Asian futures:

- Australia’s ASX 200 index fell by -160.7 points (-2.35%) to close at 6,673.3

- Japan’s Nikkei 225 index fell by -1031.37 points (-3.42%) to close at 29,136.9

- Hong Kong’s Heng Seng index has fallen by -934.25 points (-3.11%) currently trades at 29,139.92

FTSE 100:

- UK’s FTSE 100 futures are currently down -97.5 points (-1.47%), the cash market is currently estimated to open at 6,554.46

European futures:

- The Euro STOXX 50 futures are currently down -61 points (-1.65%), the cash market is currently estimated to open at 3,624.28

- Germany’s DAX futures are currently down -213 points (-1.53%), the cash market is currently estimated to open at 13,704.33

US futures:

- The Dow Jones index fell -559.85 points (-0.175%) to close at 31,402.01

- The S&P 500 index fell -96.09 points (-2.45%) to close at 3,829.34

- The Nasdaq 100 index fell -473.88 points (-3.56%) to close at 12,828.311

Yesterday’s bond rout continued to weigh on sentient as Asian indices took Wall Street’s lead and traded broadly lower. The ASX 200 fell to a 3.5 week low of 6,658.90 and, perhaps not too surprisingly, the technology sector was the worst performer, shedding -5.1% after the Nasdaq led losses on Wall Street yesterday. Ultimately, all sectors of the ASX 200 were in the red. The Hang Seng was -2.7 lower but found technical support above the January low, whilst the Nikkei 225 accelerate its downside below 30k, with its next level of support being the January high at 28,979.53.

RBA step in to retain YCC (yield curve control)

The Reserve Bank of Australia (RBA) were forced to step in and purchase 3-year government bonds today, as the 3-year yield rose above their 1% target. RBA are currently suppressing the short-end of the curve and aim to cap their 3-year at a maximum of 1%. The fact they have to step in at all makes things interesting, because if investors continue to sell their bonds (forcing yields to rise) the RBA must keep buying. If they fail to keep yields low then traders will quickly notice, which reinforces bond selling and sends yields further still. Watch this space…

AUD/USD is testing the January high after failing to hold onto the 80c handle. Now sat at a key support level, traders must keep a close eye on the USD and bond yields to decipher its next move. NZD/USD also hit our first target outlined in today’s Asia Open report and will likely continue to track AUD’s direction so, if AUDs breaks below support, expect NZD to follow.

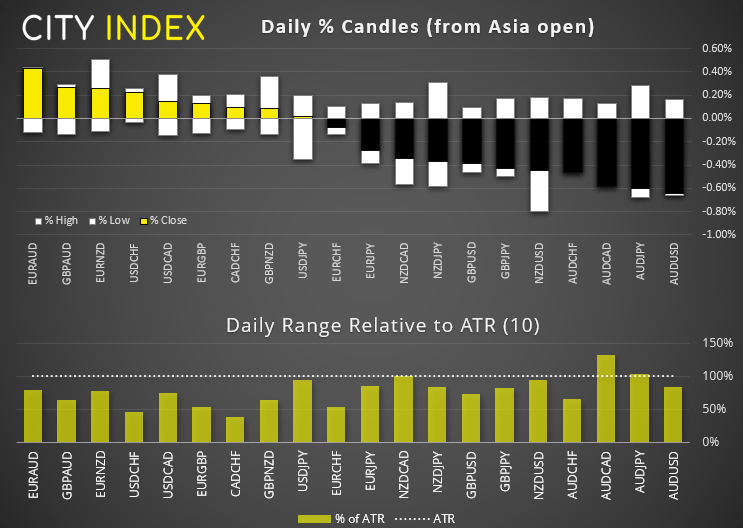

AUD, GBP and NZD are the weakest majors, USD and JPY are the strongest. AUD/CAD was the only pair to exceed its average true range (ATR) which leaves plenty of potential volatility for FX traders heading into the European and US sessions.

FaceBook re-friends Australia

After a 1-week blackout, FaceBook (FB) switched news back on for Australian users after signing content deals with three small local publishers. The timing is no coincidence.

Just yesterday, Australian parliament passed a new law which forces companies such as FaceBook and Google to pay content to news publishers, if they unable to negotiate a private deal with publishers. The fact that FaceBook have three deals today suggests the Australian government strongarmed the world’s largest media company into submission. And, with the world watching, it could pave the way for other nations to follow suit.

FaceBook currently trades at $254.69 and closed on the 200-day eMA yesterday. We could expect to see the stock weaken if investors feel revenues will be hit (if other nations follow suit) but we also have the fact that equities are broadly lower anyway. From a technical perspective, price action remains corrective since its record high last August, and we are not convinced the corrective low has occurred. A break beneath yesterday’s low assumes bearish resumption and brings the 244 lows into focus for bears.

Gold: Is it ready to fold?

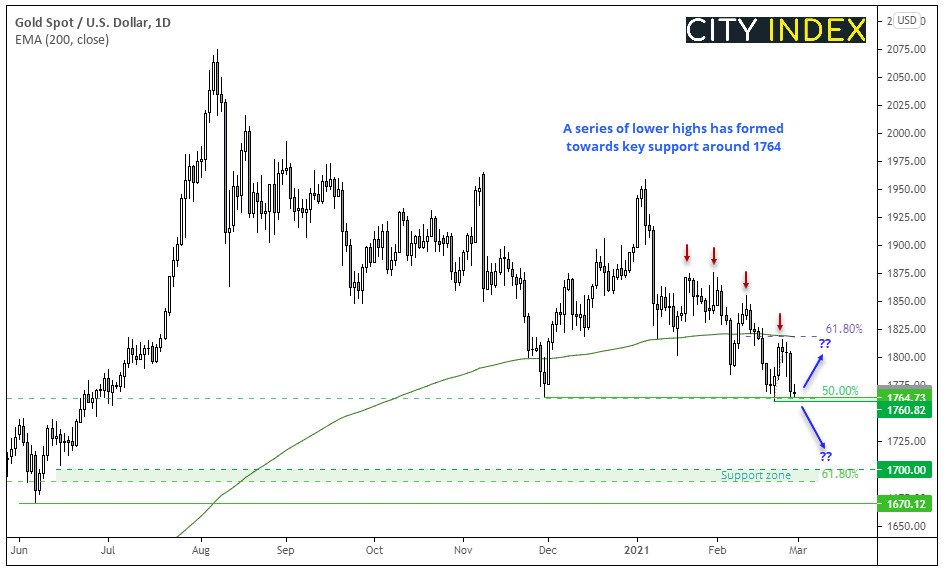

There are different grades of ‘risk-off’. During a run-of-the-mill ‘risk-off’ session gold can appreciate as it attracts safe haven inflows from investors fleeing risker assets such as stocks, commodity currencies or emerging markets. And then there are risker risk-off sessions where gold falls with sentiment, as investors sell all assets to either revert to cash or sell their gold to pay for margin calls in other markets. Last night’s session was the latter as gold fell with stocks, commodities and emerging markets.

Once again, gold has fallen to re-test the November low around 1,764, having provided a minor rebound towards its 200-day eMA. Suffice to say, the 200-day eMA capped as resistance, price action formed a lower high and we find ourselves waiting for a potential break lower.

- Last week’s low (1760.82) is a pivotal level

- A break beneath it could pave the way for a clear run towards the 1700 handle (just above a 61.8% Fibonacci retracement level)

- If support holds, we could see another minor bounce higher

- We would not consider bullish setups on the daily chart until prices break above the 200-day eMA / recent swing high

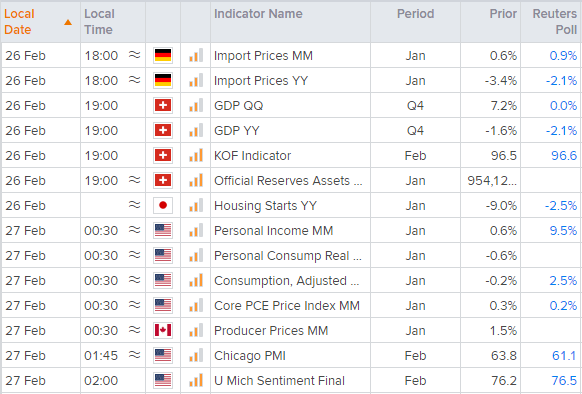

Up Next (Times in GST)

With bond yields driving the show we could find any data scheduled to be placed on the back burner. The key question for traders today is if yields continue to rise and, if so, will they make markets crack further? With several markets at critical levels (gold at 1764 support, S&P 500 at the 50-day eMA and Nasdaq-100 at key support) it could be a make-or-break session. Keep an eye on the dollar and VIX (which should rise during risk-off, particularly if yields keep rising). But if yields do not rise it could provide a reprieve for markets ahead of the weekend and provide a risk-on bounce heading into the weekend close.

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.