Asian Indices:

- Australia's ASX 200 index fell by -6 points (-0.09%) to close at 6,968.00

- Japan's Nikkei 225 index has risen by 248.91 points (0.48%) and currently trades at 29,788.64

- Hong Kong's Hang Seng index has risen by 274.25 points (0.96%) and currently trades at 28,727.53

UK and Europe:

- UK's FTSE 100 futures are currently down -3.5 points (-0.05%), the cash market is currently estimated to open at 6,885.62

- Euro STOXX 50 futures are currently up 4 points (0.1%), the cash market is currently estimated to open at 3,965.90

- Germany's DAX futures are currently up 10 points (0.07%), the cash market is currently estimated to open at 15,225.00

Monday US Close:

- The Dow Jones Industrial fell -55.2 points (-0.16%) to close at 33,745.40

- The S&P 500 index fell -0.81 points (-0.02%) to close at 4,127.99

- The Nasdaq 100 index fell -25.75 points (-0.19%) to close at 13,819.35

China’s exports rose 30.6% YoY, up from 18.1% in February but below the 35.5% forecast. Despite the miss, these are still punchy numbers and Asian equities were quick to take note with the KOSPI 200 and Hang Seng leading shares higher overnight.

Still, index futures for US and Europe are a little mixed but essentially flat – a bit like yesterday’s close as traders squared up their positions ahead of US earnings season and today’s inflation data for the US.

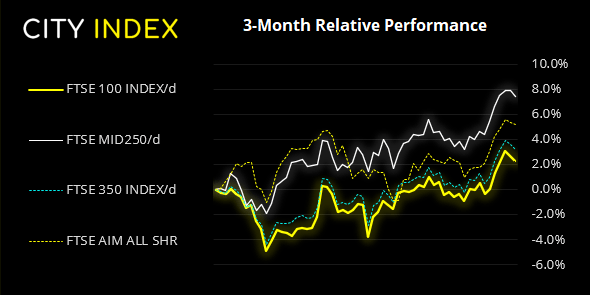

The DAX and Euro STOXX 50 have been hesitant to retest recent highs, let along break to new ones. Out of the two, the STOXX 50 appears to be the weaker as it trades closer to key support. And as it closed -0.4% lower yesterday following Friday’s Rikshaw Man Doji candle, an interim downside break cannot be ruled out. A break below 3950 suggests its counter-trend phase is underway, but keep in mind it remains in a strong daily uptrend overall.

The FTSE 100 is basically in lockstep with the ASX 200 at present; both rallied to 7,000 before retracing lower for two days. Still, the FTSE closed the session with a bullish hammer yesterday, even if it is just beneath its January high. If it can build support above 6850 then, perhaps we could be on guard for a bullish breakout sooner than later. A deeper retracement may try and find support down at the 6800- 6813 region.

FTSE 100: Market Internals

FTSE 100 (-0.38%) 09 April 2021:

- 48 (47.52%) stocks advanced and 51 (50.50%) declined

- 87.13% of stocks closed above their 200-day average

- 83.17% of stocks closed above their 50-day average

- 92.08% of stocks closed above their 20-day average

- 3 hit a new 52-week high, 0 hit a new 52-week low

Outperformers

- + 5.11% - JD Sports Fashion PLC (JD.L)

- + 2.43% - Spirax-Sarco Engineering PLC (SPX.L)

- + 2.18% - Weir Group PLC (WEIR.L)

Underperformers:

- 5.11% - British American Tobacco PLC (JD.L)

- 2.43% - BAE Systems PLC (SPX.L)

- 2.18% - International Consolidated Airlines Group SA (WEIR.L)

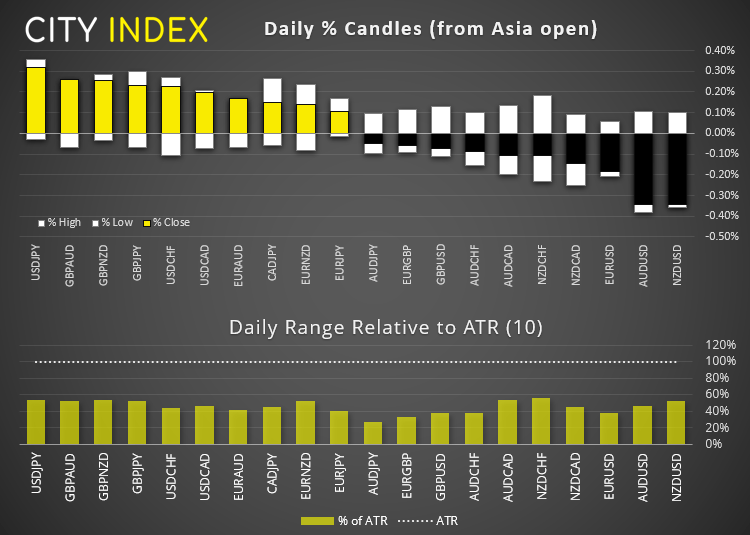

Forex: USD remains firm yet rangebound overnight

The US dollar is the strongest major overnight, seeing the dollar index (DXY) rise 0.2%. JPY, AUD and NZD are currently the weakest major, yet markets remain in tight range overall as they await a slew of economic data to arrive.

- GBP/CHF is trying to lift itself from its lows after trading lower every day last week. Yet Friday’s Doji low at 1.2643 remains untested, and an inverted pinbar formed yesterday to show downside is losing momentum, so perhaps a bounce higher is on the cards.

- EUR/GBP is holding above the 0.8650 high, although its own rally is losing steam. Furthermore, a small bearish engulfing candle formed yesterday with a large lower wick, so a break beneath it suggests a retracement is underway.

- Where the dollar index is stuck between 92.00/25, EUR/USD is stuck between 1.1860 – 1.1930. Having broken above trendline resistance last week this week’s consolidation could simply be part of a minor pause before bullish momentum returns. A break above 1.1930 brings the 1.2000 handle into focus, and we’d be tempted by ay low volatility dips towards 1.1800 to see if a ‘higher low’ base can form.

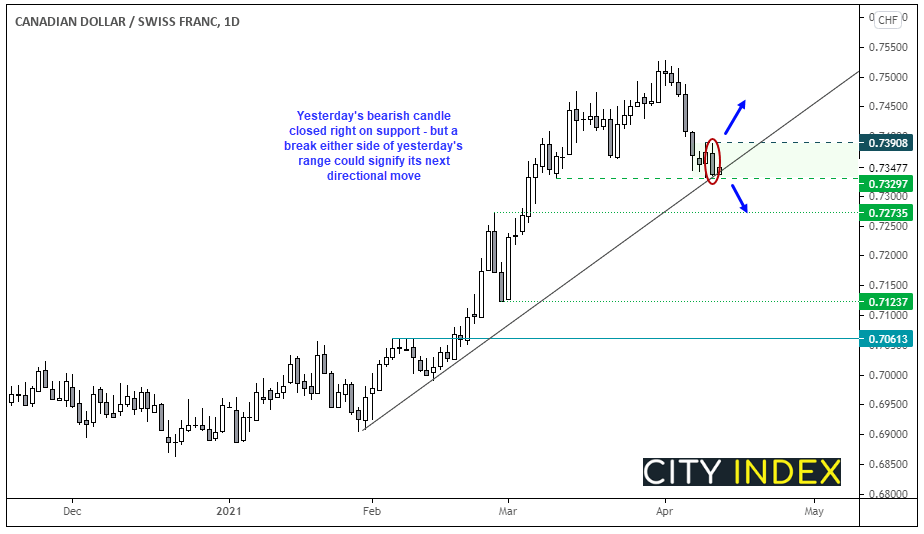

CAD/CHF is balanced precariously on a key support level, where it also meets its trendline support from the January low on the daily chart. An initial inspection could assume that a minor bounce is on the cards from current levels. However, given yesterday’s bearish candle which closed at the low of the day, just above support, perhaps a downside break is imminent.

- The great thing about yesterday’s bearish candle is it provides two clear levels to monitor for a breakout; its daily high and daily low.

- A break above yesterday’s high suggests the trendline remains intact and for a swing low to form.

- A convincing break of yesterday’s low invalidates the bullish trendline and 0.7329 support level.

Commodities look to CPI for direction.

The Thomson Reuters CRB index printed a small bearish hammer yesterday (also and outside candle) at a two-week high. Yet the market has effectively moved sideways over this period at lower levels of volatility. But with data about to start ramping up for the week we hope the deadlock is broken.

- Palladium is trying to turn higher and is forming a potential inverted head and shoulders pattern on the daily chart. Meanwhile, platinum is testing trendline support and momentum suggests it may try and drive prices lower on the daily chart. See today’s video for technical levels on these markets: Is Palladium/Platinum the Next Big Pairs Trade?

- Gold is meandering around 1730 near yesterday’s lows, although we’d need to see a break beneath 1720 before bears can claim to have full control.

- Oil prices were slightly higher on the back of strong import data from China, yet it remains a difficult market for position traders as it essentially moves sideways in a low-volatility, choppy range.

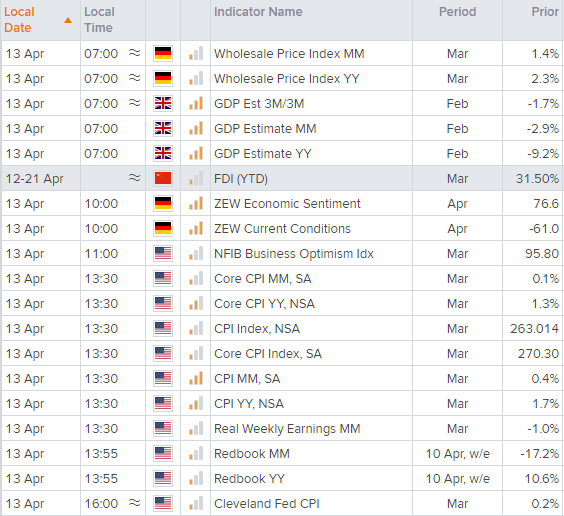

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.