Asian Indices:

- Australia's ASX 200 index rose by 6.7 points (0.09%) and currently trades at 7,406.10

- Japan's Nikkei 225 index has risen by 224.81 points (0.77%) and currently trades at 29,527.47

- Hong Kong's Hang Seng index has risen by 29.33 points (0.12%) and currently trades at 24,714.83

- China's A50 Index has fallen by -87.23 points (-0.55%) and currently trades at 15,632.62

UK and Europe:

- UK's FTSE 100 futures are currently up 15.5 points (0.21%), the cash market is currently estimated to open at 7,301.82

- Euro STOXX 50 futures are currently up 19.5 points (0.46%), the cash market is currently estimated to open at 4,295.75

- Germany's DAX futures are currently up 51 points (0.32%), the cash market is currently estimated to open at 15,929.39

US Futures:

- DJI futures are currently down -9.42 points (-0.03%)

- S&P 500 futures are currently up 26 points (0.16%)

- Nasdaq 100 futures are currently up 13.5 points (0.29%)

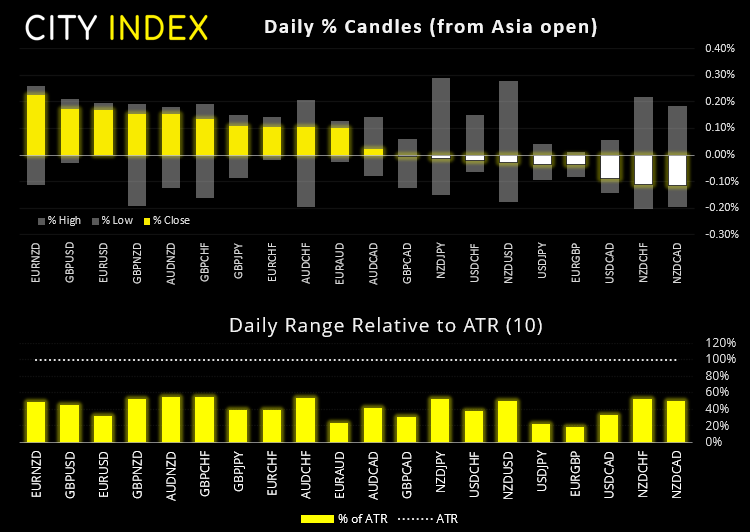

Dollar remains firm

Whilst the dollar was slightly lower overnight it is not to the degree where any other currency looks strong. EUR/USD is trying to hold above 1.12 but bears have the June 2020 low in sight at 1.1168. NZD/USD made a minor attempt to probe 0.6900 but now sits back at its lows. AUD/USD failed to ‘capitalise’ on its capital expenditure, which revealed better than expected sending plans. It trades near yesterday’s lows around 0.7200.

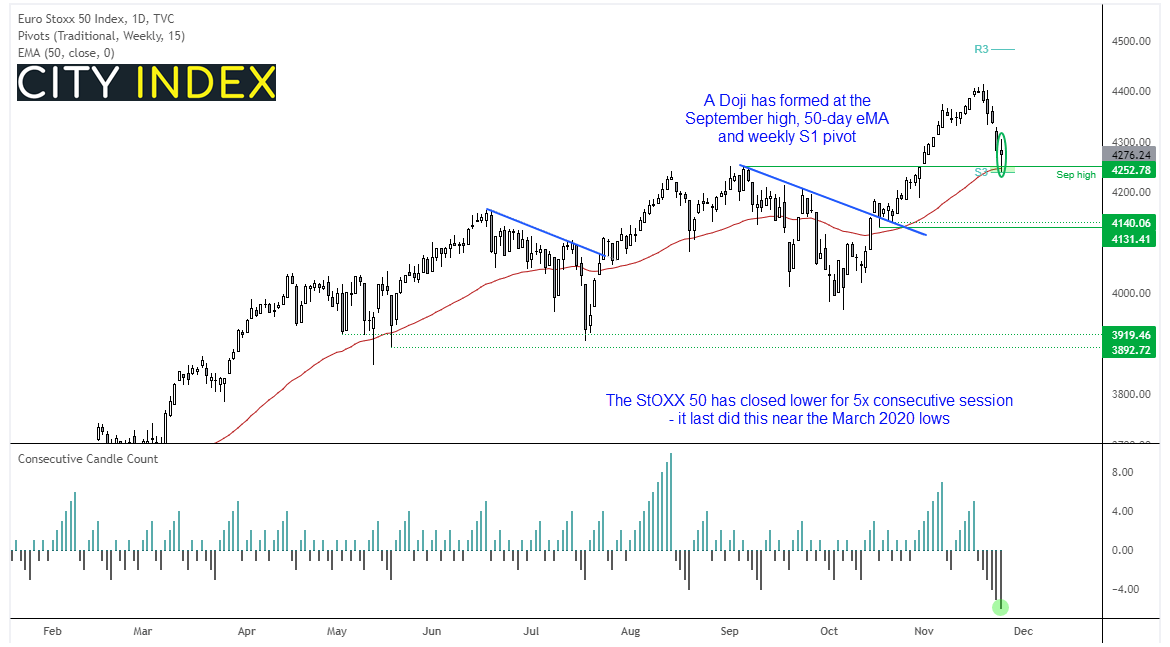

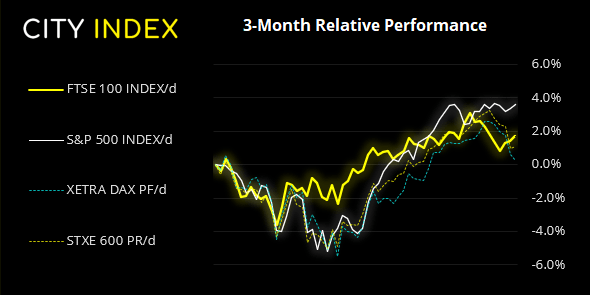

European bourses losing downside momentum

Benchmark indices across Europe have had a tough few days since fears of lockdowns across the region resurfaced. The DAX is around -3.4% from its highs, and its downside accelerated after printing a key reversal just below its record highs. It blew past our initial bearish target and got fairly close to the 15,704 high. Yet a lower wick formed yesterday and the index closed bac above its 50-day eMA, so bears are beginning to lose control after its relatively deep pullback. However, for long opportunities we prefer the Stoxx 50.

The STOXX 50 has also fallen lower for five consecutive sessions, an occurrence last seen around the March 2020 lows. Furthermore, a spinning top Doji formed and closed above its 50-day eMA and September high, which suggests demand around 4240. Yesterday’s low also formed around the weekly S3 pivot, which is a level rarely tested so provides further suggestion of (bullish) mean reversion. If you compare the Stoxx to the Dax, the former has the more appealing trend structure so we prefer longs on this index over the near-term.

Take note that US exchanges are closed today due to Thanksgiving, and close at lunchtime tomorrow.

FTSE: Market Internals

The FTE 100 moved higher in line with our bias yesterday yet its closed beneath 7291 resistance is a tad underwhelming. But, if we are right in thinking European equities may have some upside potential, perhaps this can spill over to the FTSE today.

FTSE 350: 4172.46 (0.27%) 24 November 2021

- 164 (46.72%) stocks advanced and 171 (48.72%) declined

- 6 stocks rose to a new 52-week high, 12 fell to new lows

- 56.13% of stocks closed above their 200-day average

- 52.99% of stocks closed above their 50-day average

- 16.24% of stocks closed above their 20-day average

Outperformers:

- + 6.98%-Trustpilot Group PLC(TRST.L)

- + 6.64%-Hochschild Mining PLC(HOCM.L)

- + 6.01%-Intertek Group PLC(ITRK.L)

Underperformers:

- -9.98%-Genus PLC(GNS.L)

- -6.01%-Cineworld Group PLC(CINE.L)

- -5.73%-Brewin Dolphin Holdings PLC(BRW.L)

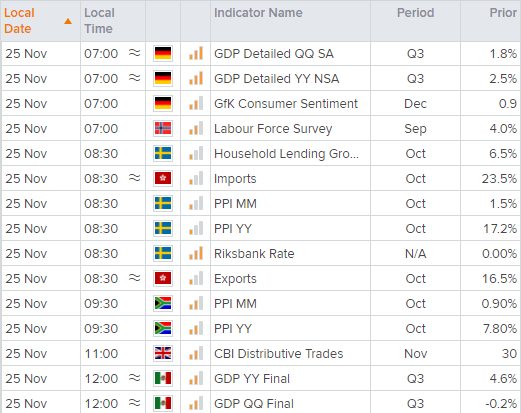

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade