• Brexit talks failed to deliver a breakthrough over the weekend, casting doubt that a deal can be reached before the end of the year.

• Sterling has slipped as a result of the UK being hit by travel bans and Brexit uncertainty, pushing it lower against both the euro and the dollar.

• In commodities, oil has lost significant ground after hitting a nine-month high last week while gold has head higher on increased uncertainty.

FTSE 100 to open significantly lower

European indices to follow lower

Countries ban travel from UK to stem new variant of virus

European Medicines Agency expected to approve first vaccine

The European Medicines Agency (EMA), the EU’s medicines regulator, is to meet later today to decide whether to approve the vaccine developed by Pfizer and BioNTech. The EU is yet to approve any vaccines for emergency use but is expected to give it the green light before the first vaccines are rolled-out just after Christmas.

No breakthrough for Brexit talks

German MEP David McAllister, who also chairs the European Parliament’s Foreign Affairs Committee, said there was no clarity whether a deal would be reached, adding a meeting would be called today to discuss what to do next. It seems both sides are willing to continue talking. The question is whether anything can be agreed to avoid a no-deal at the end of the year, or whether trade will have to fall back onto World Trade Organisation rules for a period of time until both sides can reach an agreement next year.

US agrees on a new $900 billion economic stimulus package

A new $900 billion economic stimulus package has been agreed by politicians in the US, just hours before existing funding was due to run out and plunge the country into a government shutdown. The new package replaces the huge $2.2 trillion package introduced in March, when the coronavirus began to ravage the economy.

The package includes cheques for those that have fallen on hard times because of the pandemic and further funding for businesses in trouble, as well as money to cover the cost of vaccinating its huge population.

The agreement is significant but still needs to be approved by the House of Representatives, currently controlled by the Democrats, and the Senate, currently in the control of Republicans. It would then need to be signed-off by outgoing president Donald Trump.

Shell sells stake in LNG project for $2.5 billion

Oil giant Shell has agreed to sell a 26.25% stake in the Queensland Curtis LNG facilities to Global Infrastructure Partners Australia for $2.5 billion. The sale is part of Shell’s target to offload non-core projects and will provide a boost to its ambition to make $4 billion in divestments each year. Separately, Shell provided an update on how it performed in the final quarter and said it would provide an update on its strategy on February 11.

NatWest Group buys £3 billion mortgage portfolio

NatWest Group said it has purchased a £3 billion portfolio of prime UK mortgages from Metro Bank. These are owner-occupied residential mortgages with a weighted average current loan to value of 60%, the bank said. NatWest paid £3.1 billion for the portfolio.

Vodafone ends talks with Saudi Telecom

Vodafone said it has ended talks with Saudi Telecom Co about the possible sale of its 55% stake in Vodafone Egypt.

GlaxoSmithKline gets EU approval for HIV treatment

ViiV Healthcare, owned by GSK and Pfizer, has been awarded marketing authorisation for a HIV treatment in Europe. GSK said it was ‘the first complete long-acting injectable HIV treatment in Europe’.

Forex: Sterling loses ground

GBP/USD traded at 1.33557 this morning, down 1.3% from 1.35315 at the end of the trading session on Friday.

EUR/USD was down 0.5% at 1.21893 from 1.22524.

Meanwhile, the lack of progress being made on Brexit weighed on EUR/GBP, which traded at 0.91269, up 0.7% from 0.90623 at the end of last week.

Start trading the opportunities in the forex market today.

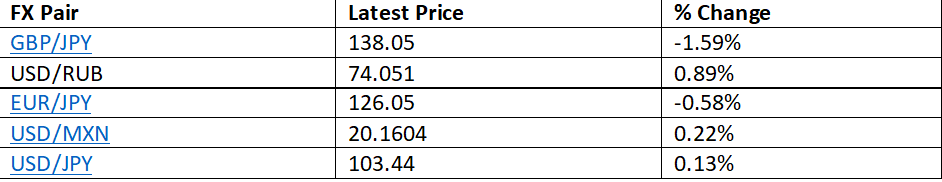

The most drastic movements in the currency markets this morning, according to data from Reuters, are as follows:FX Pair Latest Price % Change

Commodities: Oil slips from highs on virus fears

Oil prices climbed to their highest level since early March last Friday but started to lose ground as markets fear another surge in coronavirus cases will hamper the recovery in demand for oil, overriding hope provided by the rollout of vaccines.

Brent traded at $50.55 this morning, down more than 3% after ending last week at $52.24, while WTI was down at $47.71 from $49.20.

Start trading the volatility in oil prices today.

Gold traded at $1904 this morning, 1.3% higher than $1880 when markets closed on Friday.

Start trading gold and other precious metals today.

Market-moving events in the economic calendar

The economic calendar is light at the start of a shorter trading week. The Chicago Fed national activity index is at 1330 GMT, while preliminary consumer confidence data for the eurozone is due at 1500 GMT.

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.