Asian Indices:

- Australia's ASX 200 index fell by -128.2 points (-1.71%) and currently trades at 7,383.80

- Japan's Nikkei 225 index has fallen by -265.21 points (-0.87%) and currently trades at 29,917.34

- Hong Kong's Hang Seng index has fallen by -422.26 points (-1.6%) and currently trades at 25,898.67

UK and Europe:

- UK's FTSE 100 futures are currently down -41.5 points (-0.58%), the cash market is currently estimated to open at 7,054.03

- Euro STOXX 50 futures are currently down -16 points (-0.38%), the cash market is currently estimated to open at 4,161.15

- Germany's DAX futures are currently down -57 points (-0.36%), the cash market is currently estimated to open at 15,553.28

US Futures:

- DJI futures are currently down -68.93 points (-0.2%)

- S&P 500 futures are currently down -42.5 points (-0.27%)

- Nasdaq 100 futures are currently down -14.5 points (-0.32%)

Asian shares in the red, futures point to a weak open

Rising material costs have pushed China’s factory inflation to a 3-year high, even though Beijing has been trying hard to curb them. PPI rose 9.5% in the year up to August, beating estimates of 9% and now sits at its highest inflation rate since August 2008.

Asian equities tracked Wall Street lower with most benchmark indices in the red. Even the Nikkei 225, which has rallied in exponential fashion of late fell form this 6-month high although it remains above the 29,650 support area mentioned in today’s Asian Open report. The ASX 200 made a convincing break below the 7429 support, 50-day eMA and November trendline during its most bearish session in nearly 3-months.

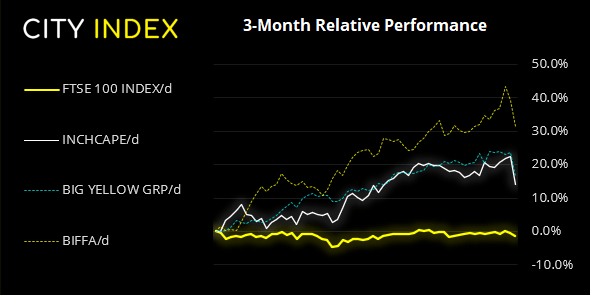

It was the most bearish day for the FTSE 100 in 2-weeks yesterday. The break below 7138 confirmed the dark cloud reversal pattern and it quickly hit our initial target around 7090. Given its inability to retest 7200 during its slow, grinding ascent over the past two weeks, 7000 remains a target for bears so long as they can keep prices beneath this week’s high (just short of 7200). With prices expected to gap low, perhaps the 7100 area may tempt bears to enter should it show evidence of holding.

FTSE 350: Market Internals

FTSE 350: 4104.05 (-0.75%) 08 September 2021

- 220 (62.68%) stocks advanced and 119 (33.90%) declined

- 8 stocks rose to a new 52-week high, 6 fell to new lows

- 76.64% of stocks closed above their 200-day average

- 76.92% of stocks closed above their 50-day average

- 25.07% of stocks closed above their 20-day average

Outperformers:

- + 12.8% - Dunelm Group PLC (DNLM.L)

- + 6.92% - B&M European Value Retail SA (BMEB.L)

- + 3.87% - Hochschild Mining PLC (HOCM.L)

Underperformers:

- -6.97% - Inchcape PLC (INCH.L)

- -5.80% - Big Yellow Group PLC (BYG.L)

- -5.69% - Biffa PLC (BIFF.L)

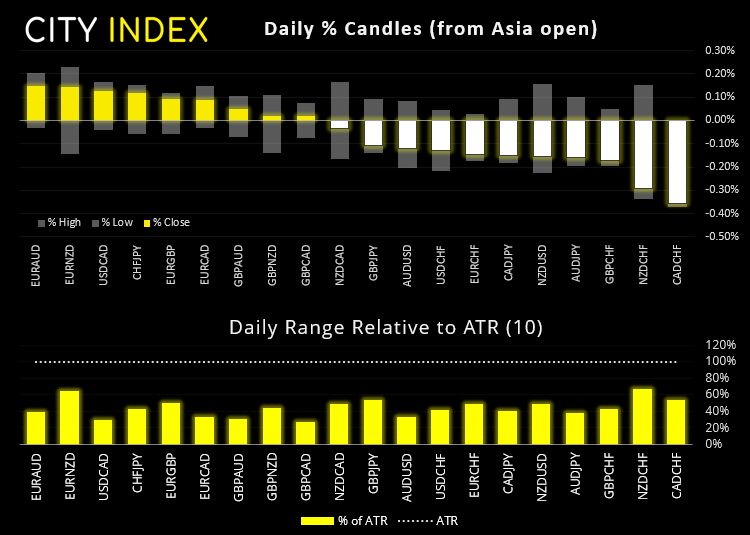

Forex: ECB meeting awaits

Commodity currencies and the British pound were lower overnight during a slightly risk-off session. Whilst CAD remains weak following BOC’s decision not to taper, it was also caught up in the equity selloff along with AUD and NZD. The British pound is also under the weaker after the UK government announced a £12 billion tax hike to help pay for NHS and social care.

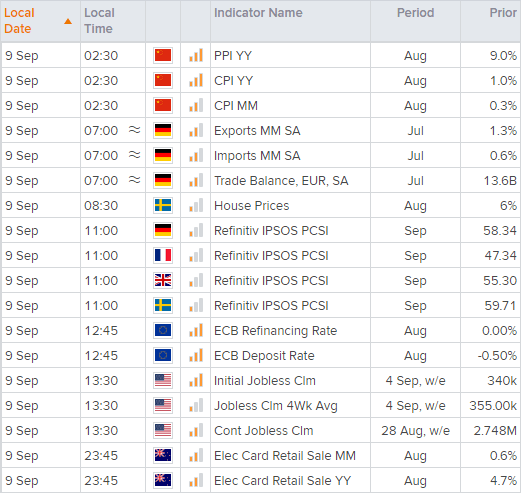

The ECB announce their monetary policy decision at 12:45 BST. No rate change is expected by traders, but they want to hear the method behind how, and how much they may taper QE. The closer their balance sheet is deemed to be to pre-pandemic levels, the more likely it could be bullish for euro pairs. But, should they disappoint (and it wouldn’t be the first time) it could weigh further on the euro as traders offload any bullish bets and / or initiate new shorts.

The we have more employment data for the US at 13:30 BST from the jobless claims report. Claims data sit at a post-pandemic low, so should we see a rise in unemployment claims (especially initial) it could be bearish for US, especially since NFP and ADP growth disappointed last week and job openings has risen to a new record high.

Learn how to trade forex

Commodities: Metals remain heavy

Metals remained under pressure with copper ‘copping it’ and currently down around -1%. Silver is down -0.4% and remains below $24 after closing below trend support yesterday. We remain bearish beneath this week’s high and, technically at least, seems more appealing for bears than gold does at present.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.