Asian Indices:

- Australia's ASX 200 index rose by 3 points (0.04%) and currently trades at 7,418.40

- Japan's Nikkei 225 index has risen by 112.15 points (0.39%) and currently trades at 28,822.41

- Hong Kong's Hang Seng index has risen by 115.37 points (0.44%) and currently trades at 26,132.90

UK and Europe:

- UK's FTSE 100 futures are currently up 25 points (0.35%), the cash market is currently estimated to open at 7,215.30

- Euro STOXX 50 futures are currently up 22 points (0.53%), the cash market is currently estimated to open at 4,177.73

- Germany's DAX futures are currently up 48 points (0.31%), the cash market is currently estimated to open at 15,520.56

US Futures:

- DJI futures are currently down -6.26 points (-0.02%)

- S&P 500 futures are currently down -75.75 points (-0.49%)

- Nasdaq 100 futures are currently down -4.75 points (-0.1%)

Learn how to trade indices

Indices

Evergrande averted another default by transferring funds for a dollar bond, according to a Reuters source. The $83.5 million payment to a trustee account was first reported by a state-backed new outlet earlier today. Whilst this provides relief for some investors the story is far from over with so many ‘known debts’ in the pipeline, alongside however many unknown ‘off balance sheet’ debts lurking in the system for Evergrande and the many Chinese property firms familiar with such practices.

Chinese equity markets led the way higher, although outside of China gains were light. China A50 is on track for a bullish outside week, with the daily chart showing increased bullish momentum. It’s one to watch next week for a break above 16,400, although it may cap as resistance initially due to the 200-day eMA and historical resistance level.

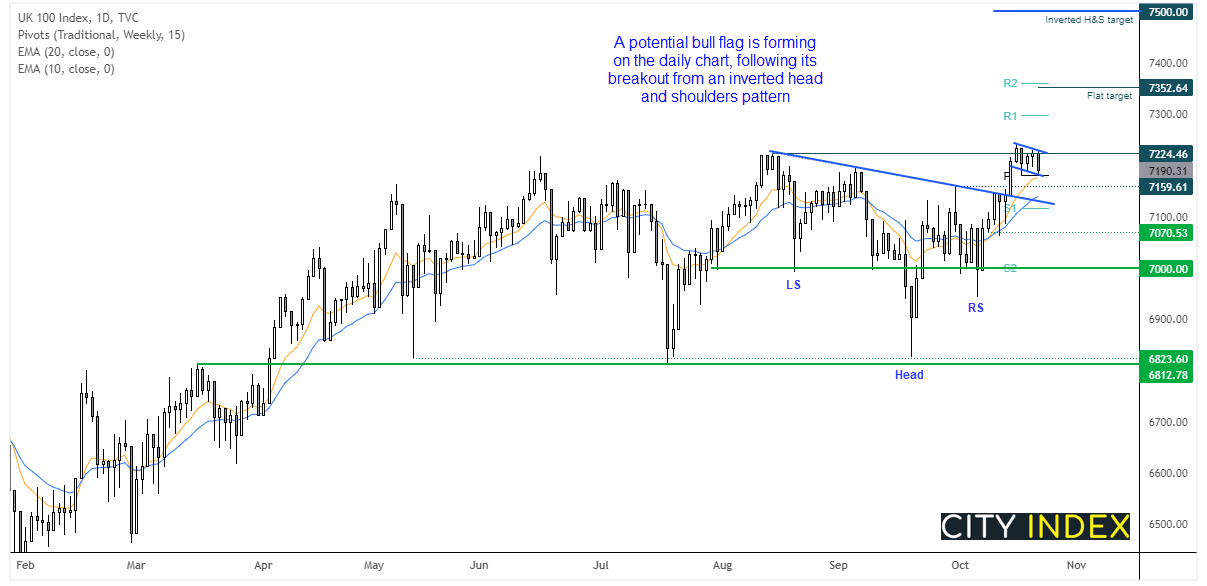

The FTSE 100 remains in a corrective phase following its inverted head and shoulders breakout on the 14th October. It shows the potential for a bull flag breakout on the daily chart, and yesterday’s low found support at the weekly pivot and 10-day eMA. We would therefore be interested in a break above the retracement line (and above yesterday’s high) to suggest momentum has realigned with the H&S breakout.

However, given the two most bearish days in the flag are bearish, we are also on guard for a downside break of yesterday’s low which would brings 7160 support into view.

FTSE 350: Market Internals

FTSE 350: 4119.22 (-0.45%) 21 October 2021

- 133 (37.89%) stocks advanced and 205 (58.40%) declined

- 5 stocks rose to a new 52-week high, 5 fell to new lows

- 56.98% of stocks closed above their 200-day average

- 98.29% of stocks closed above their 50-day average

- 18.23% of stocks closed above their 20-day average

Outperformers:

- + 11.1%-Renishaw PLC(RSW.L)

- + 4.74%-Syncona Ltd(SYNCS.L)

- + 4.22%-Darktrace PLC(DARK.L)

Underperformers:

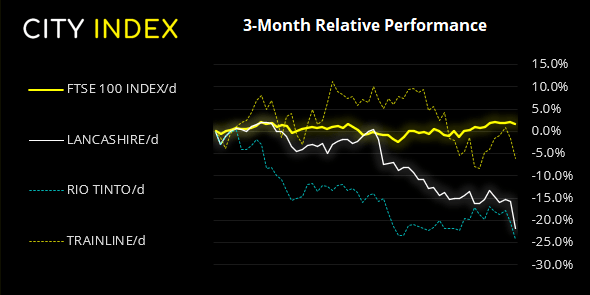

- -7.31%-Lancashire Holdings Ltd(LRE.L)

- -4.84%-Rio Tinto PLC(RIO.L)

- -4.56%-Trainline PLC(TRNT.L)

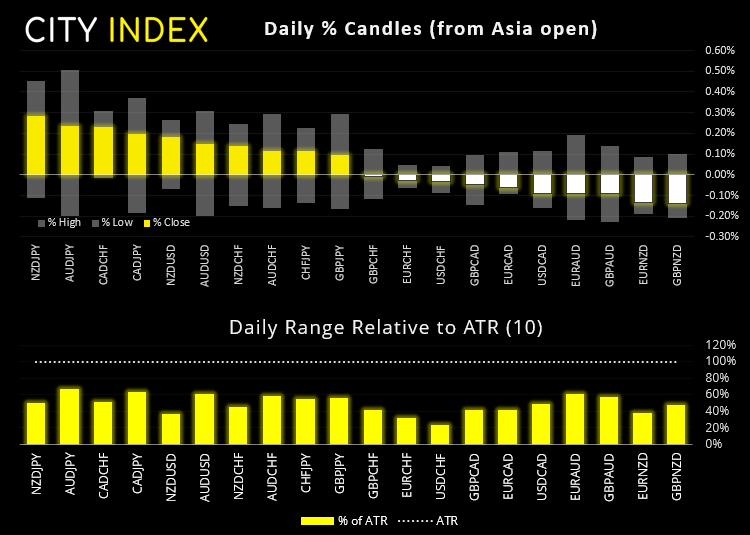

Forex:

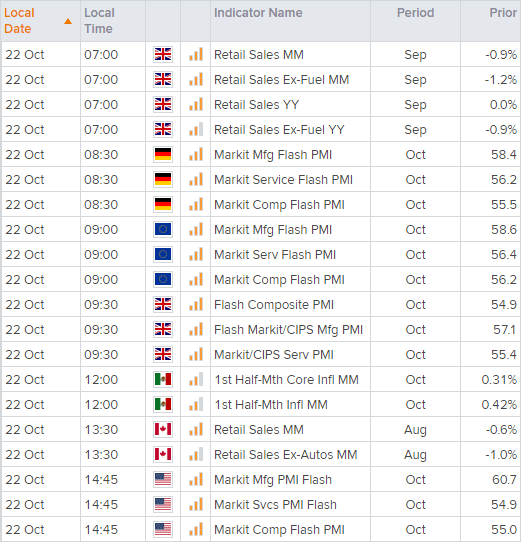

Flash PMI’s are the highlight of today’s economic calendar. Traders like them as they provide a forward look at growth potential, making them one of the preferred leading indictors to trade around.

Asia has already kicked off and there are some positive signs. Australia’s composite PMI (manufacturing and services combined) expanded at 52.2, up from 46 in September as the services component expanded for the first month in 3. Japan’s manufacturing PMI rose to a 6-month. Separately, rising energy costs saw

- German manufacturing PMI: 56.5 forecast (58.4 prior)

- German Services PMI: 55 forecast (56.2 prior)

- Eurozone manufacturing PMI: 57 forecast (58.6 prior)

- Eurozone Services PMI: 55.5 forecast (58.4 prior)

- UK manufacturing PMI: 55.8 forecast (57.1 prior)

- UK Services PMI: 54.5 forecast (55.4 prior)

- US manufacturing PMI: 60.3 forecast (60.7 prior)

- US Services PMI: 55.1 forecast (54.9 prior)

Take note that retail sales for UK and Canada are also released at

GBP/USD is on track for a 3rd bullish week. 1.3773 is today’s key level for bulls to defend. USD/CAD looks favourable for further upside (should today’s data allow) and perhaps for a run towards yesterday’s high or even the 1.2410 resistance. We suspect the pair has seen a low at 1.2300. USD/JPY is back above 1.14 and is also a preferred pair for bullish setups, should US data come in stronger than expected.

Commodities:

Oil remains a market to watch, given the key reversal days on WTI and Brent. But for that we could do with a stronger US dollar, so hopefully it can find some buyers now the US dollar index has found support above 93.50.

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade