Asian Indices:

- Australia's ASX 200 index rose by 45.6 points (0.62%) and currently trades at 7,346.80

- Japan's Nikkei 225 index has risen by 11.2 points (0.04%) and currently trades at 28,824.33

- Hong Kong's Hang Seng index has fallen by -45.35 points (-0.16%) and currently trades at 28,948.75

UK and Europe:

- UK's FTSE 100 futures are currently up 7 points (0.1%), the cash market is currently estimated to open at 7,094.55

- Euro STOXX 50 futures are currently down -1 points (-0.02%), the cash market is currently estimated to open at 4,106.51

- Germany's DAX futures are currently up 5 points (0.03%), the cash market is currently estimated to open at 15,695.59

US Futures:

- DJI futures are currently down -150.57 points (-0.44%)

- S&P 500 futures are currently up 17 points (0.12%)

- Nasdaq 100 futures are currently up 5.25 points (0.12%)

Learn how to trade indices

Asian indices look past soft China PMI print

Higher raw material costs saw China’s manufacturing PMI expand at its slowest rate in four months. It fell to 50.9 from 51 in May, although slightly above the 50.8 forecast. Non-manufacturing (services) grew at a slower rate of 53.5 compared with 55.2 previously, which together dragged the composite PMI down to 52.9 from 54.2. China’s is currently trading -0.2% lower and the SSEC is down -0.36%.

Elsewhere, equities across Asia were mostly higher as they took the lead from Wall Street following a strong consumer confidence report and a rise in employment expectations. MSCI’s global world index rose for a fifth consecutive day to print yet another record high. Futures markets are around 0.1% higher (give or take) for US and European markets which point to a flat open for cash markets.

7070 remains the key pivotal level for FTSE 100 traders. A break beneath it sends it to a five-day low and further suggests a swing high was seen on Friday at 7139. Yet we saw two rounds of buying activity just above 7070 yesterday so, until it breaks, another upside bounce from that key level remains a distinct possibility.

FTSE 350: Market Internals

FTSE 350: 4058.92 (0.21%) 29 June 2021

- 180 (51.28%) stocks advanced and 153 (43.59%) declined

- 20 stocks rose to a new 52-week high, 4 fell to new lows

- 82.91% of stocks closed above their 200-day average

- 50.14% of stocks closed above their 50-day average

- 15.67% of stocks closed above their 20-day average

Outperformers:

- + 5.71% - Liontrust Asset Management PLC (LIO.L)

- + 3.88% - Just Eat Takeaway.com NV (TKWY.AS)

- + 3.77% - Serco Group PLC (SRP.L)

Underperformers:

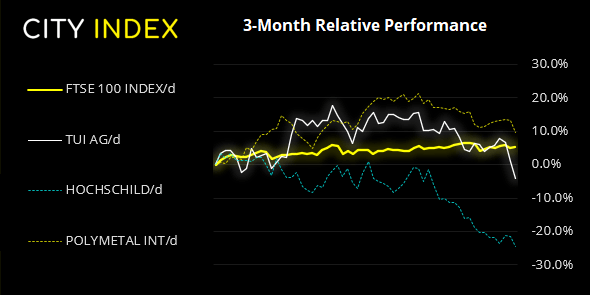

- -5.05% - Tui AG (TUIT.L)

- -3.71% - Hochschild Mining PLC (HOCM.L)

- -3.25% - Polymetal International PLC (POLYP.L)

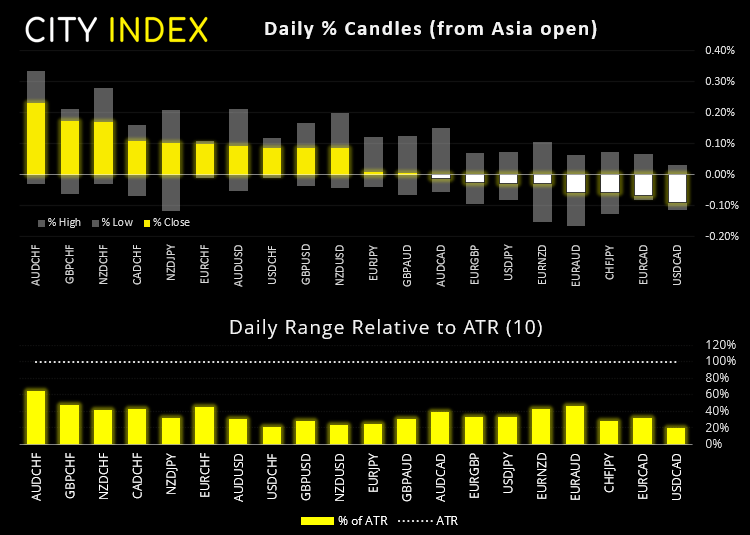

Thin ranges for forex pairs:

AUD and NZD were the strongest major overnight, but the lack of volatility (relative to the prior day’s sell-off) suggests it is technical repositioning at best, and far from a risk-on rebound. You can see on the ATR dashboard how thin ranges were overnight, and this leaves plenty of ‘meat on the bone’ for the European and US sessions if and when catalysts arrive.

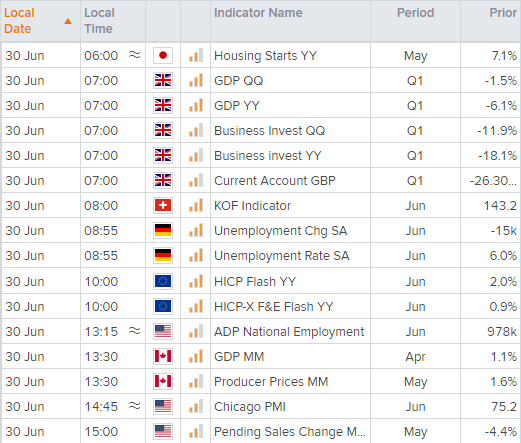

First up we have the final read for UK’s Q1 GDP. They generally attract the least excitement as the revisions tends to be negligible. But that cuts both ways because if there is a revision that catches traders off guard then it can instil volatility. So this clearly places GBP pairs into focus (along with the FTSE) at the start of the session.

GBP/USD didn’t quite reach our 1.3800 target but came close enough. The intraday trend remains bearish so, unless GDP is upwardly revised by a noteworthy amount then bears are likely to want to fade into minor rallies.

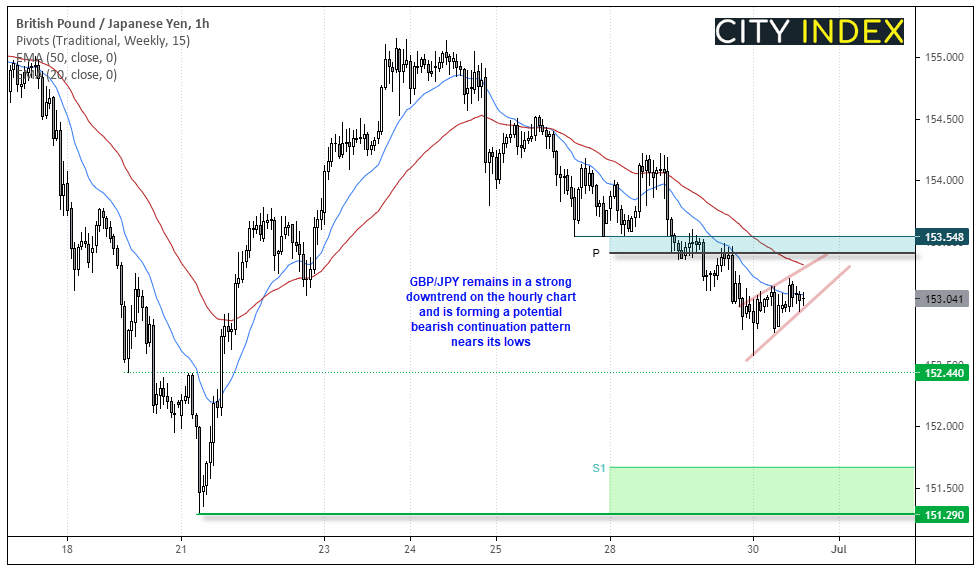

GBP/JPY is in a similar situation structurally; its hourly chart is producing lower lows and highs and the 20 and 50-bar eMA’s are acting as dynamic resistance. Its forming a consolidation / bearish continuation pattern off the lows, so a break of its retracement line should be of interest to bears (or any signs of weakness around the weekly pivot point at 153.40)

Learn how to trade forex

Commodities:

Gold is on track for its worst month in 3.5 years and is heading into the final session on the ropes. The stronger dollar took its toll yesterday to see the yellow metal break lower form its small range, and bears may be tempted to fade into rallies within yesterday’s range to see if it can break yesterday’s low.

WTI futures opened higher overnight (currently up around 0.6%) , supported by a report that US crude stockpiles were down last week, which helped traders look past concerns over the rise of covid cases across parts of Asia. Yet we may find volatility a little lower today ahead of tomorrow’s OPEC meeting and Friday’s NFP report.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.