Asian Indices:

- Australia's ASX 200 index fell by -9.3 points (-0.13%) and currently trades at 7,289.20

- Japan's Nikkei 225 index has risen by 45.23 points (0.16%) and currently trades at 28,920.12

- Hong Kong's Hang Seng index has fallen by -6.76 points (-0.02%) and currently trades at 28,810.31

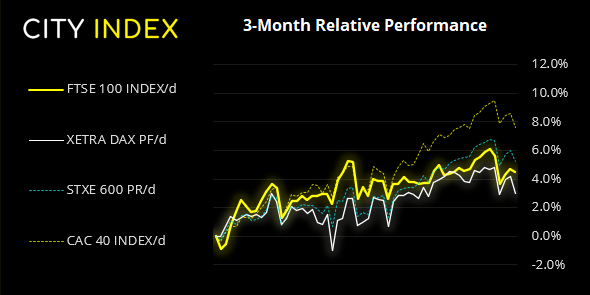

UK and Europe:

- UK's FTSE 100 futures are currently up 8 points (0.11%), the cash market is currently estimated to open at 7,082.06

- Euro STOXX 50 futures are currently up 10 points (0.25%), the cash market is currently estimated to open at 4,085.94

- Germany's DAX futures are currently up 24 points (0.16%), the cash market is currently estimated to open at 15,480.39

US Futures:

- DJI futures are currently down -71.34 points (-0.21%)

- S&P 500 futures are currently up 36.5 points (0.26%)

- Nasdaq 100 futures are currently up 9.75 points (0.23%)

Learn how to trade indices

Futures tick higher, Asian equities in holding patterns

It was a mixed session overnight in Asia as equities are mostly in holding patterns ahead of tomorrow’s inflation data from the US. That said, futures markets are pointing to a higher open for Europe and US and the FTSE 100 is expected top open 8 points higher at 7082.06.

Despite rising to a three-day high, the FTSE 100 was dragged lower with European and US equities later in the session to close the day -0.23% lower and form a bearish hammer, beneath its 10-day eMA. A break beneath 7073.55 (yesterday’s low) also places it beneath the weekly pivot point, and confirms our bearish bias for the day. Its next major support level is 7043 – 7046, then 7025 ad 7,000. Key resistance levels are 7100 and 7129.

German IFO and BOE meeting in focus

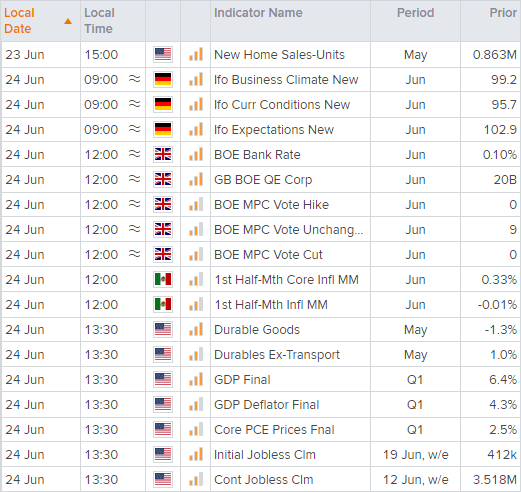

Today’s calendar events kick off at 09:00 with Germany’s IFO business report, with all three headline figures (current assessment, business climate and expectations) all expected. If they can beat expectations then it should help European indices ad the euro lift themselves from yesterday’s lows.

But the main focus is on the BOE (Bank of England) who reveal their monetary policy meeting at 12:00 today. Whilst there is no expectations for a hike (far from it in fact), traders want know if they’ll taper their asset purchases again, or see an increase in voting members wanting to hike. As Fiona Cincotta points out, above target inflation could decide whether they remain dovish or lean towards a slightly hawkish stance.

FTSE 350: Market Internals

FTSE 350: 4056.33 (-0.2%) 23 June 2021

- 138 (39.32%) stocks advanced and 202 (57.55%) declined

- 19 stocks rose to a new 52-week high, 2 fell to new lows

- 84.62% of stocks closed above their 200-day average

- 70.37% of stocks closed above their 50-day average

- 14.25% of stocks closed above their 20-day average

Outperformers:

- + 4.86% - Trainline PLC ( TRNT.L)

- + 4.35% - Micro Focus International PLC (MCRO.L)

- + 4.06% - Tullow Oil PLC (TLW.L)

Underperformers:

- -3.10% - Beazley PLC (BEZG.L)

- -3.81% - Meggitt PLC (MGGT.L)

- -4.88% - RHI Magnesita NV (RHIM.L)

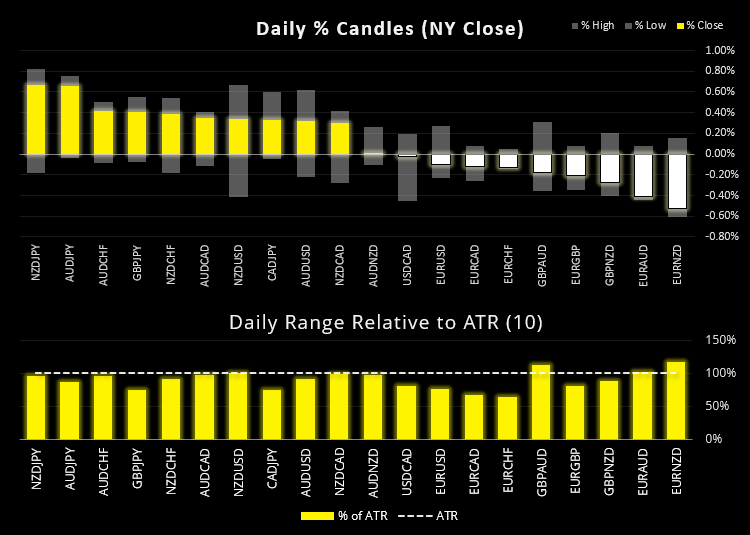

Tight ranges for forex pairs ahead of BOE

Ranges were very tight across the FX space, although AUD and NZD are ticking higher with futures markets whilst CHF and JPY are the weakest. Call it a very mild dose of risk-on if you will.

The US dollar index formed a Doji yesterday to show bearish momentum is waning, and its lower tail stopped just shy of 91.44 support. Given the three-day pullback on AUD, NZD, EUR and GBP, we may find volatility remains capped ahead of tomorrow’s CPI report (which could prove make or break for the greenback).

GBP/CHF broke higher and stopped just shy of our 1.2850 target yesterday before printing a bearish hammer o the daily chart. Whilst prices have drifted higher overnight, the BOE meeting could just as easily send it through 1.2850 today or back into its nine-week range below 1.2817.

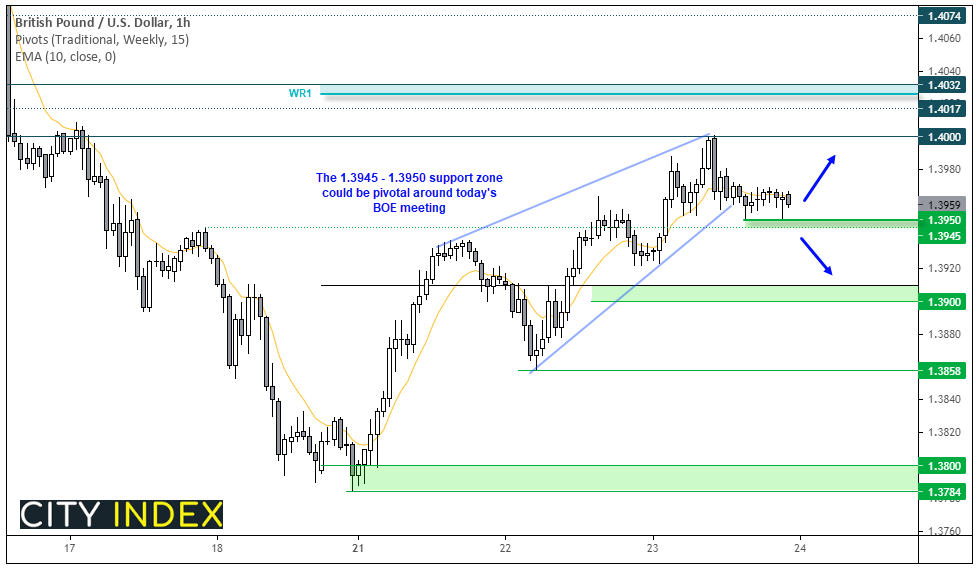

GBP/USD has gained 1.2% over the past week, although remains -1.7% lower this month. Volatility has remained typically low overnight ahead of today’s BOE meeting, and prices are holding around the mid-way point of yesterday’s range.

Resistance was found at 1.4000 yesterday and prices printed a two-bar reversal on the four-hour chart. Prices have since found support at the 10-bar eMA, making a range between the 1.3950 – 1.4000 area.

Should traders be treated to a hawkish BOE meeting then a retest of 1.4000 seems more than easy pickings. But take note that the weekly R1 pivot sits at 1.4017, so it may have to be a particularly hawkish surprise to break convincingly above it. Should the BOE be a none-event (or be a dovish surprise) and / or the dollar strengthen, then a clear break beneath 1.3945 switches our bias to bearish over the near-term.

Learn how to trade forex

Commodities:

Copper futures found resistance at 4.340 yesterday, and we expect it to be a pivotal level today. Prices are currently testing trendline support on the hourly chart, projected from the June 1t low, which could create opportunities for bulls or bears depending on which way momentum breaks today.

Gold and silver futures remains in tight ranges off their weekly lows, but in both cases they have failed to take advantage of the dollar’s retracement, so should dollar strength return look out below.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.