Asian Indices:

- Australia's ASX 200 index rose by 2.1 points (0.03%) and currently trades at 7,396.50

- Japan's Nikkei 225 index has risen by 338.31 points (1.21%) and currently trades at 27,880.73

- Hong Kong's Hang Seng index has fallen by -847.92 points (-3.1%) and currently trades at 26,474.06

UK and Europe:

- UK's FTSE 100 futures are currently down -29.5 points (-0.42%), the cash market is currently estimated to open at 6,998.08

- Euro STOXX 50 futures are currently down -25.5 points (-0.62%), the cash market is currently estimated to open at 4,083.60

- Germany's DAX futures are currently down -75 points (-0.48%), the cash market is currently estimated to open at 15,594.29

US Futures:

- DJI futures are currently up 238.15 points (0.68%)

- S&P 500 futures are currently down -11.25 points (-0.07%)

- Nasdaq 100 futures are currently down -12.5 points (-0.28%)

Learn how to trade indices

Indices

Concerns that Beijing will tighten regulation over the property and education sectors weighed on equity prices overnight, seeing shares fall and the MSCI APAC index (less Japan) fall slide -1.4%. China’s CSI300 is currently down -2.9% although the weakest performer is the HSCE at -3.4%.

The Nikkei 225 rose 1.8% after its 4-day weekend due to the start of the Olympic games, although its upside remains capped as concerns linger over the rise of Delta cases in the region. The Nikkei is currently up 1.2% and the TOPIX has risen 1.3%.

The ASX 200 saw an intraday break to a new high although volatility remains low and early gains have been pared, to see the index on track for a flat close.

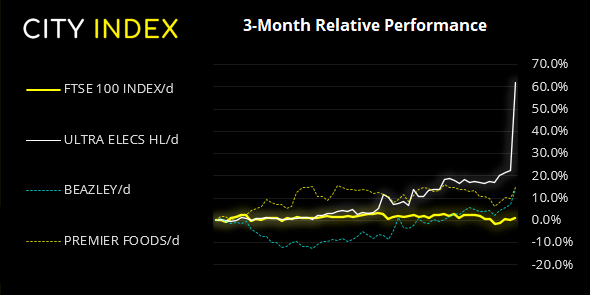

Like many benchmarks, the FTSE 100 also made a solid turnaround last week after a heavy day of selling on Monday. However, whilst some indices posted bullish engulfing weeks, the FTSE printed a long bullish hammer which bounced off the 200-week eMA. Given the strength of the rebound we suspect its corrective low has formed at 6812.

Price action has formed a higher high and higher low on the four-hour chart and Friday’s bullish close confirms it as a new trend. So we need to see prices hold above the 6956.24 low to keep the trend alive. Take note that prices are expected to open just below 7,000 so bulls need to get their skates on but, if prices can break above Friday’s high then the next target is 7088 (Friday’s POC) to the 7117.77 high.

FTSE 350: Market Internals

FTSE 350: 4041.5 (0.85%) 23 July 2021

- 271 (77.21%) stocks advanced and 69 (19.66%) declined

- 36 stocks rose to a new 52-week high, 4 fell to new lows

- 77.49% of stocks closed above their 200-day average

- 53.28% of stocks closed above their 50-day average

- 21.08% of stocks closed above their 20-day average

Outperformers:

- + 32.4% - Ultra Electronics Holdings PLC (ULE.L)

- + 5.96% - Beazley PLC (BEZG.L)

- + 4.76% - Premier Foods PLC (PFD.L)

Underperformers:

- -4.13% - Fidelity China Special Situations PLC (FCSS.L)

- -2.98% - Indivior PLC (INDV.L)

- -2.56% - Centrica PLC (CNA.L)

Forex:

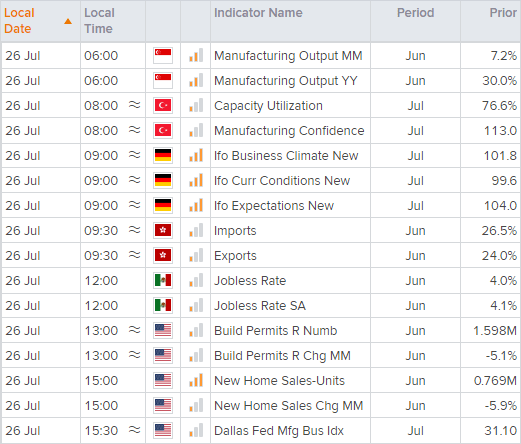

German IFO business sentiment is released at 09:00 BST and is expected to rise to 102.1, which would be its highest level since October 2018. However, expectations (of the future) are expected to dip to 103.3 from 104. And US housing data is released early afternoon with revised building permits released at 13:00 and hones sales at 15:00. Soaring house prices saw sales drop to a one-year low in June so we could be in for another weak print.

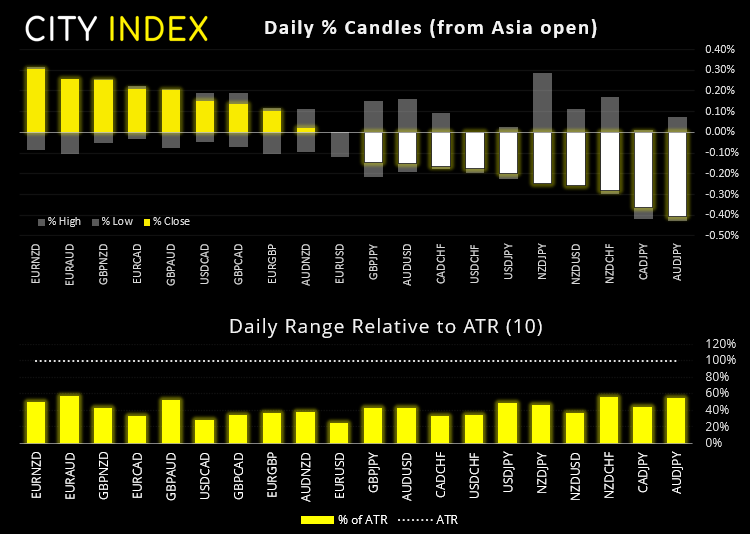

Commodity currencies remained under pressure overnight with CAD, AUD and NZD all falling around -0.2%.

GBP/AUD rose to its highest level since May 2020 as traders offloaded the Australian dollar ahead of two RBA members scheduled to speak this week. AUD/USD broke beneath Friday’s low to further suggest a swing high was seen on Thursday. GBP/USD is forming a potential bull-flag on the four-hour chart, so a break above 1.3787 assumes bullish continuation. EUR/USD remains rangebound near July’s low and we expect this to remain the case ahead of Wednesday’s FOMC meeting.

Learn how to trade forex

Commodities:

WTI fell -0.64% as floods in China and concerns over covid weighed slightly demand expectations. Now trading just above Friday’s low we’d look for support to build around 70.0 to form a potential swing low.

Gold prices were up slightly by 0.17% overnight ahead of Wednesday’s FOMC meeting. Its currently trading just below its 200-day eMA although the 50-day resides at 1812 which makes another likely area of resistance. For now, range trading strategies are preferred between 1790 and 1834.

Lumber futures remain in a strong downtrend on the daily chart although Friday produced a bearish hammer on the daily chart after a 5-day correction, suggesting a swing high may be in place. A break beneath Friday’s low confirms the near-term reversal candle.

The Thomson Reuters CRB commodity index closed just beneath its 4-year high on Friday with a small Doji candle. Given the significance of the 217.72 high then a retracement from current levels is a plausible scenario but, as we outlined in Friday’s video we suspect the CRB index could eventually break higher.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.