Asian Indices:

- Australia's ASX 200 index fell by -52.3 points (-0.7%) and currently trades at 7,379.10

- Japan's Nikkei 225 index has fallen by -422.75 points (-1.51%) and currently trades at 27,547.47

- Hong Kong's Hang Seng index has fallen by -59.27 points (-0.24%) and currently trades at 25,027.16

UK and Europe:

- UK's FTSE 100 futures are currently down -7.5 points (-0.11%), the cash market is currently estimated to open at 6,988.58

- Euro STOXX 50 futures are currently up 1.5 points (0.04%), the cash market is currently estimated to open at 4,066.33

- Germany's DAX futures are currently down -16 points (-0.1%), the cash market is currently estimated to open at 15,503.13

US Futures:

- DJI futures are currently down -85.79 points (-0.24%)

- S&P 500 futures are currently down -28.75 points (-0.19%)

- Nasdaq 100 futures are currently down -6 points (-0.14%)

Learn how to trade indices

Asian equities down but bearish volatility subsides

Asian equities were in the red again overnight as the fallout from Beijing’s regulatory tightening weighed on sentiment. The MSCI’s broad APAC index (excluding Japan) was down just -0.31%, whilst shares market in Japan tracked Wall Street lower to fall around -1%. Whilst the Hang Seng is down -0.3% its days range held above yesterday’s low and sits around 25k, so clues are appearing that a trough could be forming ahead of today’s FOMC meeting.

Yet with state-run media calling for calmness, one has to question how long until the markets become supported via intervention to slow the bleeding. But given the magnitude of losses seen these past few sessions, if word gets out that the market is being support it could provide a sentiment boost and market rally, if history is anything to go by.

Despite the FTSE’s best efforts to break beneath the 6948 low, it failed yesterday to produce a (potentially) bullish hammer on the daily chart. A break above its high is required to confirm yesterday’s candle as such, although a break above this week’s high would also clear several moving averages. The initial upside target remains the same as yesterday; between 7088 (last week’s POC) – 7011.

FTSE 350: Market Internals

FTSE 350: 4026.43 (-0.42%) 27 July 2021

- 129 (36.75%) stocks advanced and 203 (57.83%) declined

- 19 stocks rose to a new 52-week high, 7 fell to new lows

- 78.92% of stocks closed above their 200-day average

- 52.71% of stocks closed above their 50-day average

- 22.79% of stocks closed above their 20-day average

Outperformers:

- + 6.23% - Mitie Group PLC (MTO.L)

- + 5.62% - Croda International PLC (CRDA.L)

- + 3.77% - Just Eat Takeaway.com NV (TKWY.AS)

Underperformers:

- -9.33% - Moonpig Group PLC (MOONM.L)

- -8.43% - Reckitt Benckiser Group PLC (RKT.L)

- -6.47% - Ascential PLC (ASCL.L)

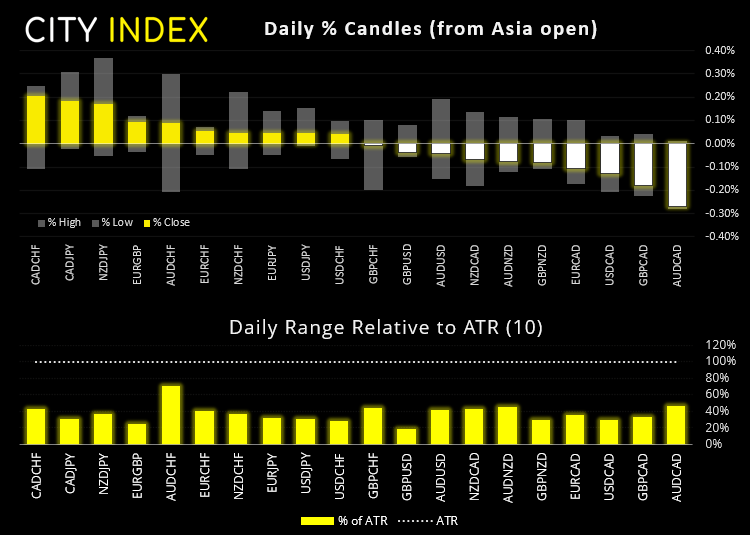

Forex: AUD rises with inflation, FOMC and CA CPI up next

The Australian dollar was the strongest currency overnight on a strong CPI report. Inflation rate shot past expectation to its highest level in nearly 13 years at 3.8% YoY. Yet core inflation remains below 1.6% YoY, meaning it has remained stuck beneath the lower bound of RBA’s target of 2-3% for over 5 years. AUD rose across the board but gained the most tractions against the Swiss franc. But at just 0.26% higher volatility remained capped as the data set will do little to stir hawkish sprits from a highly dovish RBA.

AUD/JPY remains in the lower third of yesterday’s bearish range and, until we see a break above 81.66 our bias remains bearish over the near-term.

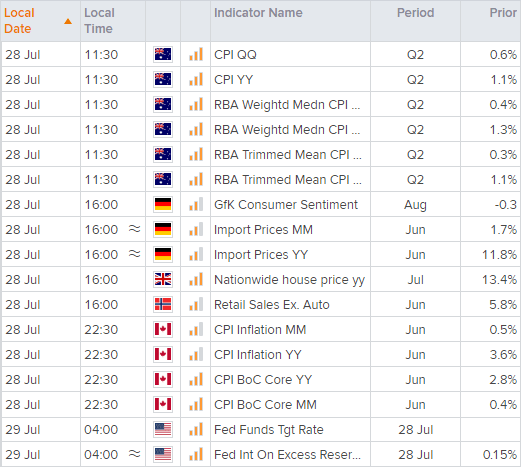

We may find volatility subsides ahead of the FOMC meeting and press conference later this evening, especially in the hour or minutes leading up to it. To see our view on the dollar for today’s meeting please see today’s video.

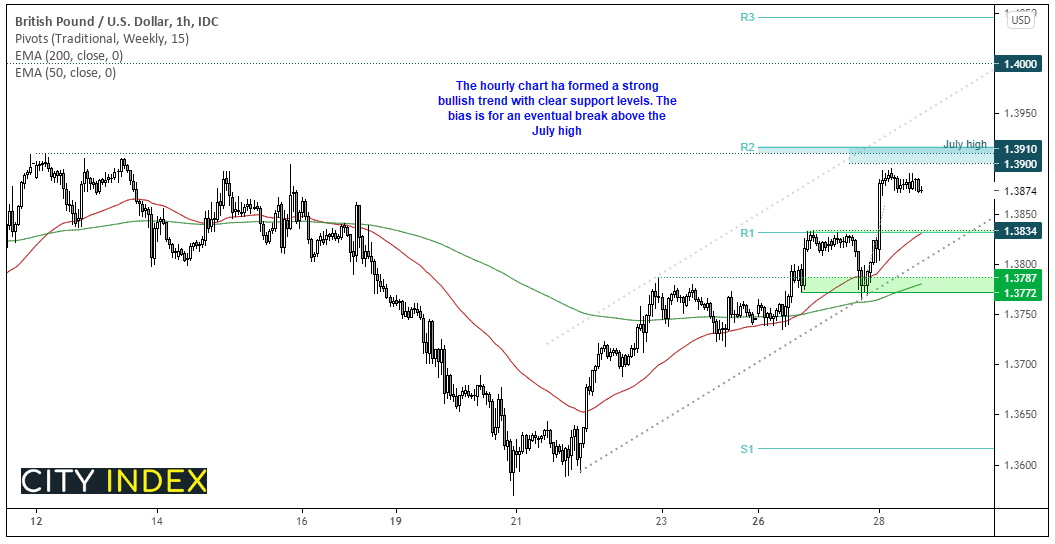

GBP/USD stopped just shy of our 1.3900 target yesterday, thanks to a sixth day of lower covid cases and a growth upgrade from the IMF (International Monetary Fund). Ahead of today’s open we find ourselves in a very similar situation as to yesterday; prices are consolidating near their highs, beneath a resistance cluster after breaking higher the day before.

Due to the strong bullish trend developing on the hourly chart our bias remains for a break above the June high. But as we saw yesterday, prices first dipped towards support before breaking higher. And as we have an FOMC meeting on tap (which we suspect may disappoint hawks) then its plausible to expect at least a shakeout from current levels first before its real moves get underway. A rise in covid cases and hawkish FOMC would likely ruin that bias.

Learn how to trade forex

Commodities:

Copper futures found resistance at the weekly R2 pivot yesterday and prices are now consolidating ahead of the FOMC meeting. Should the Fed remain quiet of tapering plans then copper could benefit not only from a weaker US dollar, but the prospect of continued stimulus. Our bias remains bullish above 4.435 (prior resistance) and for a run for the June high at 4.888.

WTI continues to consolidate above the 70.00 – 70.76 support zone, a zone which remains pivotal over the near-term so the bias remains bullish above it (should prices break to new highs) or a counter-trend move is confirmed with a break below it.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.