Asian Indices:

- Australia's ASX 200 index fell by -12 points (-0.16%) and currently trades at 7,444.90

- Japan's Nikkei 225 index has risen by 93.43 points (0.31%) and currently trades at 29,518.80

- Hong Kong's Hang Seng index has fallen by -141.88 points (-0.57%) and currently trades at 24,728.63

- China's A50 Index has fallen by -7.29 points (-0.05%) and currently trades at 15,584.17

UK and Europe:

- UK's FTSE 100 futures are currently down -1.5 points (-0.02%), the cash market is currently estimated to open at 7,302.46

- Euro STOXX 50 futures are currently down -4 points (-0.09%), the cash market is currently estimated to open at 4,359.04

- Germany's DAX futures are currently down -13 points (-0.08%), the cash market is currently estimated to open at 16,041.36

US Futures:

- DJI futures are currently up 203.75 points (0.56%)

- S&P 500 futures are currently down -65.75 points (-0.4%)

- Nasdaq 100 futures are currently down -10.75 points (-0.23%)

Indices

Asian equities were a touch lower overnight as investors remained cautious ahead of inflation data form the US tomorrow. Of all the major indices we track it was only Singapore’s STI and China’s SSEC that posted minor gains of around 0.1%. The KOSPI 200 is off by -0.7% and the Hang Seng is down around 0.6%. Futures markets are also slightly lower which points to a softer open.

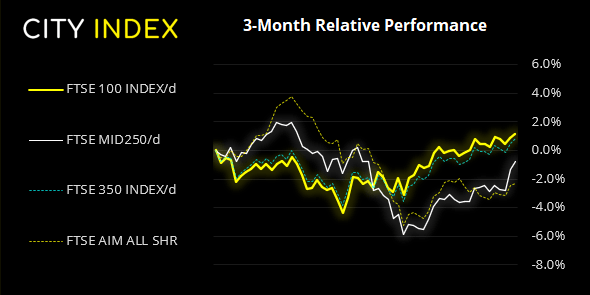

The BOJ released their summary of opinions today, and they expect the economy to pick up in the first half of 2022 and have higher expectations of inflationary pressures. Whilst not mentioned in the report, they may have a helping hand from fiscal policy if Japan’s PM can get the anticipated stimulus packages over the line this year. The Nikkei traded -0.3% lower despite the news. It found resistance at the monthly R1 pivot last week although remains above the postelection open price of 29,330.As for FTSE 350 earnings, Scottish Mortgage Investment (SMT) and AVI Global (AGT) report before market open. Sirius Real Estate (SRET) and Fidelity Special Values (FSV) also report today, although no time has been specified.

FTSE 350: Market Internals

FTSE 350: 4194.4 (0.33%) 05 November 2021

- 215 (61.25%) stocks advanced and 123 (35.04%) declined

- 43 stocks rose to a new 52-week high, 3 fell to new lows

- 64.67% of stocks closed above their 200-day average

- 60.68% of stocks closed above their 50-day average

- 23.93% of stocks closed above their 20-day average

Outperformers:

- + 11.1%-Airtel Africa PLC(AAF.L)

- + 9.96%-SSP Group PLC(SSPG.L)

- + 9.42%-Carnival PLC(CCL.L)

Underperformers:

- ·-5.96%-Baltic Classifieds Group PLC(BCG.L)

- ·-3.94%-4imprint Group PLC(FOUR.L)

- ·-3.77%-Oxford BioMedica PLC(OXB.L)

Forex:

China’s exports slowed slightly to 27.1% y/y compared with 28.1% in September, but this is above the 24.5% forecast. Yet domestic demand also increased with imports rising 20.6% y/y compared with 17.6% expected. The yuan was little changed overnight with USD/CNH trading near Friday’s close just below 6.40.

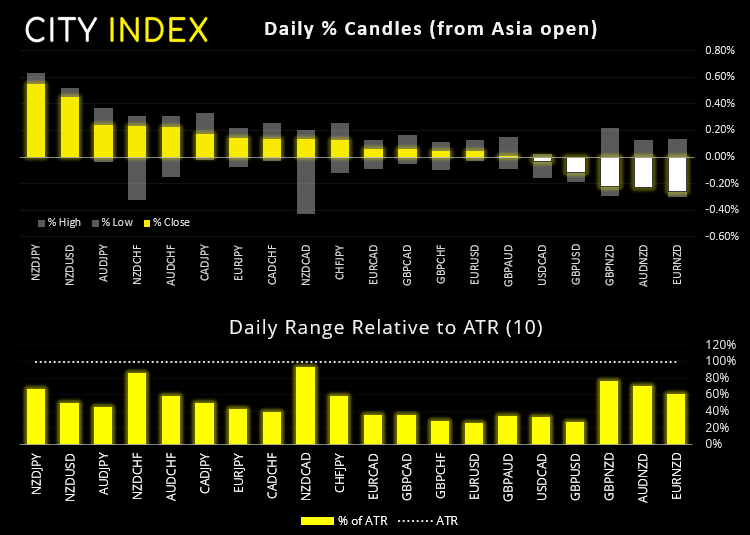

NZD was the strongest currency overnight as traders continue to price in the prospects of a 50 bps hike at this month’s policy meeting. Then yen and Swiss franc were the weakest, although volatility remained low overall.

With no top-tier data scheduled for today and US CPI lurking in the shadows tomorrow, we may find volatility remains capped for currency traders.

GBP/USD fell to its lowest level since 30th of September on Friday, although closed the day with a bullish pinbar just above the September low. The US dollar index also has a bearish pinbar on the daily chart so perhaps there is chance of a bounce. However, quite how far we are not sure, so really the pattern could act as a deterrent to short as opposed to swich to being long.

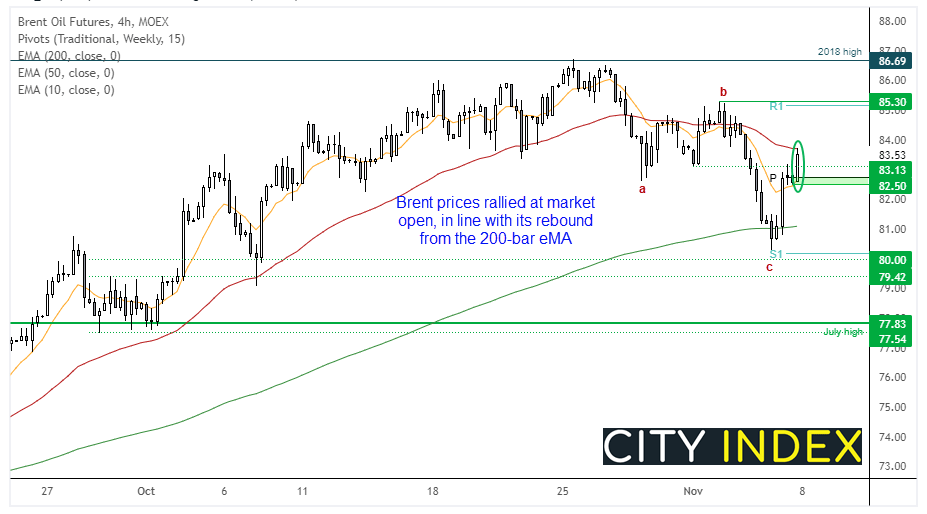

Commodities: Oil prices rally at the open

We noted that WTI has managed to rally back above $80 after finding support at a level of high trading activity around 79.15. Brent futures have performed a similar recovery after finding support at its 200-bar eMA. The bullish bar which accelerated away from the average was on high volume, and prices have shot higher at the open and breaking above a small consolidation range.

We suspect the end of an ABC correction was seen t 80.30, so we may now be in the early stages of a rally. We retain a bullish bias today above 82.50 and would welcome any pullbacks towards 83.13. Next major resistance is near the 85.30 high and monthly R1 pivot. A break above its 50-bar eMA is now required to extend this rally.

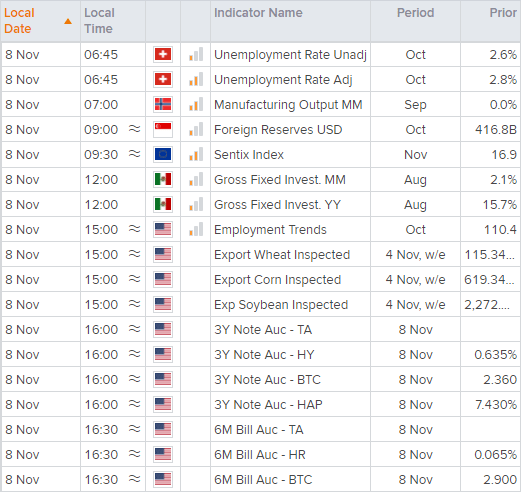

Up Next (Times in GMT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade