Asian Indices:

- Australia's ASX 200 index rose by 26.3 points (0.36%) and currently trades at 7,419.00

- Japan's Nikkei 225 index has risen by 217.47 points (0.74%) and currently trades at 29,738.40

- Hong Kong's Hang Seng index has risen by 67.48 points (0.27%) and currently trades at 25,092.23

- China's A50 Index has risen by 187.54 points (1.22%) and currently trades at 15,599.63

UK and Europe:

- UK's FTSE 100 futures are currently up 31.5 points (0.44%), the cash market is currently estimated to open at 7,280.39

- Euro STOXX 50 futures are currently up 22.5 points (0.52%), the cash market is currently estimated to open at 4,332.11

- Germany's DAX futures are currently up 72 points (0.45%), the cash market is currently estimated to open at 16,031.98

US Futures:

- DJI futures are currently up 104.95 points (0.29%)

- S&P 500 futures are currently up 30.5 points (0.19%)

- Nasdaq 100 futures are currently up 0.25 points (0.01%)

Asian indices track Wall Street higher

Asian equities took the positive lead from Wall Street, with Japan’s broad TOPIX rising 1.26% and the Nikkei 225 up around 0.8%. China’s equity markets were supported by consumer staples stocks after the government urged people to stock up on essential groceries, as some food companies sent warnings that prices will rise between 15-15% over the coming two weeks.

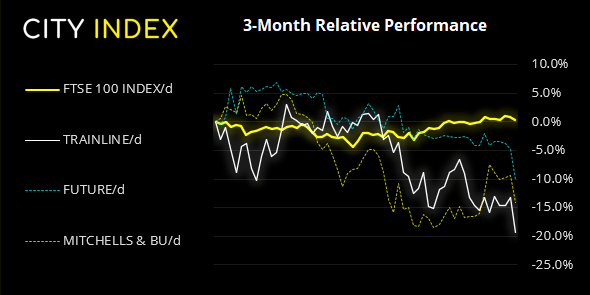

The FTSE 100 was lower for a second day after touching a fresh post-pandemic high on Monday. Yet the 10-day eMA continue to support and futures are pointing to a positive open, so perhaps yesterday was the corrective low. BT Group (BT) release their half year earnings at 07:00.

FTSE 350: Market Internals

FTSE 350: 4153.21 (-0.36%) 03 November 2021

- 169 (48.15%) stocks advanced and 166 (47.29%) declined

- 24 stocks rose to a new 52-week high, 8 fell to new lows

- 60.97% of stocks closed above their 200-day average

- 20.23% of stocks closed above their 20-day average

Outperformers:

- + 10.04%-Micro Focus International PLC(MCRO.L)

- + 3.51%-4imprint Group PLC(FOUR.L)

- + 3.21%-Diversified Energy Company PLC(DEC.L)

Underperformers:

- -7.07%-Trainline PLC(TRNT.L)

- -5.47%-Future PLC(FUTR.L)

- -5.33%-Mitchells & Butlers PLC(MAB.L)

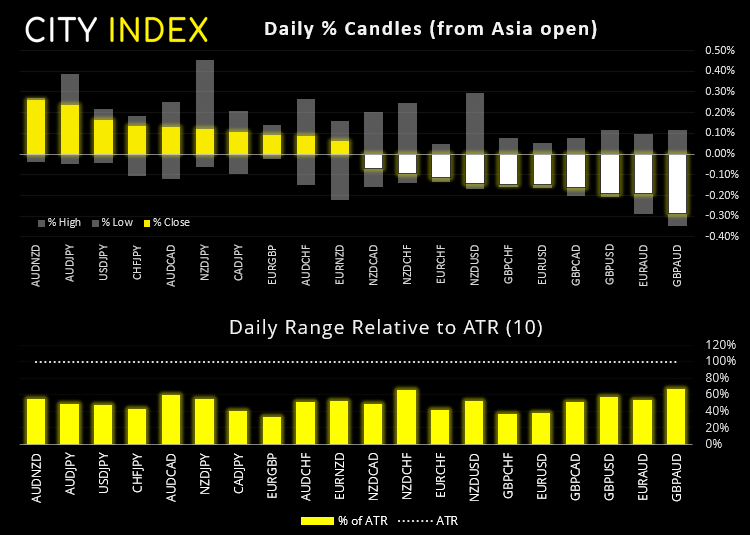

Forex:

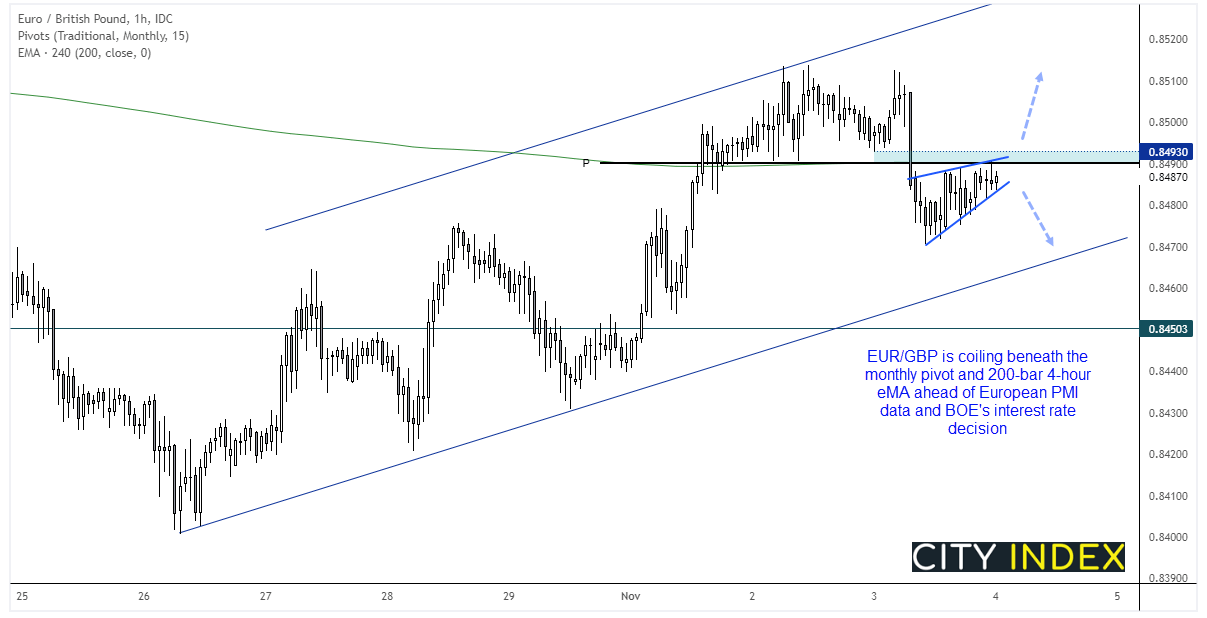

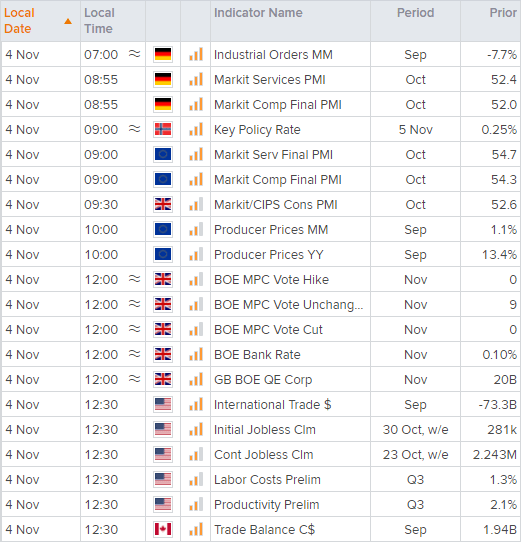

Today’s BOE meeting at 12:00 GMT is the main economic event. It remains up in the air as to whether they will raise rates or not, as the BOE grapple with above target inflation (and higher prices expected to come) with the latest woes surrounding Brexit. Several MPC members have made hawkish comments and markets have fully priced in a hike today. Yet economists remain split over whether they will pull the trigger today. No offence to economists, but I’d prefer to back market pricing as there is actually money on the line in this case. Still, a hike doesn’t appear to be priced into GBP, so a hike should theoretically be bullish whilst a cut could be bearish for the pound following the announcement.

But first, German industrial orders are scheduled for 07:00 followed by services PMI at 08:55, the Eurozone PMI data at 09:00. Norges Bank (Central Bank of Norway) also hold their policy meeting at 09:00, although they said themselves that they’re likely to hike again in December after raising rate at their last meeting.

The combination of European data and BOE meeting places EUR/GBP into the crosshairs of volatility today. Technically it finds itself at an interesting juncture as prices are coilin up within a wedge pattern below the monthly pivot point and 200-bar eMA (from the four-hour chart). Therefore, weak European data on net, combined with a cheeky hike form BOE could send the pair back towards the lower trendline. Conversely, strong European data and no hike / dovish BOE could send this above its resistance zone, in lie with its bullish trend channel. The worst outcome for traders today is mixed European data, coming in around expectations and a confusing message from BOE.

Commodities:

Today we find out the conclusion of the OPEC+ meeting. According to CME futures, traders are pricing in a 75% chance that they will maintain output cuts, with a 23.7% chance they will increase output. This leaves less than 1% chance of output cuts, which would likely be the most bullish scenario for oil prices. Check out key levels and further background for today’s meeting in today’s article. Oil Slips Ahead of OPEC+ MeetingUp Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade