Asian Indices:

- Australia's ASX 200 index rose by 40.7 points (0.58%) and currently trades at 7,038.20

- Japan's Nikkei 225 index has risen by 560.48 points (1.97%) and currently trades at 29,069.03

- Hong Kong's Hang Seng index has risen by 132.9 points (0.46%) and currently trades at 28,754.82

UK and Europe:

- UK's FTSE 100 futures are currently up 32 points (0.47%), the cash market is currently estimated to open at 6,927.29

- Euro STOXX 50 futures are currently up 20 points (0.51%), the cash market is currently estimated to open at 3,996.41

- Germany's DAX futures are currently up 68 points (0.45%), the cash market is currently estimated to open at 15,263.97

Wednesday US Close:

- The Dow Jones Industrial fell -123.04 points (-0.36%) to close at 34,077.63

- The S&P 500 index rose 38.48 points (0.94%) to close at 4,173.42

- The Nasdaq 100 index fell -134.24 points (-0.96%) to close at 13,935.15

European indices put up a mild fight against Tuesday’s losses

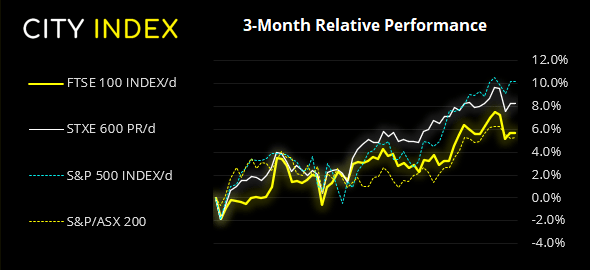

Stronger earnings helped European bourses recoup some of Tuesday’s sell-off, even if their rebound did pale in comparison to the subsequent rally on Wall Street. Retail, technology and healthcare sectors helped the STOXX 600 index rise 0.65%, with nine sectors outperforming the broad index.

The DAX has found support at its 20-day eMA with a small bullish pinbar. Whilst the size of this cute reversal candle is relatively small compared with its 2-day retracement from record high, it does suggest a minor rebound with a break of its high, with next resistance being 15,300 by its congestion-range top.

The FTSE 100 (+0.52%) outperformed the broader FTSE 350 index (0.4%) although the day’s range was about a third of the prior day’s losses. Still, it is holding above the 20-day eMA and also held above the 6915 lows. Ultimately, its global sentiment which is likely to dictate the FTSE’s direction today. The daily chart shows the potential to break to a new high, yet the intraday chart could equally be consolidating into a bearish continuation pattern at the lows, which would be confirmed with a break beneath 6915.

Learn how to trade indices

FTSE 350: Market Internals

FTSE 350: 6895.29 (0.52%) 21 April 2021

- 179 (51.00%) stocks advanced and 157 (44.73%) declined

- 11 stocks hit a new 52-week high, 5 hit news lows

- 85.75% of stocks closed above their 200-day average

- 74.93% of stocks closed above their 50-day average

- 18.23% of stocks closed above their 20-day average

Outperformers

- + 5.26% - Hochschild Mining PLC (HOCM.L)

- + 5.26% - Indivior PLC (INDV.L)

- + 4.47% - Carnival PLC (CCL.L)

Underperformers:

- 0.59% - Rolls-Royce Holdings PLC (RR.L)

- 0.60% - Cineworld Group PLC (CINE.L)

- 0.60% - Foresight Solar Fund Ltd (FSFL.L)

Forex: No change expected from ECB

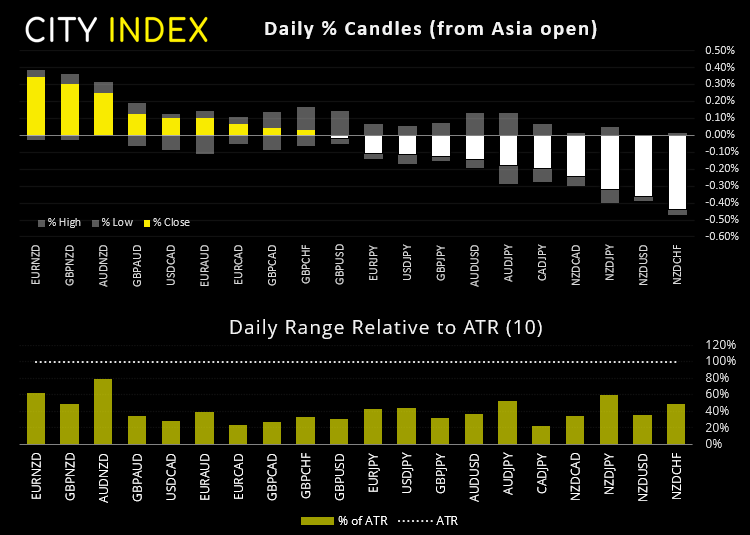

It was a fairly quiet session overnight where was concerned. The New Zealand dollar is the weakest major, after the government announced the Finance Minister would have more control to decide what types of loans RBNZ could restrict for financial institutions.

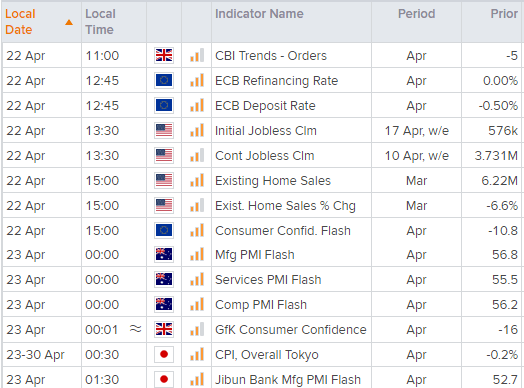

The European Central Bank (ECB) meets today, although there is no expectation for a change of policy, given they have signalled (like the Fed) that they will look past any temporary inflationary overshoot. And one is yet to materialise. Furthermore, the trade-weighted euro is beneath its 6-month average which makes the price of the euro less of a concern overall (it’s not all about EUR/USD, after all).

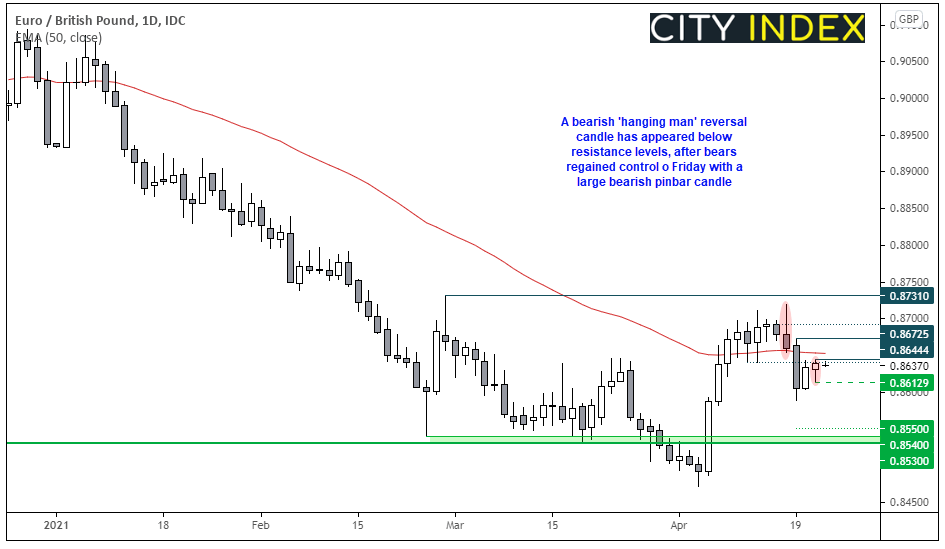

EUR/GBP is consolidating beneath yesterday’s high after printing a hanging man candle (a 1-bar bearish reversal). Resistance has been found beneath the 50-day eMA and near a prior support level, so we see potential for another dip lower.

- A break beneath yesterday’s low confirms the hanging man reversal candle.

- A more conservative approach would be to wait for a break beneath 0.8600. Under either scenario, the bias remains bearish below Wednesday high.

- Bears could target the 0.8550 level, just above a cluster of support.

The US dollar index (DXY) found resistance at the 91.30/40 zone with a bearish hammer on the daily chart yesterday.

- USD/CHF is mirroring DXY and has printed a bearish pinbar beneath 0.9200 resistance on the daily chart. Our bias remains bearish beneath this key resistance level.

- Price action on USD/CAD has not been nice of later, but the large bearish engulfing candle yesterday cannot be ignored after its breakout failed to hold above 1.2680 resistance before crashing to a four-week low. The bias remains bearish beneath 1.2562 and prices are coiling up near the lows.

- EUR/USD remains within its 4-hour bullish channel but, more importantly, above the pivotal level of 1.2000. With DXY remaining below resistance, the bias remains bullish whilst prices hold above 1.2000 (whipsaws around this level aside).

- GBP/USD has built a base of support around the 1.3900/19 support zone. Given the strength of the rally into 1.4000 on Monday the bias is for a retest of those highs.

Learn how to trade forex

Commodities: Oil tries to build a base but cases are rising

Oil prices remain under pressure yet WTI is trying to build a base above Wednesday’s low of 60.38 (the day that opened at the low and rallied to new highs on positive reports). 60.38 is a key level for bulls to defend this session. But, with India recording a new daily record of coronavirus cases, they may have their work cut out as it is this reason oil prices have been under pressure this week. Markets are yet to react, so we’ll see what European and US traders make of it after their opens.

Gold and silver are effectively flat, yet near the highs of yesterday’s session. Gold bulls need to break above the 200-day eMA (currently sat on it) and 1800 to extend the run whilst silver bulls need to break above the May 18th high.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.