Asian Indices:

- Australia's ASX 200 index rose by 56.1 points (0.77%) and currently trades at 7,312.80

- Japan's Nikkei 225 index has risen by 472.09 points (1.71%) and currently trades at 28,150.30

- Hong Kong's Hang Seng index has fallen by -65.27 points (-0.26%) and currently trades at 24,636.46

UK and Europe:

- UK's FTSE 100 futures are currently down -2.5 points (-0.04%), the cash market is currently estimated to open at 7,075.54

- Euro STOXX 50 futures are currently down -1.5 points (-0.04%), the cash market is currently estimated to open at 4,096.84

- Germany's DAX futures are currently down -5 points (-0.03%), the cash market is currently estimated to open at 15,245.86

US Futures:

- DJI futures are currently up 337.95 points (0.98%)

- S&P 500 futures are currently up 4 points (0.03%)

- Nasdaq 100 futures are currently up 2.25 points (0.05%)

China’s Services PMI bounces back to expansion

They may have kicked the can down the road but that is good enough for Wall Street, with US futures currently around 1% higher overnight. Yet further optimism has also been gifted with Chinese data.

Equities were broadly higher during the Asian session as China’s service PMI expanded at a convincing rate, after a sudden contractor dip in August. Rising an impressive +6.7 points it now sits at 53.4 versus 56.7 previously. Whilst the manufacturing print was flat earlier this week at 50, it does at least hint at a trough as last month’s read was also negative. So optimism is in the air for stronger growth for China over the coming months. The China A50 index is the top performer and currently trades 2% higher for the session.

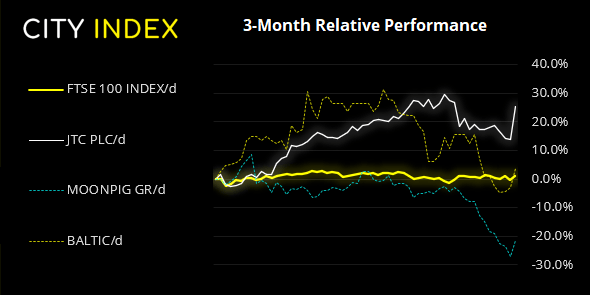

FTSE 350: Market Internals

FTSE 350: 4054.91 (1.17%) 07 October 2021

- 266 (75.78%) stocks advanced and 74 (21.08%) declined

- 5 stocks rose to a new 52-week high, 9 fell to new lows

- 52.42% of stocks closed above their 200-day average

- 20.51% of stocks closed above their 50-day average

- 8.55% of stocks closed above their 20-day average

Outperformers:

- + 10.03%-Jtc PLC(JTC.L)

- + 7.57%-Moonpig Group PLC(MOONM.L)

- + 6.63%-Baltic Classifieds Group PLC(BCG.L)

Underperformers:

- ·-4.65%-IP Group PLC(IPO.L)

- ·-4.29%-Marks and Spencer Group PLC(MKS.L)

- ·-3.50%-Restaurant Group PLC(RTN.L)

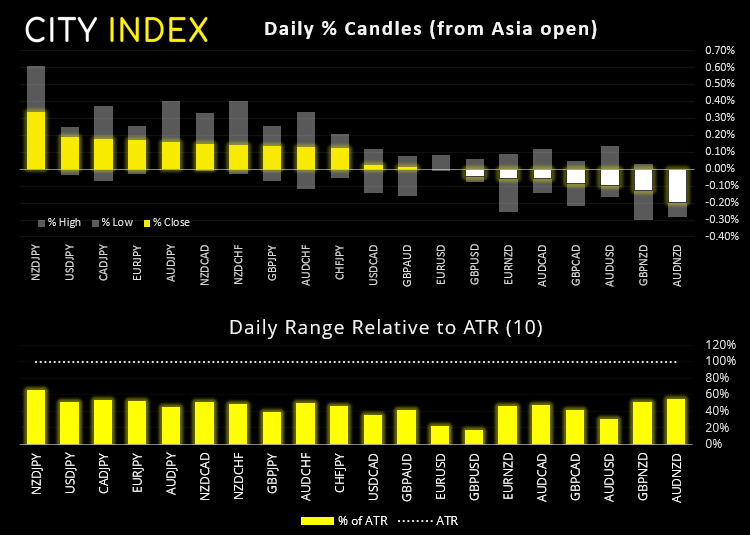

Forex:

The risk-on vibe remained in the air overnight with NZD being the strongest major, whilst CHF and JPY were the weakest.

USD/JPY breached the 111.78 high as some early birds are seemingly anticipating a strong employment report. 112 is now within easy reach although the 112.08 and 112.23 highs (Feb 2020 high) make likely resistance levels. Should volatility spike and we end up with a weak print, the 112 area could be tempting for counter-trend traders to fade into.

USD/CAD is of interest should NFP disappoint, given hawkish comments from BOC’s governor yesterday, a stronger PMI print and firmer energy prices (which all favour a stronger CAD). USD/CAD printed a minor new low and trades flat for the day.

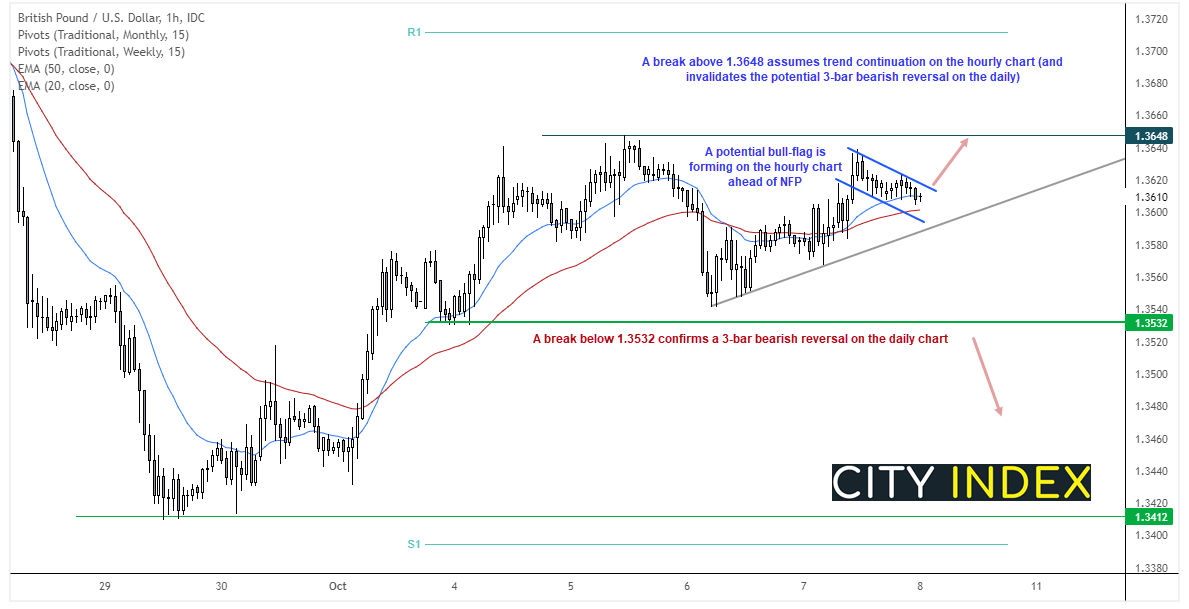

For today’s chart we’ll do some counter-analysis for GBP/USD. Yesterday we highlighted a potential swing high on the daily chart, stating a 3-bar bearish reversal pattern (Evening Star Reversal) would be confirmed with a break below 1.3532. And whilst 1.3368 continues to cap as resistance, it remains a possibility.

Yet the hourly chart is currently trending higher, and a shallow pullback marks a potential bull flag. This leaves around 20-pips of potential upside for bulls to the 1.3648 high, a break above which assumes trend continuation (and invalidates yesterday’s analysis on the daily chart).

Commodities:

Oil prices rose over 1% during Asian trade, seeing WTI hit an overnight high of 79.50 as it inched its way towards $80. Given that NFP is being taken as a proxy to confirm the Fed’s tapering in November, we suspect oil and the USD could share a positive correlation. A strong employment report points towards stronger oil demand from an improving economy, whilst simultaneously taking the Fed a step closer towards tightening which should be bullish for the dollar.

Gold remains trapped between 1750 – 1770. Hopefully NFP will see it breakout today (and ideally in line with our original bullish bias). But, until then, its either one to keep for range trading strategies or simply step aside.

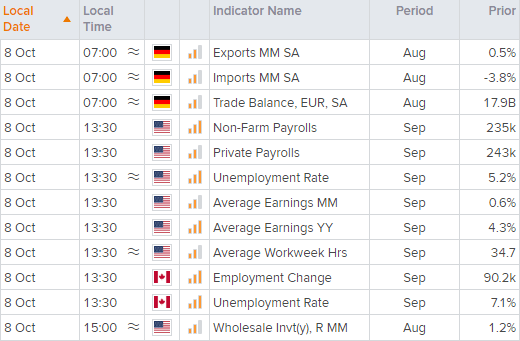

Up Next (Times in BST)