cash market is currently estimated to open at 4,131.15

- Germany's DAX futures are currently up 153 points (1.01%), the cash market is currently estimated to open at 15,322.98

US Futures:

- DJI futures are currently down -59.72 points (-0.17%)

- S&P 500 futures are currently up 18.5 points (0.12%)

- Nasdaq 100 futures are currently up 22.5 points (0.5%)

Late of Friday, Evergrande announced that creditors had demanded around $260 million so it was not sure if it would be able to repay a bond coupon today of around $82.5 million. As this is the end a 30-day grace period it looks likely the company will default on this debt. The stock currently trades around 1.97 and looks set to test it previous record low of 1.83 set in May 2010.

US futures bounce

Sentiment improved overnight which allowed US equity futures markets, oil, AUD and NZD to rise whilst the VIX traded lower. It is unclear whether this is simply a retracement of Friday’s move or whether investors really are looking on the bright side. However, the sentiment was not broadly shared across Asia with China’s equity markets leading the way higher whilst Hong Kong’s indices were down over 1%. Traders were bullish on China with expectations of a reserve requirement ratios cut from Beijing whilst shares elsewhere lagged and track Wall Street’s bearish moves from Friday.

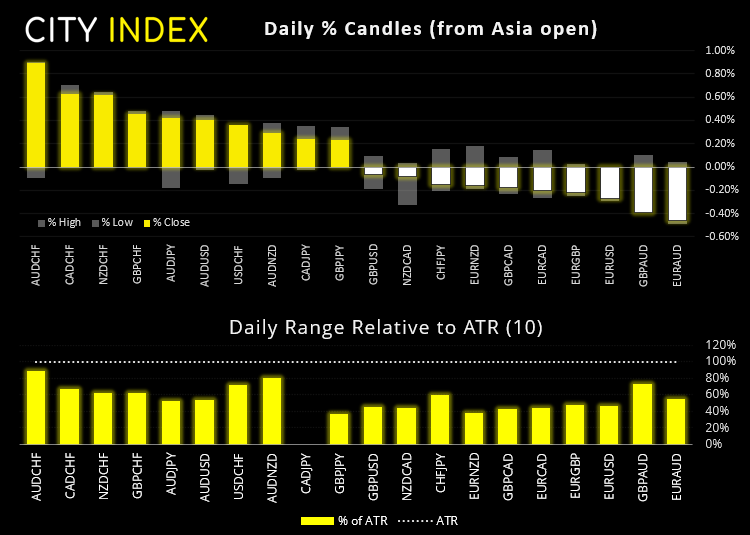

AUD trades back above 70c

The Australian dollar is the strongest currency overnight as traders repositioned after a week of heavy losses last week. AUD/USD is back above 70c but only just. Friday was its most bearish session since May and closed below this key level on Friday and the central bank divergent polices between the Fed and RBA favour a weaker currency.

USD/CHF is trying to form a bullish engulfing candle on the daily chart and is back above its 200-day eMA. This could be one to watch tomorrow as a daily close above 0.9222 also clears the monthly pivot point and warns of a potential swing low.

GBP/AUD hit our 1.8870 target following its break above 1.8695 on Thursday. Given it has perfectly respected the monthly R2 pivot and now trading lower we are happy to step aside until a new opportunity arrives.

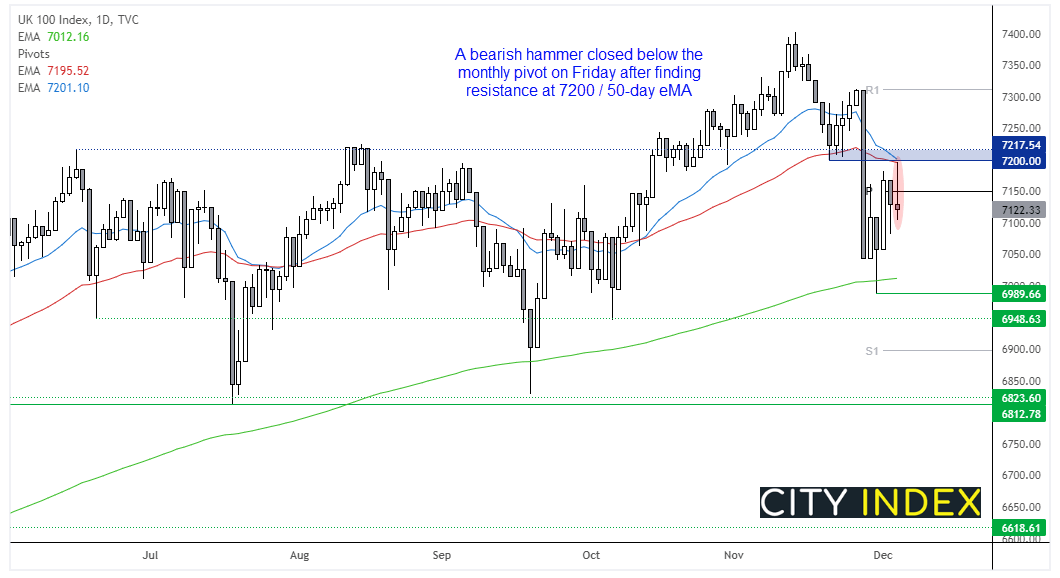

FTSE 100 stumbles around 7200

On Friday the FTSE 100 closed the day with a bearish pinbar below the monthly pivot point, with the 50-day eMA acting as resistance. A break of Friday’s low assumes that an interim top has been seen and bears may try to gun for 7000 once more. Interestingly, the futures market points to a stronger open, but we’d want to see a daily close above 7200 before becoming more confident of further gains. Until then we’d prefer to fade into minor rallies within Friday’s range or wait for a break of its low.

FTSE 350: 4078.56 (-0.10%) 03 December 2021

- 161 (45.87%) stocks advanced and 174 (49.57%) declined

- 4 stocks rose to a new 52-week high, 7 fell to new lows

- 48.43% of stocks closed above their 200-day average

- 45.58% of stocks closed above their 50-day average

- 9.97% of stocks closed above their 20-day average

Outperformers:

- + 3.20%-Vivo Energy PLC (VVO.L)

- + 2.71%-AJ Bell PLC (AJBA.L)

- + 2.56%-TBC Bank Group PLC (TBCG.L)

Underperformers:

- -6.43%-John Wood Group PLC (WG.L)

- -5.56%-Future PLC (FUTR.L)

- -4.56%-Discoverie Group PLC (DSCV.L)

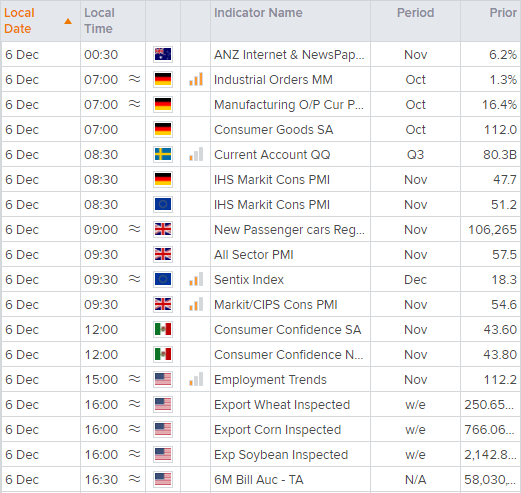

Up Next (Times in GMTST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade