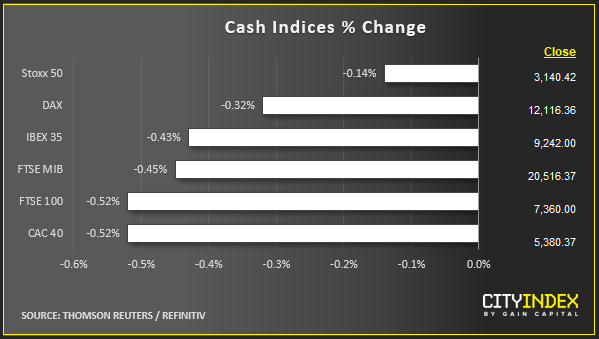

Stock market snapshot as of [12/6/2019 3:25 PM]

- There’s no sign that markets want to pull out of their post-Mexican-relief slide just yet. As trade concerns linger and with clashes between protestors and police in Hong Kong increasingly on the radar, almost all European and U.S. stock markets are trading lower

- Still, it’s worth noting that the current phase of the sell-off lacks conviction. MACD, a measure of what chart analysts call ‘momentum’, remains positive over daily intervals for many major indices, including the S&P 500. Furthermore the U.S. benchmark remained around 3% below its latest record peak a short while ago

- Unless or until such indications of internal strength deteriorate, stocks are likely to continue churning around at lows, but not much worse, for the foreseeable future; at least till the G-20 leaders’ summit on 28th-29th June, where U.S. President Trump and China’s President Xi are expected to meet

- This phase could still be punctuated by occasional bouts of gains; and of course, sentiment could deteriorate sharply at any time. Another surprise update of U.S. trade policy from the @realDonaldTrump Twitter feed would do it

- In keeping with investors’ return to seeing ‘bad news as good news’, the U.S. dollar quickly shrugged off disappointing inflation data a little earlier. The expectation that the prints added more impetus for the Fed to cut rates was underlying support for risk assets too

Corporate News

- In Europe, bank shares faced particularly strong headwinds, though that looks more a reflection of the region’s largest and most heavyweight lender, HSBC, trading 1% lower, tracking events in Hong Kong

- Trade tensions are present and correct though, keeping the region’s technology sector on the backfoot

- Oil shares struggle the most into the U.S. session on concerns of drooping demand. Oilfield services groups led the downside, suggesting that the market is beginning to foresee production projects curtailed

- Wall Street’s upside standouts include Mattel, which was up 7% just before I sent this, after rejecting another bid from a rival. Tesla is another, adding 3% after last night’s AGM, which included a raft of new bullish forecasts from Elon Musk. On the downside, ADRs in French conglomerate Dassault Systèmes catch the eye. They slide 4% in reaction to a $5.7bn deal to buy clinical software group Medidata Solutions

Upcoming corporate highlights

BMO: before market open AMC: after market close

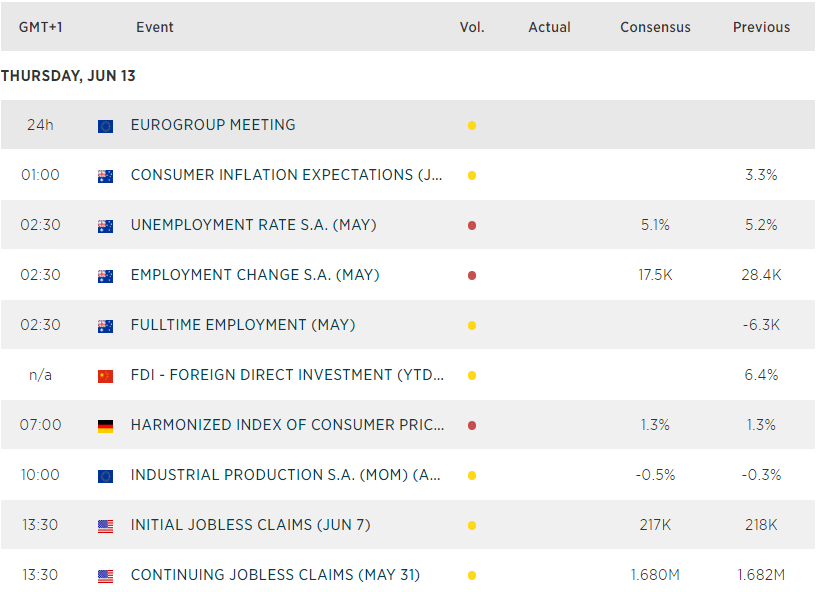

Upcoming economic highlights

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM