Asian Indices:

- Australia's ASX 200 index rose by 38.4 points (0.51%) and currently trades at 7,524.10

- Japan's Nikkei 225 index has risen by 243.84 points (0.85%) and currently trades at 28,787.35

- Hong Kong's Hang Seng index has fallen by -92.08 points (-0.35%) and currently trades at 25,998.35

UK and Europe:

- UK's FTSE 100 futures are currently down -3 points (-0.04%), the cash market is currently estimated to open at 7,160.90

- Euro STOXX 50 futures are currently down -0.5 points (-0.01%), the cash market is currently estimated to open at 4,231.60

- Germany's DAX futures are currently up 11 points (0.07%), the cash market is currently estimated to open at 15,851.59

US Futures:

- DJI futures are currently up 131.29 points (0.37%)

- S&P 500 futures are currently up 20.75 points (0.13%)

- Nasdaq 100 futures are currently up 7.75 points (0.17%)

Learn how to trade indices

Indices

At 46.7, China’s service PMI is contracting at its fastest rate since April 2020. And this also backs up the NBS (official) report of the service sector falling to 47.5 from 53.5 in July, prompting analysts to revise lower growth expectations for the second half this year.

China’s CSI300 fell -0.7% on the report before recouping earlier losses and now trades around -0.1% on the day.

The Nikkei 225 broke above trend resistance on reports that Japan’s PM, Yoshihide Suga will not run in the next leadership race.

The ASX 200 recovered from yesterday’s close after finding support at the 50-day eMA yesterday. Given trendline support nearby we’re now anticipating a bullish breakout above 7560.

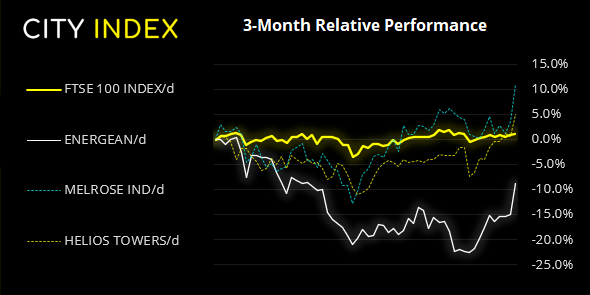

FTSE 350: Market Internals

FTSE 350: 4148.24 (0.20%) 02 September 2021

- 176 (50.00%) stocks advanced and 158 (44.89%) declined

- 50 stocks rose to a new 52-week high, 3 fell to new lows

- 76.42% of stocks closed above their 200-day average

- 77.84% of stocks closed above their 50-day average

- 22.73% of stocks closed above their 20-day average

Outperformers:

- + 7.27% - Energean PLC (ENOG.L)

- + 7.19% - Melrose Industries PLC (MRON.L)

- + 4.25% - Helios Towers PLC (HTWS.L)

Underperformers:

- -27.38% - CMC Markets PLC (CMCX.L)

- -11.01% - IG Group Holdings PLC (IGG.L)

- -10.23% - Auction Technology Group PLC (ATG.L)

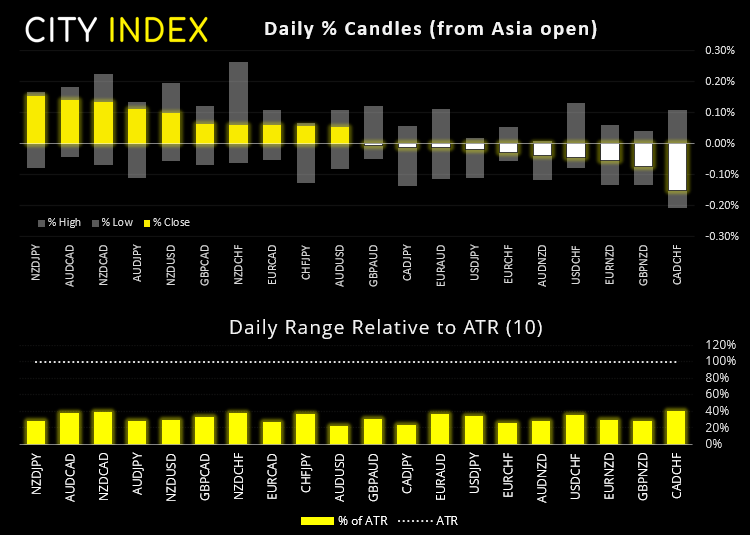

Forex:

Final PMI reads are scheduled for Europe, with Germany’s scheduled for 08:55 GMT. The flash PMI revealed that the German service sector had expanded at its fastest on record as reopening boosted economic activity fuelled by pent up demand. The composite (manufacturing and services combined) also hit a new high – so today we will see if the preliminary report has merit, or simply revised lower. Either way it could provide a little pocket of volatility for euro pairs if the revision deviates too far from the flash read.

EUR/USD hit fresh highs overnight as bulls march their way to the 1.19 handle, just below the July high. A strong employment report today could strengthen the US dollar as it is a proxy for early tightening from the Fed. Therefore, a weak employment report today could weaken the dollar and send EUR/USD swiftly from its highs.

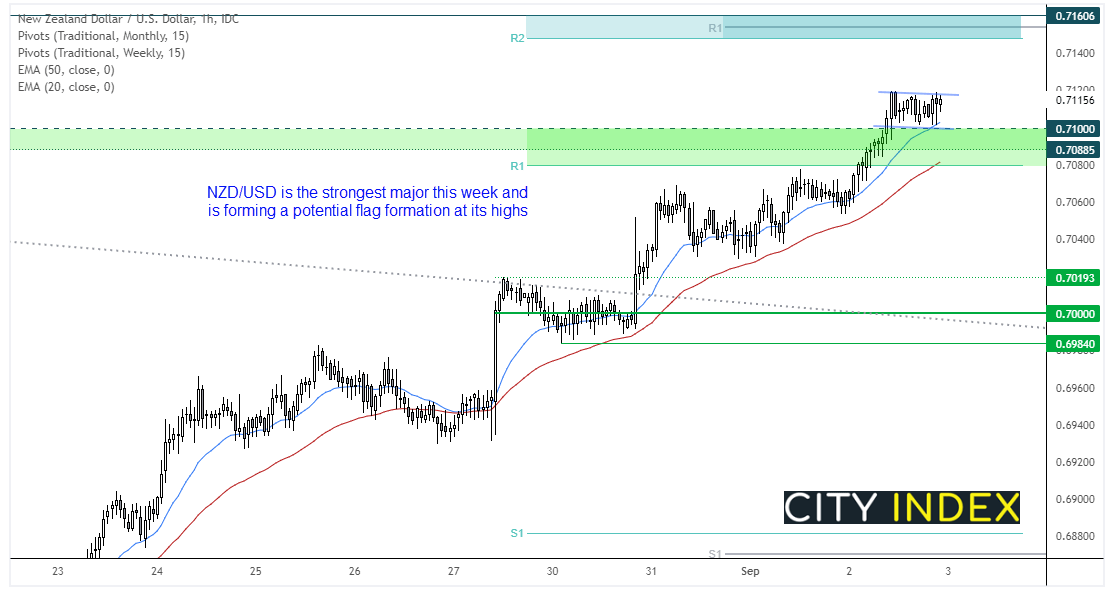

AUD/USD and NZD/USD are trading in a tight ranges as part of a potential flag formations. Out of the two the Kiwi dollar looks more appealing as it has found support at 0.7100 and has more ‘headroom’ for a potential upside move. Of course, this assumes the weaker dollar. Yet as the New Zealand dollar is the strongest currency this week, we’d prefer to step aside from this pair should the dollar strengthen give the bullish structure of the hourly chart on NZD/USD.

Learn how to trade forex

Commodities:

Gold continues to coil up in a potential bull flag formation on the four-hour chart. Yet should prices fail to break higher we’d prefer to look elsewhere for bearish setups across metals given gold has been a strong performer of late.

Such as silver, which displays a potential bearish wedge pattern on the four-hour chart. If downside momentum returns our bias remains bearish below this week’s high.

Palladium appears to be leading silver after topping our below 2500 this week. 2260 remains the initial target with nearby resistance sitting at 2452.

WTI is treading water beneath 70 but, if it can break above yesterday’s high it confirms a 3-bar bullish reversal pattern on the daily chart and assumes bullish continuation.

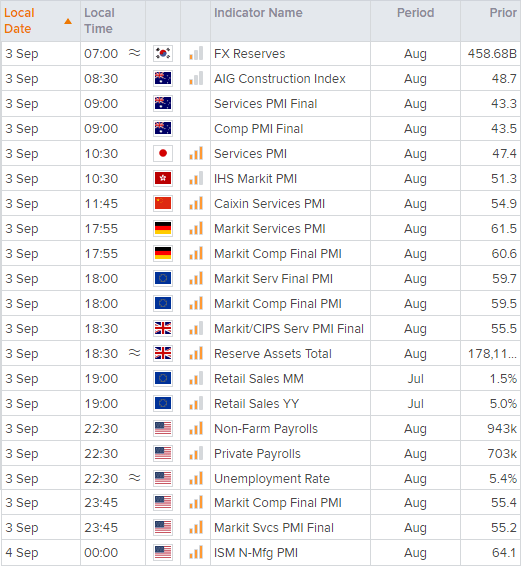

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.