Asian Indices:

- Australia's ASX 200 index rose by 11.8 points (0.17%) to close at 6,790.60

- Japan's Nikkei 225 index has fallen by -26 points (-0.24%) and currently trades at 29,099.06

- Hong Kong's Hang Seng index has fallen by -13.41 points (-0.05%) and currently trades at 27,904.73

UK and Europe:

- UK's FTSE 100 futures are currently down -11 points (-0.17%), the cash market is currently estimated to open at 6,701.89

- Euro STOXX 50 futures are currently down -14 points (-0.37%), the cash market is currently estimated to open at 3,818.55

- Germany's DAX futures are currently down -33 points (-0.23%), the cash market is currently estimated to open at 14,577.39

Wednesday US Close:

- The Dow Jones Industrial fell -3.09 points (-0.01%) to close at 32,420.06

- The S&P 500 index fell -21.38 points (-0.55%) to close at 3,889.14

- The Nasdaq 100 index fell -218.91 points (-1.68%) to close at 12,798.88

The US and South Korea have said that ‘unidentified’ projectiles have been fired and the US is now consulting with allies. But that this comes just before the Olympic Games in Japan, and just after NK warned the US against military drills, on the surface it does appear to be straight out of King Jong-Un’s playbook. So we’ll have to wait for the official reports to come in and see how the Biden Administration reacts. But, so far at least, market reactions are relatively muted.

It was choppy trade in part overnight as Chinese tech shares fell on fears some companies may be delisted from US exchanges. Although as Tony Sycamore pointed out in Twitter there has been market chatter that the ‘plunge protection team’ have stepped in. Which may help explain why shares in Asia are now mostly higher at the time of writing.

- China’s CSI300 is not 0.3% higher after a rocky start to the session, the KOSPI 200 is 0.4% higher and the Hang Seng I 0.2% up for the day.

- The DAX and STOX 50 indices look quite comfortable perched on their 20-day eMA’s, following a gentle retracement. As price action appears cleaner on the STOXX 50 chart, bulls may be interested in any break above Tuesday’s high as it may suggest trend continuation and another attempt to set new highs.

- As for the CAC, it tried to extend losses yesterday but has produced a bullish candle bac above its 20-day eMA. A break above yesterday’s high paints a near-term bullish bias for the day but take note that the 10-day eMA is at 5975.

- The FTSE 100 has printed a third bullish hammer, above the 50-day eMA and below the 10-day. It cannot stay in there for ever but, whilst it does, range trading strategies on intraday timeframes may be prefferable.

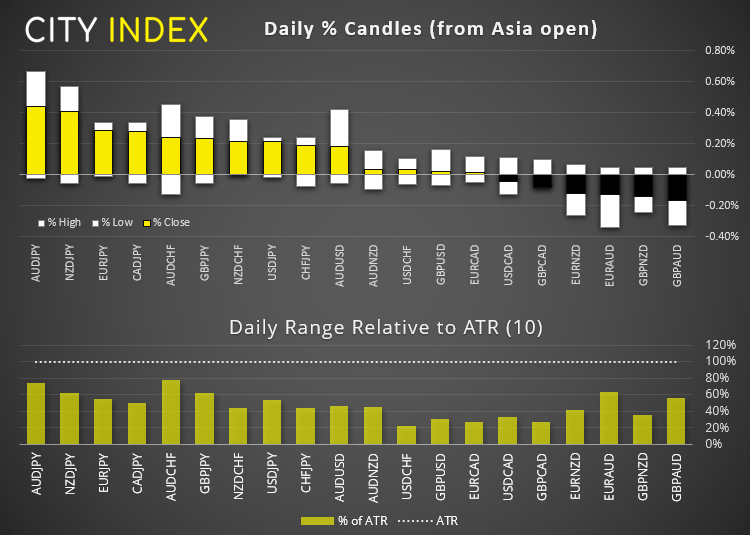

Forex: All eyes on the dollar at its great big, pivotal level

The US dollar index tested its 200-day eMA in overnight trade. It would be a surprise to see prices rip straight above it, so some noise can be expected around current levels. But if the 92.60 area (give or take) caps as resistance, it should provide some relief for majors such a NZD, AUD and of course EUR.

- EUR/USD trades below its 200-day eMA and above the 1.1800 barrier. This 35-pip range it finds itself in screams ‘breakout’ but, of course we need to wait to see which way it will be and how noisy the price action is. A clear break below 1.1800 assumes bearish continuation whilst a clear break above 1.1835 assumes a counter-trend move. But we’d suggest keeping an eye on dollar performance overall to help gauge price action on EUR/USD.

- GBP/USD is anchored to yesterday’s 6-week low and sits around half-way between the 1.3600 – 1.3880 range. Given recent bearish momentum on the four-hour chart we would welcome a retracement towards resistance to seek a potential wing trade short. A break above 1.3800 takes it back into its previous range where we would like to see the 1.3776 – 1.3800 area hold as support.

- EUR/GBP is another range-bound market and is treading water in the upper quartile of the 0.8540 – 0.8650 range. Until it breaks above 0.8653, bears may be licking their lips for a tasty short.

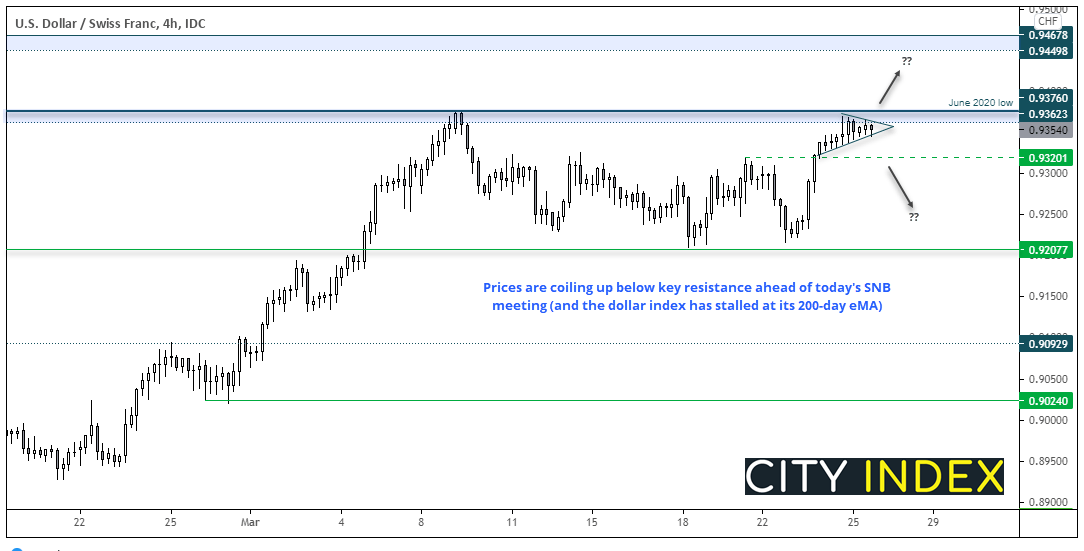

USD/CHF in focus ahead of the SNB meeting

So, the dollar index has hit a key milestone and USD/CHF is also probing resistance ahead of today’s SNB (Swiss National Bank) meeting. We do love a good pivotal level ahead of such events as they can provide binary outcomes.

As there are no expectations for a policy change, this may simply become a technical play around the dollar. Should resistance cap and signs of bearish momentum return then bearish range traders may try and push this lower. Whilst a break out of range may well trigger some stops and send it higher.

- Bears could wait for a break below the minor trendline support to suggest an interim top is in place and target 0.9300 support.

- Or, for a higher-timeframe play, wait for a break below 0.9300 to confirm a top

- Bulls could either seek to enter a break above the June 2020 low, or wait for it to be confirmed as support.

- As with EUR/USD, it is worth monitoring FX pairs and DXY in general to see how it behaves around its 200-day eMA.

Commodities: WTI edges lower overnight after rallying on supply concerns

WTI has fallen -2.3% overnight although price action appears to be more technical repositioning over a fundamental play. It rallied over 6% yesterday as a blockage on the Suez Channel was preventing oil tankers (ad other cargo) to get through.

Given the choppy nature these past four session we have a neutral bias today, and suggest intraday traders remain nimble and ready to switch their views.

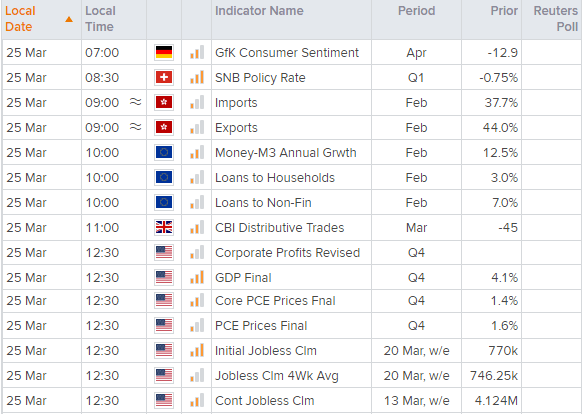

Up Next (Times in GMT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here

- The Swiss National Bank (SNB) meetings is at 08:30 GMT. Read Matt Weller’s preview here.

- Other than that, it’s a fairly quiet economic calendar in the European session.

- Final GDP figures are released for the US, which is not expected to be a market mover. And the weekly employment figures (initial jobless claims) is also on tap.